| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

I subscribe to John Mauldin's weekly e-Letter which I find always stimulating, informative and of late, mostly depressing. This week's letter is no exception as he focuses on a leading indicator from the Consumer Metrics Institute who have developed a leading indicator of GDP growth based on consumer major discretionary spending ("such items as automobiles, housing, vacations, durable household goods and investments. Not included would be expenditures that are more or less automatic, relatively minor and/or non-discretionary, such as groceries, fuel or utilities").

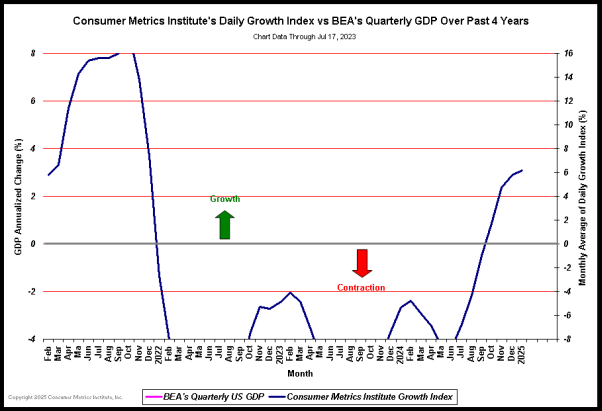

The startling thing about their latest indicator values is that they predict that GDP will contract in the third quarter by 2% rather than expand by 3% which is the consensus estimate among economists. If you look at the following chart, you will see that their leading indicator does a reasonable job of giving advance warning of GDP levels announced by the Bureau for Economic Analysis (BEA) by 90-120 days. You will see that their latest level for June is of the order of -2% so if their predictive record holds, we should find that the BEA will eventually announce third quarter growth in the vicinity of negative 2%. In other words, a double-dip recession is in the cards.

So this chart is effectively confirming that the 14.5% drop in the S&P 500 since its April high is certainly justified and things are likely to get even worse as the still overly optimistic equity valuations become more realistic.

Buy on Confirmed Breakout Strategy

Throughout this year we have been focusing on the most effective strategies for profiting from breakouts from the cup-with-handle pattern. So far we have evolved a recommended strategy for buying on breakout alert as follows:

- Buy stocks that meet our target criteria (see below) when breaking out on at least 3 times average daily volume as close to the breakout price as possible (use our alerts for this).

- Sell them immediately:

- they fall to 8% below their breakout price, or

- they fall 11% from their most recent high, or

- they have gained at least 55% above their breakout price, or

- you've held the position for 20 sessions

- Stocks that meet our target criteria get the thumbs up (

) on

our watchlists and alerts.

) on

our watchlists and alerts. - Do not enter a new position if our NASDAQ market trend signal is down

For many of you, this may not be practicable as you are not able to monitor the markets in real time and/or act immediately on an alert. So for you, we have used our backtest simulator to develop a strategy that works if you choose to buy at the next open on a confirmed breakout.

We found that the optimum strategy for buying on a confirmed breakout, when backtested to 2004, was as follows:

- Buy stocks that meet our target criteria when they close above their breakout price on daily volume that is at least 1.2 times the average daily volume (see comment below)

- Sell them immediately:

- they fall to 8% below their breakout price, or

- they fall 11% from their most recent high, or

- they have gained at least 50% above their breakout price, or

- you've held the position for 30 sessions

- Stocks that meet our target criteria get the thumbs up (

) on

our watchlists and alerts.

) on

our watchlists and alerts. - Do not enter a new position if our NASDAQ market trend signal is down

Note that the volume requirement for buying at the open is just 1.2 times the average daily volume. In other words, we don't need the volume to be as heavy as when buying on breakout because we already know that the stock has closed above its breakout price whereas when buying on breakout alert the stock could close below the BoP for the day.

This strategy yielded a 182% gain compared to a loss of -8.6% for the S&P 500 since December 1, 2004. The strategy parameters, results and cumulative profit charts are shown below. Using the input parameters shown, you should be able to reproduce similar results yourself and vary the parameters to meet your needs.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 9931.97 | -2.02% | -4.76% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2219.17 | -1.68% | -2.2% | Down | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1064.88 | -2.25% | -4.5% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 633.97 | -4.18% | -0.02% | Down | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 11121.9 | -2.47% | -3.27% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 3 | 14.15 | 6.05% | 0.04% |

| Last Week | 3 | 16.38 | 3.31% | 0.08% |

| 13 Weeks | 193 | 16.62 | 16.11% |

-8.25% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | INWK | InnerWorkings Inc. | 96 |

| Top Technical | NGA | North American Galvanizing & Coatings Inc. | 71 |

| Top Fundamental | MED | Medifast Inc. | 70 |

| Top Tech. & Fund. | MED | Medifast Inc. | 70 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | ARUN | Aruba Networks, Inc. | 72 |

| Top Technical | REGN | Regeneron Pharmaceuticals, Inc. | 44 |

| Top Fundamental | ARUN | Aruba Networks, Inc. | 72 |

| Top Tech. & Fund. | ARUN | Aruba Networks, Inc. | 72 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2010 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.