Breakoutwatch.com Suggested Trading Strategies

The strategies outlined below are outdated and have been revised, although this document has not been brought up to date, as yet

See Newsletter for Saturday, July 11, 202 for updates. New Buy at Open and Buy on Alert Guidelines

Introduction

Each day we publish a list of stocks that meet the requirements of a Cup and Handle Pattern as of the close for that day. The list is refreshed each day as stocks drop off the list and new ones are added. Some of the important data points published for each stock are its breakout price,close price, average volume, daily volume, etc. On the following day, we track the price of each stock and issue an alert both on the site and by email if the stock moves above its breakout price.

Those subscribers who can follow the market in real time can react to these alerts and trade according to their individual trading strategy. As a guide, we have developed a suggested trading strategy we call "Buy on Alert".

This is not feasible for many subscribers so I have developed a strategy for trading stocks that close above their breakout price on the day we issue the alert. We call it the "Buy at Open" strategy.

Both strategies can be categorized as "Swing Trading".

The biggest problem facing a trader is not what to buy, but when to

sell. The strategies solve this problem by providing specific

instructions for both what and how to buy, and when and how to sell. The

strategy also includes a portfolio management component.

Portfolio Management

Both strategies use a common portfolio management scheme.

- Decide on the amount of capital you wish to devote to the strategy. In the examples that follow, I use an amount of $10,000.

- Limit the number of holdings at any one time to just 2. This was found to be the optimum number to generate the best return.

- For each buy trade allocate 50% of your available capital to the trade.So for your first trade you will allocate $5,000.As your portfolio rises (or falls) you will allocate 50% of the portfolio value to each subsequent trade.

- As a sell trade is made, add the proceeds to your portfolio value.

- For example,

- if you have zero share holdings in your portfolio, you have 100% of the capital as cash on hand. Allocate 50% to the next trade.

- if you have one share holding, you have 50% of your capital as cash on hand so allocate the entirety of it to the next trade

- if you have two share holdings, do not trade.

Buy at Open Strategy

Opening a Trade

Each day we analyze the alerts we issued that day on cup and handle pattern stocks looking for stocks that meet the Buy at Open Criteria:

- Closed above their breakout price for the day

- Minimum 50 day average volume of 100,000

- Volume for the day was equal or above the 50 day average

- RS rank is above 80

- Maximum breakout price is $20

If there are more than two stocks meeting the criteria(some days there may be none) we select the two that have the highest volume to average volume of those meeting the above criteria and publish them to subscribers by email. One or more of these these two stocks can be bought at the next day's open, assuming you do not already hold the maximum (2) positions.

To open a trade, place a 'stop market' order for the chosen stock at the breakout price of that stock for the previous day. This will ensure you do not buy the stock if the market price does not rise above the breakout price.

Closing a Trade

- A trade is closed by setting a trailing stop for the next day.

- If the trailing stop is not met, then the trailing stop is adjusted for each succeeding day.

- The value of the latest trailing stop is the upper ATR value found on our chart for the symbol when specifying a price band of 'ATR Bands'. This is the trailing stop value to be set for the next days trading. Here's an example:

Alternatively, the value of the latest trailing stop can be found using our Trailing Stop Calculator

Backtest Results

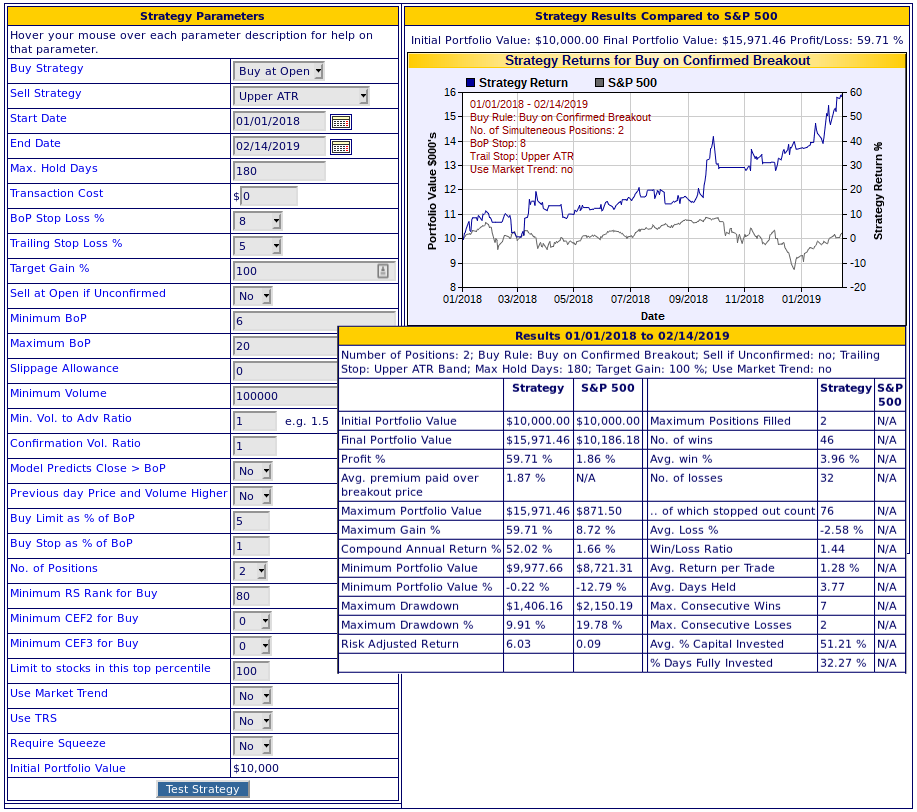

The strategy is based on backtest result from January, 2018 to 02/14/19. The backtest gave a return of 60% with a maximum draw down of 10%. Average number of days held per trade was 3.

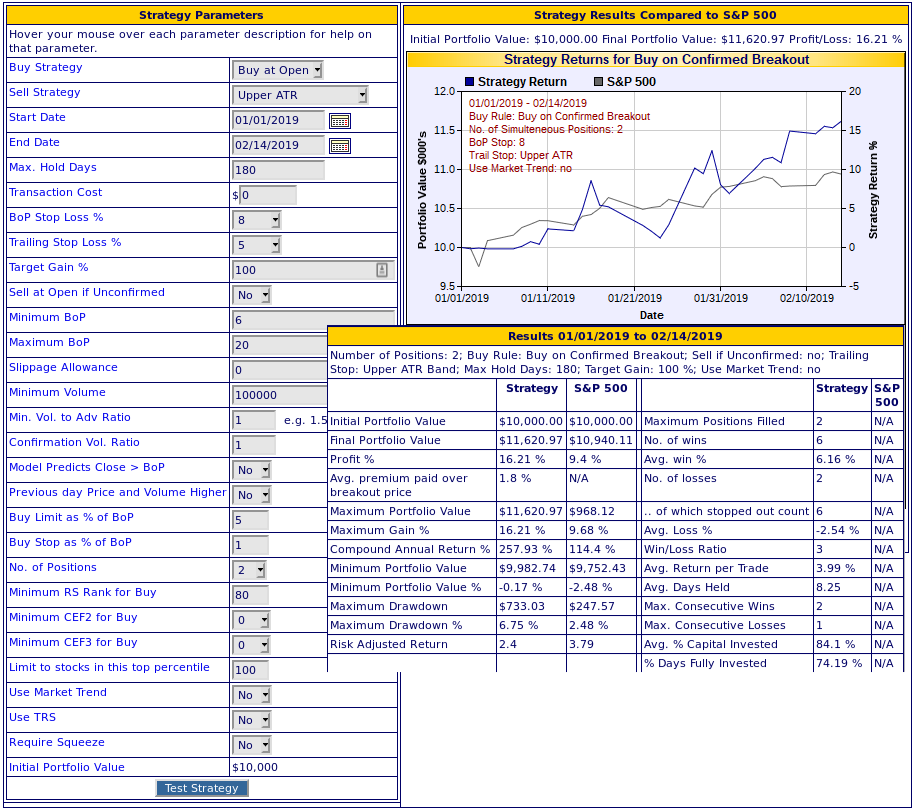

As of early February 2019, the strategy earned16% with a maximum draw down of 6.8%.

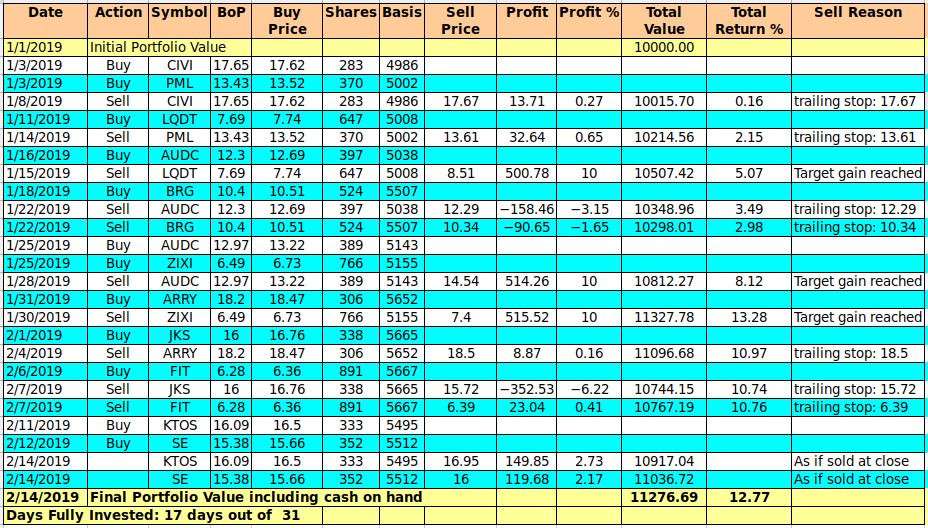

Here's a table of trades that were made (a target gain of 10% was used. I subsequently found that a target gain limited overall performance and removed that constraint in the rules) :

Here are some graphical examples of two of the trades:

Buy on Alert Strategy

This strategy uses the same Portfolio Management techniques as described above.

Opening a Trade

To replicate the results of the Buy at Open backtest, you would buy the first two alerts (assuming you had positions available in the portfolio) that meet the following criteria:

- Minimum BoP $6

- Maximum BoP $20

- Minimum 50 day average volume of 100,000

- Volume on the previous day at least equal to the 50 day average volume

- RS Rank above 80

- A trade is closed by setting a trailing stop for the next day.

- If the trailing stop is not met, then the trailing stop is adjusted for each succeeding day.

- The value of the latest trailing stop is the upper ATR value found on our chart for the symbol when specifying a price band of 'ATR Bands'. This is the trailing stop value to be set for the next days trading.

- See above for an example of closing a trade.

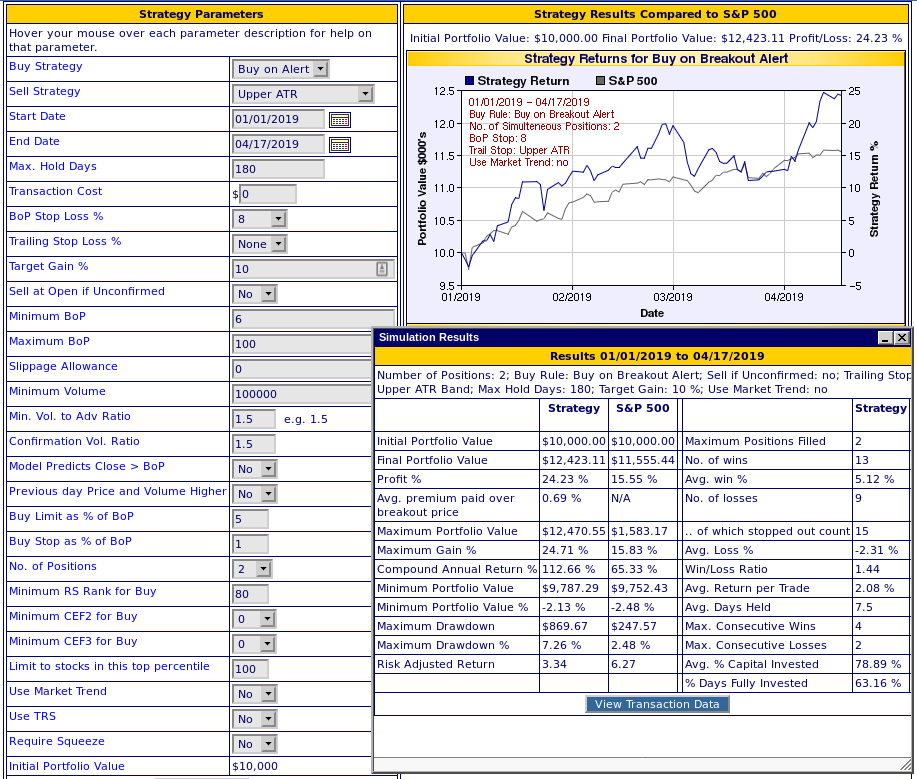

As of April 2019, the strategy earned 24.2% with a maximum drawdown of 7.3%.