| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

Market Summary

NASDAQ Vacillates but Outperforms DJI and S&P 500

We reported last week that investors had adjusted to the new expectation that interest rates will remain steady this year and that growth stocks were back in favor. That prediction looked a little shaky on Tuesday when our market model again reversed itself for the NASDAQ but low increases in the core producer price index and consumer price index reassured the markets that an interest rate rise would not be necessary to control inflation and two solid days of gains caused the model to reverse itself yet again on Friday. For the week, the NASDAQ Composite easily outperformed the other major indexes with a 2.07% gain while the DJI rose 1.6% and the S&P 500 gained 1.67%.

Although the NASDAQ made solid gains, volume was disappointing until Friday when it jumped up to 21% above the 50 day average. Volumes on the broader market were also up sharply on Friday. While this would normally be a sign of increasing confidence, Friday was also a 'quadruple witching' day which always generates much higher than normal volumes. Nevertheless, with two successive reports of tame core inflation at the producer and consumer level, Investors are now reassured that the interest rate environment will be stable for the foreseeable future.

The consumer is not so reassured however as they pay a higher price for food and gas. The overall increase in the CPI was a higher than expected 0.7% month-on-month and the effects of a higher cost of living were evident in a fall in consumer sentiment as measured by the University of Michigan. The short term effect of higher food and energy costs is to reduce discretionary spending which acts as a break on the economy so there is no need for the Fed to act to curb the higher headline inflation number.

The conditions for breakouts continue to be favorable. Of 23 breakouts this week, only 1 failed to show a profit by week's end, with a small loss of 0.24%, and the average gain was 3.35%. Our 'Top Tip' this week shows how to select the most successful breakouts based on recent market conditions.

There were no new features added this week.

The Best Filters for Recent Market Conditions

Our backtest feature on the CwH watchlist provides you with a tool to identify the filters that work best in recent market conditions. The backtest feature and its use is described here.

We've done our own analysis for you and found that since April 1, the approximate date of the most recent upwards trend, the filters that select the best Cup-with-Handle breakouts are quite simple:

CET >= 6, UpDownRatio>=0.5, Industry_rank_CT<=25.

This set of filters beat the average return of all breakouts over the last 75 days by 51.5%. The filters would have given you 21 alerts with 7 breakouts confirmed. The average gain to the high since breakout would have been 23.6%, AND there would have been zero failures (a failure occurs when a breakout falls by more than 8% from its breakout price).

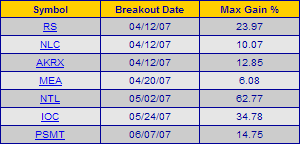

This result surprises us, because it is contrary to the trend we have seen over the 6 years we have operated the site in that industry rank (based on technical not fundamental criteria) has taken on an importance not previously seen. It reflects that in the uncertain market we have seen recently, investors have preferred 'quality' stocks over speculative issues. It is also notable that of the seven successful breakouts selected by these filters, only two were listed on the NASDAQ, which is consistent with the recent trend. the seven stocks are:

Investment Advisors Using our Service

TradeRight Securities, located in a suburb of Chicago, is a full services investment management company and broker/dealer. They have been a subscriber, and user, of BreakoutWatch.com for some time now. They practice CANTATA and use Breakoutwatch.com as a “research analyst”. You can learn more about TradeRight Securities at: www.traderightsecurities.com. If you’re interested in speaking to a representative, simply call them toll-free at 1-800-308-3938 or e-mail gdragel@traderightsecurities.com.

Note to advisors: If you would like to be listed here, please contact us. As a service to those who subscribe to us, there is no additional charge to be listed here.

| Get a 14 day Trial of

our premium 'Platinum' service and TradeWatch for just $9.95 and

if you subsequently subscribe to any subscription

level we will credit your $9.95 to your subscription.

14

Day Platinum Trial |

| Index | Value | Change Week | Change YTD | Market1 Signal |

||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 13639.5 | 1.6% | 9.44% | enter | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2626.71 | 2.07% | 8.75% | enter | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1532.91 | 1.67% | 8.08% | enter | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone (similar to IBD). The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 23 | 19.77 | 4.59% | 3.44% |

| Last Week | 37 | 18.38 | 1.84% | -1.81% |

| 13 Weeks | 320 | 20.15 | 12.02% |

4.46% |

Sector

|

Industry

|

Breakout Count for Week

|

|---|---|---|

AEROSPACE/DEFENSE

|

Aerospace/Defense Products & Services

|

2

|

INTERNET

|

Internet Software & Services

|

2

|

MANUFACTURING

|

Diversified Machinery

|

2

|

CHEMICALS

|

Synthetics

|

1

|

COMPUTER HARDWARE

|

Computer Peripherals

|

1

|

COMPUTER SOFTWARE & SERVICES

|

Business Software & Services

|

1

|

COMPUTER SOFTWARE & SERVICES

|

Application Software

|

1

|

DRUGS

|

Drug Manufacturers - Major

|

1

|

DRUGS

|

Drug Manufacturers - Other

|

1

|

DRUGS

|

Drug Delivery

|

1

|

ENERGY

|

Oil & Gas Equipment & Services

|

1

|

FINANCIAL SERVICES

|

Closed-End Fund - Foreign

|

1

|

FINANCIAL SERVICES

|

Closed-End Fund - Equity

|

1

|

FOOD & BEVERAGE

|

Farm Products

|

1

|

MANUFACTURING

|

Industrial Electrical Equipment

|

1

|

MATERIALS & CONSTRUCTION

|

General Contractors

|

1

|

MEDIA

|

CATV Systems

|

1

|

TRANSPORTATION

|

Air Delivery & Freight Services

|

1

|

WHOLESALE

|

Industrial Equipment Wholesale

|

1

|

WHOLESALE

|

Basic Materials Wholesale

|

1

|

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | CUP | Peru Copper Inc | 107 |

| Top Technical | JOSB | Jos A Bank Clothiers | 41 |

| Top Fundamental | CPX | Complete Production Services Inc | 31 |

| Top Tech. & Fund. | CPX | Complete Production Services Inc | 31 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | SAPE | Sapient Corporation | 86 |

| Top Technical | CALM | Cal-Maine Foods Inc | 69 |

| Top Fundamental | OMNI | Omni Energy Services Cp | 80 |

| Top Tech. & Fund. | OMNI | Omni Energy Services Cp | 80 |

If you received this newletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2007 NBIcharts, LLC dba BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan "tomorrow's breakouts today" are service marks of NBIcharts LLC. All other marks are the property of their respective owners, and are used for descriptive purposes only.