| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

Market Summary

Market Signal at Exit

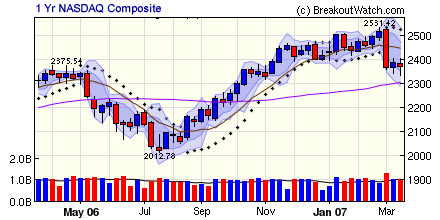

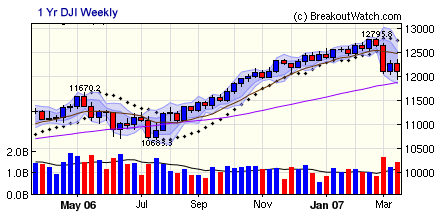

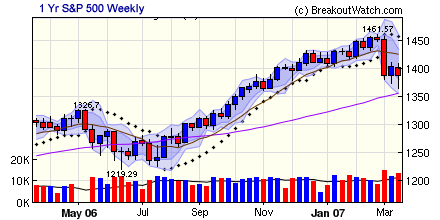

On Tuesday the NASDAQ Composite registered its fifth distribution day in eleven sessions and our market signal went to exit. At the time, the rally that had begun the previous week was still barely viable but the low set on March 5 was taken out the next day. Although a new low was set on Wednesday, the markets recovered in the afternoon and a possible new rally started. The first possible follow-through day to confirm that rally would be on the fourth day of the rally, which is Monday. The markets would have to deliver an accumulation day and simultaneously be at least 1.5% above Wednesday's close before our market model will confirm the rally. Until then, we recommend liquidating all growth stock holdings. For the week, the DJI lost 1.35%, the NASDAQ Composite slipped 0.62% and the S&P 500 lost 1.13%. None of the major indexes have been under accumulation since the second week in January. The NASDAQ has undergone four distribution weeks since then and the DJI and S&P 500 three each.

We are pessimistic about the outlook for the markets even if the current tentative rally is confirmed by a follow-through day. It is usual for there to be several failed rallies as the market moves into a correction, but this time there are underlying economic factors that could deepen the correction to a real bear market (usually a correction is of the order of 10% and a bear market 20% or worse). For a thoughtful analysis of the reasons why, we once again refer you to Nouriel Roubini's Blog.

The three major indexes all show a similar pattern as can be seen in the charts below. Over the last three weeks, the shadows (tails) of the candlesticks have been getting progressively longer and are coming closer to the 200 day moving average. We would not be surprised to see the current rally fail and the 200-day moving average support level tested shortly thereafter. That would represent a 10% correction for the NASDAQ, and a 7% correction for the Dow and S&P 500.

In view of these possibly devastating scenarios, we are strengthening our short sale offering, of which there is more below.

| Get a 14 day Trial of our premium 'Platinum'

service and TradeWatch for just $9.95 and if you subsequently subscribe

to any subscription level we will credit your $9.95 to your subscription.

14

Day Platinum Trial |

Our daily TradeWatch email was enhanced to include the Short at Open for the next session. An example from Friday, March 16 close is shown below. To understand the Short stop Price columns, please see our March 3 Newsletter.

Short at Open Performance to Date

We are continuing to develop our short position tools and will have further announcements next week. Since introducing our 'Short at Open' list in the March 3 Newsletter we suggested 10 stocks. Four positions were covered for an average gain of 7.13%, and there are six position not yet covered. Until Friday's close, these positions showed a profit of 2.47%. The overall gain to date is 4.41%.

| Short Positions Closed | |||||

| Symbol | Short Date | Short Price | Cover Price | Cover Date | Gain/Loss % |

|---|---|---|---|---|---|

| ATVI | 3/5/2007 | 16.52 | 16.17 | 3/14/2007 | 2.12% |

| GES | 3/14/2007 | 38.98 | 37.83 | 3/15/2007 | 3.04% |

| SAY | 3/14/2007 | 22.8 | 19.52 | 3/15/2007 | 16.76% |

| SWIR | 3/13/2007 | 13.85 | 12.99 | 3/14/2007 | 6.60% |

| Average Gain | 7.13% | ||||

| Short Positions Still Open | |||||

| Symbol | Short Date | Short Price | Cover Price | Cover Date | Gain/Loss % |

| AAPL | 3/5/2007 | 86.84 | 89.59 | -3.07% | |

| BRLC | 3/6/2007 | 7.88 | 7.7 | 2.34% | |

| BRLC | 3/14/2007 | 7.88 | 7.7 | 2.34% | |

| MHK | 3/13/2007 | 85.85 | 83.12 | 3.28% | |

| RFMD | 3/15/2007 | 7.63 | 7.5 | 1.73% | |

| XMSR | 3/5/2007 | 14.24 | 13.16 | 8.21% | |

| Average Gain | 2.47% | ||||

| Average Overall | 4.41% | ||||

Investment Advisors Using our Service

TradeRight Securities, located in a suburb of Chicago, is a full services investment management company and broker/dealer. They have been a subscriber, and user, of BreakoutWatch.com for some time now. They practice CANTATA and use Breakoutwatch.com as a “research analyst”. You can learn more about TradeRight Securities at: www.traderightsecurities.com. If you’re interested in speaking to a representative, simply call them toll-free at 1-800-308-3938 or e-mail gdragel@traderightsecurities.com.

PivotPoint Advisors, LLC takes a technical approach to investment planning and management. A breakoutwatch.com subscriber since May, 2004, they use breakouts, market signals, and now TradeWatch to enhance returns for their clients. Learn more at http://pivotpointadvisors.net or contact John Norquay at 608-826-0840 or by email at john.norquay@pivotpointadvisors.net.

Note to advisors: If you would like to be listed here, please contact us. As a service to those who subscribe to us, there is no additional charge to be listed here.

| Get a 14 day Trial of

our premium 'Platinum' service and TradeWatch for just $9.95 and

if you subsequently subscribe to any subscription

level we will credit your $9.95 to your subscription.

14

Day Platinum Trial |

| Index | Value | Change Week | Change YTD | Market1 Signal |

||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 12110.4 | -1.35% | -2.83% | enter | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2372.66 | -0.62% | -1.77% | exit | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1386.95 | -1.13% | -2.21% | enter | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone (similar to IBD). The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 10 | 19.38 | 0.7% | -3.36% |

| Last Week | 15 | 20.77 | 2.29% | -0.92% |

| 13 Weeks | 347 | 21.15 | 8.65% |

-1.83% |

Sector

|

Industry

|

Breakout Count for Week

|

|---|---|---|

FINANCIAL SERVICES

|

Closed-End Fund - Debt

|

2

|

BANKING

|

Regional - Midwest Banks

|

1

|

COMPUTER HARDWARE

|

Networking & Communication Devices

|

1

|

CONSUMER DURABLES

|

Home Furnishings & Fixtures

|

1

|

DRUGS

|

Biotechnology

|

1

|

FINANCIAL SERVICES

|

Closed-End Fund - Equity

|

1

|

INTERNET

|

Internet Software & Services

|

1

|

INTERNET

|

Internet Information Providers

|

1

|

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | LPSN | Liveperson Inc | 99 |

| Top Technical | STTX | Steel Technologies Inc | 34 |

| Top Fundamental | WBD | Wimm Bill Dann Foods Ojsc | 47 |

| Top Tech. & Fund. | WBD | Wimm Bill Dann Foods Ojsc | 47 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | AVCI | Avici Systems | 75 |

| Top Technical | AVCI | Avici Systems | 75 |

| Top Fundamental | AVCI | Avici Systems | 75 |

| Top Tech. & Fund. | AVCI | Avici Systems | 75 |

If you received this newletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2007 NBIcharts, LLC dba BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan "tomorrow's breakouts today" are service marks of NBIcharts LLC. All other marks are the property of their respective owners, and are used for descriptive purposes only.