| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

Head and Shoulders chart pattern still on beta-test - see this week's Top Tip for backtest results

Market Summary

The major indexes made gains of over 3% this week led by the NASDAQ which gained 3.65%. This was the biggest gain for the NASDAQ since the first week of the year. The DJI followed with a 3.23% gain and the S&P 500 closed 3.08% higher. The largest gains came on Friday when investors reacted favorably to a Commerce Department report that GDP growth slowed by a greater than expected amount to 2.5% in the second quarter. In moving stocks higher, investors overlooked a growth in core inflation to 2.9% and stronger than expected increase in employment costs.

Although the week's upward movement was encouraging we expect the recent volatility to continue, at least until the Federal Reserve's Open Markets Committee meeting on August 8. While a slowing of economic growth may give the Fed pause in raising interest rates, the Fed is also likely to view the increase in the core inflation figure with concern. The Fed's twin mandates are stable prices and full employment and they generally believe that the former is important to ensure the latter. Faced with a choice of controlling inflation or slowing the economy, they are likely to choose to control inflation. So while the markets rejoiced at a cooling economy yesterday, they are likely to return to their fear of inflation again shortly. A slow down in growth also hurts earnings, so we may see a reassessment of current price levels in view of the confirmation of slower economic growth.

There are indications that the NASDAQ may have finally found a bottom. It has climbed off its recent lows with a couple of follow-through days and overcome short term resistance. Also, the PSAR (dotted line on the chart below) has moved into a long position. It is still below both its 50 and 200 day moving averages, however, and will need to climb above th e200 before our market model will signal an 'enter'.

We are continuing to work on our new head and shoulders pattern and have just completed backtesting it to 1999. Results are presented below.

| Get a 14 day Trial of

our premium 'Platinum' service and TradeWatch for just $9.95 and

if you subsequently subscribe to any subscription

level we will credit your $9.95 to your subscription.

14

Day Platinum Trial |

See our Top Tip below.

Head and Shoulders Chart Pattern Backtest Results

Last week we described our methodology for recognizing head and shoulder (H&S) chart patterns. The newsletter article can be reviewed here. This week we look at the results of back testing this methodology against all stocks in our database (all NYSE, AmEx and NASDAQ NM companies) back to January 1, 1999, the earliest date for which we have data.

We have not completed integration of the H&S methodology with the rest of the site, including email alerts, so the existing beta-test version of the H&S display will continue to be accessible to subscribers and guests for another week.

The back testing shows that an H&S pattern is an extremely reliable predictor of a pending breakdown in a stock.

Methodology

- Stocks were considered if they closed above $5 on an average volume of 500,000 shares or more. These stocks comprise over 70% of all stocks.

- Stocks were examined at the end of six-monthly periods (June 30 and December 31) for H&S patterns that formed during the previous 6 months. If there was more than one pattern, then only the most recent pattern was considered. This was for computational efficiency, but it is unlikely that many patterns were missed, so the results are believed to be very representative. Overall, there were 525 head and shoulders patterns found that met our criteria for this pattern.

- For each pattern we determined the 'target' price after breakdown using the slope of the neckline as a guide. In the case of an upward sloping neckline, the target is the difference between the neckline and intraday high on the day the head is formed. In the case of a flat or downward sloping neckline, the target is the difference between the intraday low at the left shoulder and the intraday high at the head. In four cases this gave an expected decline from the breakdown price of over 100%. Since this is impossible to achieve in practice, we set the target % decline to 100%.

- Moving forward from the right shoulder of each pattern, we looked for the first day where the stock closed below the breakdown price. The breakdown price for each pattern was determined by extending the neckline, in the case of a positive neckline slope (i.e. sloping upwards), or the low at the left shoulder if the neckline slope was down.

- We then searched for the minimum intraday low on the breakdown day and subsequent days. The search stopped if the daily close was above the breakdown price. We did not search further to see If the stock then went on to breakdown again, although we did observe that there were many occasions when it did.

- We compared the 'target' decline from the breakdown with the actual decline from the breakdown.

- We also looked at what percentage of breakdowns exceeded an actual decline of 5% or more.

Results

| Slope >= 0 | Slope < 0 | Total | |

|---|---|---|---|

| Number of Patterns | 334 (63.62%) | 191 (36.38%) | 525 |

| Number of Breakdowns | 323 (96.70%) | 183 (95.81%) | 506 (96.38%) |

| Average Target % Decline | 22.00% | 20.97% | 21.63% |

| Average Actual % Decline | 19.75% | 19.44% | 19.64% |

| Results >= 5% | 252 (78%) | 125 (68.31%) | 377 (74.5%) |

The complete set of results with links to the head and shoulders patterns can be seen here.

|

|

Analysis

We found that a breakdown occurred in 96.38% of cases. This indicates that the head and shoulders pattern is a very powerful predictor of a price decline to come. This is true whether the slope of the neckline is upwards, flat or downwards. Of these, the decline after breakdown exceeded 5% in 74.5% of breakdowns.

Upward sloping necklines are much more common than downward sloping necklines and have a slightly higher potential return by about 1%.

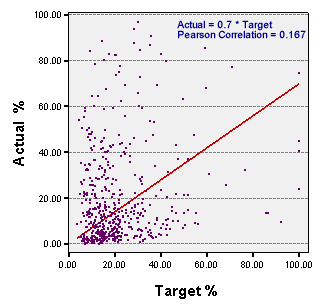

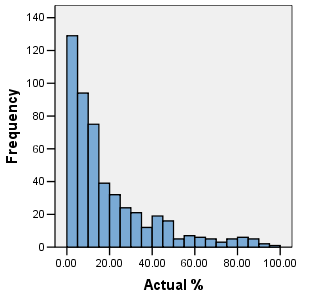

The average actual % decline was very close to the target for both upward and downward sloping necklines and overall. However, there was wide variability between the actual % decline result versus the target % decline in each case as the scatter plot shows. Nevertheless, the Pearson correlation coefficient of 0.167 for 506 cases determined there is a statistically significant relationship between target and actual results. The regression line through the origin shows that the actual result will be about 70% of the target although there will be wide variation in that result.

In our sample, we found that 89 stocks (17.6%) set their low on the same day as they broke down and closed above the breakdown price the next day. Many went on to breakdown again, but we did not analyze their number.

Our definition of a head and shoulders pattern does not include a consideration of the volume at the left shoulder, head and right shoulder whereas most definitions of the pattern suggest that volume should be lower at each of these points. Our analysis shows that the pattern is a very good predictor of impending breakdown without considering volume.

Implications

If you hold a long position in a stock that has completed the right shoulder of an H&S pattern, then you should sell because 96% of these stocks will break down.

Because of the high probability that a breakdown is about to occur, you may wish to open a short position immediately an H&S is identified before waiting for the breakdown. The position can then be added to when the breakdown occurs.

Immediately after the breakdown, set a stop loss at the breakdown price to protect yourself against the 17.6% of breakdowns that recover the next day. Otherwise, a reasonable target profit for the trade is 70% of the target price.

As always, we welcome your comments and suggestions. Please post them to the Breakoutwatch Forum.

Investment Advisors Using our Service

TradeRight Securities, located in a suburb of Chicago, is a full services investment management company and broker/dealer. They have been a subscriber, and user, of BreakoutWatch.com for some time now. They practice CANTATA and use Breakoutwatch.com as a “research analyst”. You can learn more about TradeRight Securities at: www.traderightsecurities.com. If you’re interested in speaking to a representative, simply call them toll-free at 1-800-308-3938 or e-mail gdragel@traderightsecurities.com.

PivotPoint Advisors, LLC takes a technical approach to investment planning and management. A breakoutwatch.com subscriber since May, 2004, they use breakouts, market signals, and now TradeWatch to enhance returns for their clients. Learn more at http://pivotpointadvisors.net or contact John Norquay at 608-826-0840 or by email at john.norquay@pivotpointadvisors.net.

Note to advisors: If you would like to be listed here, please contact us. As a service to those who subscribe to us, there is no additional charge to be listed here.

| Get a 14 day Trial of

our premium 'Platinum' service and TradeWatch for just $9.95 and

if you subsequently subscribe to any subscription

level we will credit your $9.95 to your subscription.

14

Day Platinum Trial |

| Index | Value | Change Week | Change YTD | Market1 Signal |

||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 11219.7 | 3.23% | 4.69% | enter | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2094.14 | 3.65% | -5.04% | exit | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1278.55 | 3.08% | 2.42% | enter | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone (similar to IBD). The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 40 | 16.54 | 3.98% | 1.46% |

| Last Week | 33 | 15.92 | 6.23% | 2.44% |

| 13 Weeks | 265 | 18.85 | 7.36% |

-1.36% |

Sector

|

Industry

|

Breakout Count for Week

|

|---|---|---|

Real Estate/ REIT

|

Real Estate-REIT

|

3

|

Banks

|

Banks-West/Southwest

|

2

|

Finance

|

Finance-Misc Services

|

2

|

Healthcare

|

Healthcare-Med/Dent Services

|

2

|

Insurance

|

Insurance-Life

|

2

|

Media

|

Media-Cable/Satellite TV

|

2

|

Special

|

Special-Market/Tracking Funds

|

2

|

Special

|

Special-ClsdEndFunds/Bond

|

2

|

Telecomm

|

Telecomm-Services US

|

2

|

Agricultural Operations

|

Agricultural Operations

|

1

|

Banks

|

Banks-Super Regional

|

1

|

Banks

|

Banks-Southeast

|

1

|

Banks

|

Banks-Midwest

|

1

|

Banks

|

Banks-Northeast

|

1

|

Building

|

Building-Tools

|

1

|

Business Services

|

Business Svcs-Advertising

|

1

|

Chemical

|

Chemical-Specialty

|

1

|

Computer

|

Computer-Services

|

1

|

Electronics

|

Electr-Parts Distrib

|

1

|

Healthcare

|

Healthcare-Med/Dent Supply

|

1

|

Healthcare

|

Healthcare-Biomed/Genetic

|

1

|

Healthcare

|

Healthcare-Products

|

1

|

Healthcare

|

Healthcare-Drugs/Ethical

|

1

|

Insurance

|

Insurance-Prop/Casualty/TItl

|

1

|

Leisure

|

Leisure-Movies & Related

|

1

|

Leisure

|

Leisure-Services

|

1

|

Telecomm

|

Telecomm-Wireless Services

|

1

|

Transportation

|

Transportation-Ship

|

1

|

Utility

|

Utility-Electric

|

1

|

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | CANI | Carreker Corporation | 103 |

| Top Technical | AVCI | Avici Systems | 87 |

| Top Fundamental | ENDP | Endo Pharmaceuticals Hld | 27 |

| Top Tech. & Fund. | BWP | Boardwalk Pipeline Partners LP | 31 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | RMKR | Rainmaker Systems Inc | 103 |

| Top Technical | RICK | Rick's Caberet Intl | 101 |

| Top Fundamental | WOOF | Vca Antech | 45 |

| Top Tech. & Fund. | WOOF | Vca Antech | 45 |

If you received this newletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2006 NBIcharts, LLC dba BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan "tomorrow's breakouts today" are service marks of NBIcharts LLC. All other marks are the property of their respective owners, and are used for descriptive purposes only.