| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

Breakoutwatch.com Reviewed in Stocks & Commodities Magazine

Technical

Analysis of Stocks & Commodities magazine editor, Jayanthi Gopalakrishnan,

reviewed breakout watch.com for the June issue of the magazine. You can read

the review here.

Technical

Analysis of Stocks & Commodities magazine editor, Jayanthi Gopalakrishnan,

reviewed breakout watch.com for the June issue of the magazine. You can read

the review here.

Market Summary

This week saw a divergence from recent market trends. The NASDAQ, which has outperformed the other indexes since April 29, lost ground while the DJI and S&P 500 made small gains for the week. Also, volume increased by approximately 10%, reversing the downwards volume trend we have seen for the last 6 weeks. The result was that the DJI and S&P 500 recorded accumulation for the week, while the NASDAQ came under distribution. The DJI gained 0.49% for the week, the S&P 500, 0.17% and the NASDAQ lost 0.41%. So the short term trend seems bullish for large caps but the bigger picture shows more concern for the broader market. The S&P 500 is in a head and shoulders pattern, which is usually bearish. The index needs to rally above the neckline at 1210 before there can be confidence that the broader market is showing strength.

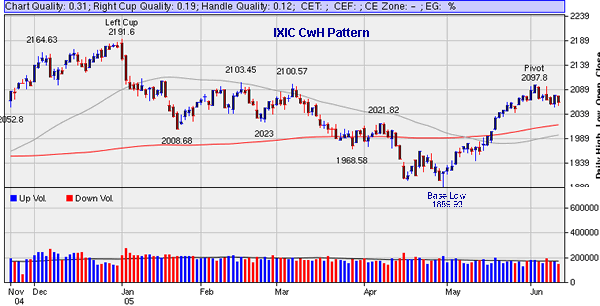

Despite this week's distribution on the NASDAQ, this index looks to be forming a more bullish pattern over the longer term. The following chart was produced using our CwH Chart Selector and shows that the NASDAQ Composite is forming a potentially nicely shaped handle with daily volume decreasing. A move above the pivot of 2097 on strong volume would be a bullish signal and we can expect many strong breakouts from NASDAQ stocks if that occurrs.

Breakouts

The number of successful breakouts slipped slightly to thirty this week but the average gain at week's end was 2.81%, easily beating the market averages. Of these, fourteen stocks registered intraday gains of more than 5% and four made intrady gains exceeding double digits. The strongest performer was ECOL which gained 27.4% before settling back to close at 25.13% above the pivot. This was the third breakout for ECOL which has gained 87% since its first breakout on 4/1/04. Another strong performer making its third breakout appearance was WFR which gained 15.9% intraday before closing the week for a 12.4% gain. Our 'Top Tip' this week revisits the question of how to find potentially strong breakouts in the shortest amount of time.

There were no breakdowns this week.

Industry Analysis

Healthcare-Hospitals has been the strongest industry of late but it slipped to second place behind Oil & Gas-Us Integrated when averaged over the week, but it regained its top placement on a one day basis on Friday. The Oil & Gas sector occupies the next three places in our rankings based on continued strength in oil prices. Electrical-Laser Systems was the most improved industry rising 65 places in our rankings to position 61 out of 192 industry groups.

Get a 14 day Trial of our premium 'Platinum' service for just $9.95 and if you subsequently subscribe to any subscription level we will credit your $9.95 to your subscription. 14

Day Platinum Trial |

There were no new features added this week.

A new subscriber posed the following question this week: "I would like to know the easiest way to check the watchlist for possible breakouts for the next day."

As I explained, all the stocks are possible breakouts and there is no way I know of determine which ones will break out on any given day. However, I have done considerable work on which ones will achieve the biggest gains, both on the day of breakout and subsequently and I've reported that work in various newsletter articles which were summarized in the 5/6/05 newsletter.

The quickest way to find stocks on the CwH watchlist that meet the conditions described is through the use of filters and the ChartBrowser. Here are the steps.

- Set a filter on Expected Gain of at least 40%. I choose that figure because the standard error on the expected gain model is about 38% so a 40% threshold gives a 70% probability that the stock will move higher after breaking out.

- Filter for stocks with a CE Cell of 4-3 or better. Research has shown that most breakouts have come from zone 4-3.

- Filter for stocks that are within 10% of the left cup high. Research has shown that over 80% of succesful CwH breakouts come when the 'Pivot % off Left Cup' value is > -10%.

- Filter for stocks with a strong right cup. RCQ values greater than 0.5 are acceptable.

- Filter for stocks with a well-behaved handle. HQ values greater than zero are acceptable.

- After applying these filters (and other filters that meet your personal

preference), use the ChartBrowser to examine the charts of the filtered list.

Look for handles that have the characteristics described in our 4/23/05

Newsletter. While using the ChartBrowser, check the other charts as well.

In addition to the price/volume action, you also want to see:

- Relative Strength compared to the S&P 500 trending upwards

- High and/or improving RS Rank

- Up/Down volume improving and preferably in the green zone.

- After reviewing and selecting stocks in the ChartBrowser, put a check against them in the 'P W/L' (Personal Watchlist) column on the display. This is also the time to perform any other due diligence on them you might choose to do, such as reviewing their CE and industry position.

- Save your Personal Watchlist and set your Alert Preference to 'Personal Watchlist'. You will then only receive alerts on the stocks you selected.

I am working on a new tool that will allow you to backtest your filters. This is important because as market conditions change, so the characteristics of strong breakouts change as well. the new tool will allow you to backtest your filters against recent successful breakouts.

Get a 14 day Trial of our premium 'Platinum' service for just $9.95 and if you subsequently subscribe to any subscription level we will credit your $9.95 to your subscription. 14

Day Platinum Trial |

| Index | Value | Change Week | Change YTD | Market1 Signal |

||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 10512.6 | 0.49% | -2.51% | enter | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2063 | -0.41% | -5.17% | enter | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1198.11 | 0.17% | -1.14% | enter | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone (similar to IBD). The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 31 | 25.08 | 5.63% | 2.85% |

| Last Week | 43 | 23.62 | 5.89% | 0.58% |

| 13 Weeks | 385 | 26 | 10.04% |

3.44% |

Sector

|

Industry

|

Breakout Count for Week

|

|---|---|---|

Healthcare

|

Healthcare-Products

|

2

|

Insurance

|

Insurance-Prop/Casualty/TItl

|

2

|

Transportation

|

Transportation -Airlines

|

2

|

Aerospace & Defense

|

Aerospace & Defense-Electr

|

1

|

Business Services

|

Business Svcs-Misc

|

1

|

Business Services

|

Business Svcs-Sec/Safety

|

1

|

Computer

|

Computer-Graphics

|

1

|

Computer Software

|

Comp Software-Security

|

1

|

Computer Software

|

Comp Software-Financial

|

1

|

Electronics

|

Electr-Misc Products

|

1

|

Electronics

|

Electr-Connectors/Components

|

1

|

Electronics

|

Electr-Semicndtr Equip

|

1

|

Energy

|

Energy-Other Sources

|

1

|

Finance

|

Finance-Brokers

|

1

|

Healthcare

|

Healthcare-Outpnt/HmCare

|

1

|

Healthcare

|

Healthcare-Biomed/Genetic

|

1

|

Healthcare

|

Healthcare-Hospitals

|

1

|

Internet

|

Internet-ISP/Content

|

1

|

Leisure

|

Leisure-Services

|

1

|

Oil & Gas

|

Oil & Gas-Drilling

|

1

|

Oil & Gas

|

Oil & Gas-Intl Integrated

|

1

|

Oil & Gas

|

Oil & Gas-U S Explr/Prod

|

1

|

Pollution Control

|

Pollution Control-Services

|

1

|

Real Estate/ REIT

|

Real Estate-REIT

|

1

|

Retail

|

Retail-Building Products

|

1

|

Retail

|

Retail-Restaurant

|

1

|

Telecomm

|

Telecomm-Services Fgn

|

1

|

Utility

|

Utility-Electric

|

1

|

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | HYC | HYPERCOM CORP | 107 |

| Top Technical | ACU | ACME UTD CORP | 63 |

| Top Fundamental | CNC | CENTENE CORP DEL | 44 |

| Top Tech. & Fund. | XXIA | IXIA | 51 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | OSUR | ORASURE TECHNOLOGIES INC | 92 |

| Top Technical | SSNC | SS&C TECHNOLOGIES INC | 67 |

| Top Fundamental | USPI | UNITED SURGICAL PARTNERS INT | 28 |

| Top Tech. & Fund. | USPI | UNITED SURGICAL PARTNERS INT | 28 |

If you received this newletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2005 NBIcharts, LLC dba BreakoutWatch.com. All rights reserved.