| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

Market Summary

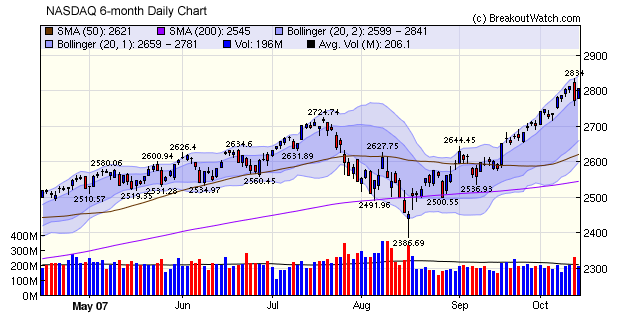

We are returning from Australia this weekend so our summary is once again rather brief. We continue to be bullish on the market and the NASDAQ in particular. The NASDAQ Continues to outperform the other major indexes and has now gained over 16% for the year. The daily chart shows the index has continued to trade within a band separated by the 1 and 2 standard deviation Bollinger Bands. Although there was a sharp pullback on Thursday the index recovered on Friday as investors were encouraged by a hostile bid by ORACLE for BEA.

Important note to Newsletter Subscribers who are not yet full subscribers: Our 14 day Trial is now completely free - no credit card needed to sign-up.

No new features this week.

The Primary Chart Pattern - the Cup-with-Handle and associated metrics

The cup-with-handle chart pattern was first popularised by William O'Neil in his 1988 book, "How to make Money in Stocks". Of the chart patterns we have studied., we have found it to be the most successful in that the gains made after breakout from this pattern exceed the returns from other patterns. In this tutorial we examine the pattern, how and why it develops and our own criteria for identifying it. Our identification criteria are somewaht broader than those originally proposed by O'Neil, but our filters (more in a later tutorial) allow you to restrict yourself to only patterns that meet his criteria, if you wish.

Stage 1: Setup. The pattern starts with a stock rising from a former base. At some point, profit taking sets-in and the stock begins to decline, ending the setup. The maximum price reached at the end of Stage 1 is called the 'Left Cup', and the amount by which the stock rose from its prior low is the Setup Gain. To ensure a well-defined left cup, we require that the setup gain be at least 30% from the prior low level for it to qualify as a valid left cup.

Stage 2: Decline. The stock now collapses into a new base. The collapse can occur for any number of reasons: poor company results; over-all market conditions; bad news; profit taking after a strong setup stage, and so on. There should be strong selling and volume should be well above average for the first few days of the collapse. Note that collapsing price alone is not sufficient to provide a good CwH pattern, volume is also important. This is because we want most of the buyers from the setup stage to liquidate their holdings, so there will not be a lot of overhead supply when the stock begins to climb the right side of the cup. The combined price and volume action in stage 2 is important if the eventual breakout is to succeed. By the end of stage 2, volume should have fallen to well below average levels as most holders have sold and there is little buying activity, if any. The depth of the base is important also. We do not want the stock to collapse to a level from which recovery will be difficult, if not impossible, so when selecting CwH stocks for our watchlist we limit the cup depth to be at most 60% of the left cup price.

Stage 3: Recovery. If and when the conditions that brought about the stage 2 collapse have been resolved, the stock may begin to recover. If it does so, the stock will start to climb the right side of the cup. As it does so, we like to see above average volume on days when the price moves up, which indicates that institutions are taking an interest in the stock, but light volume on days when it closes down, indicating that there are small numbers of sellers. Ideally, this constructive price and volume action will strengthen as the right side of the cup is formed and the stock moves higher. Meanwhile, there will be some holders of the stock who bought at or near the left cup price but didn't sell in stage 2. These holders are waiting for the time when they can recoup some or all of their losses. There will also be profit taking by bottom-fishers. As losses are covered or profits are taken there will be pauses in the recovery and a typical cup right-side will exhibit a stair-step characteristic, rather than the smooth ascension shown in the idealized chart. Each of these pauses, or pullbacks, reduces the overhead supply left over from the left cup setup.

As the price on the right side approaches the left cup level, the last holders will finally decide to cut their losses and there will be a large volume sell-off. This often is preceded by a day on which the price spikes on high volume which the sellers have interpreted as an overbought condition and therefore a last opportunity to recoup their losses. This is the point at which the pivot forms, and marks the end of the recovery stage.

There are several technical conditions that must be met before our algorithm will recognize a valid pivot. Firstly we want the stock to have attained a strong relative strength when compared to all other stocks, so we require an RS (Relative Strength Rank) of 80 on a scale from 1-99. We also want the pivot to be approaching the left cup level, so we require the pivot price to be at least 60% of the left cup. Thirdly, there must have been sufficient time for a shakeout of holders during stage 2, and sufficient time for institutions to notice and take an interest in the stock during stage 3. This is essential if the stock is to be projected to new highs after the breakout. Consequently, we require the distance from the left cup to the pivot, to be at least 6 weeks (30 sessions). On the other hand, we don't want the cup to be so long as to be meaningless, so there is a maximum cup length of 325 sessions imposed. A complete list of our criteria is provided at the end of this article.

We mentioned above the need for constructive price/volume action while the stock is building the right side of its cup. This is measured by our Right Cup Quality indicator (RCQ) and is a component of our overall Chart Quality metric (CQ). CQ is described here.

Stage 4: Consolidation. After the pivot we want and expect to see a shakeout while the overhead supply is depleted. This will cause the price to decline, initially on high volume but then the price should stabilize or drift down on volume well below average levels. The institutions who are tracking the stock know that they want the overhead supply eliminated and will wait for these stable conditions to materialize before they pounce. To identify well behaved handles, we require that the decline (or 'droop') in the handle should not be more than 30% of the pivot price, that the mid-point of the handle be above the mid-point of the base and that the minimum time spent in the handle should be two days, but that the overall handle length should not be more than 90 days. We also do not want the handle to be disproprtionate to the cup, so we require that the handle be no longer than a third of the cup length. The two day handle minimum is quite short but we want to make sure we don't miss any strong candidates (as will be seen shortly). We give our subscribers the ability to filter out short handles if they wish.

We measure the price/volume action in the handle using a proprietary metric called Handle Quality (HQ), which is also a component of CQ, mentioned earlier.

After the price has stabilized, it is not uncommon to see the price begin to rise on higher volume. This is an indication that institutions are starting to nibble and may indicate a strong breakout to come. We have noticed that breakouts are 17% stronger, on average, when the price and volume rise on the day before the breakout. See our newsletter of 4/23/05.

When the conditions described in these 4 stages are satisfied, we have a valid CwH pattern and the stock will be placed on our CwH watchlist, CwHWatch. If the conditions change so the stock no longer meets the criteria, then the stock will be dropped from CwHWatch. We monitor the stock while it is on CwH Watch and issue a real-time alert if the pivot price is met or exceeded and the projected daily volume exceeded 1.5 times the average daily volume - an indication that institutions are buying the stock in large quantities.

A CwH Example: Boom

On November 12, 2004, Dynamic Materials reported earnings of 16 cents a share compared to a loss of 13 cents a share for the same quarter a year earlier, and predicted strong future earnings based on order backlogs (see story). The stock went from $3.66 to $17.58 (a 380% gain) in the next 8 sessions, completing its stage 1 setup. The stock then entered the stage 2 decline as profit taking took over and after one failed recovery attempt the stock lost almost 50% of its value. At its low, volume was well below the average and had almost returned to the pre-November12 levels. The recovery then began with constructive price/volume action as needed. As price and volume picked up, the stock formed a low handle with pivot at 13.73. The mid-point of this handle was below the mid-point of the base, however, so it did not qualify for our CwHWatch. A valid pivot did form on Feb. 15 at 14.75 with positive HQ and RCQ values and our Expected Gain model predicted a gain of 66% if the stock broke out. On February 18 the stock indicated it was ready to move higher when it closed at its high of the day. After the long weekend it gapped up at the open by more than $2 and broke out on nearly 8 times average daily volume. It formed a second short handle and broke out again on 2/25 on 10 times average daily volume and went on to gain 164% in the next month.

Cup-with-Handle Chart for BOOM as of 02/18/05

Cup-with Handle Chart for BOOM as of 5/12/05 showing progress since breakout.

| Item |

Definition |

CwHWatch

Criteria |

|---|---|---|

Current

Close |

The price at which the

stock closed on the day it is included in CwHwatch. This is updated each

day that the stock remains on the list. |

>= $6 |

Average Volume |

The average daily volume over the last

50 days |

>=30,000 |

RSRank |

The stock’s weighted price appreciation over the prior year, as ranked against all other stocks in our database. |

>=80 |

Setup Gain |

The amount by which the stock price rose

from its prior low to the left cup, measured as a percentage of the previous

low. |

>=30% |

Cup |

Trading days between Left Cup and Current Close. |

>=30 days |

Handle |

Action on the right side of the Cup in which the price has discontinued rising, falling back slightly in a tight consolidation. (see Pivot) |

>= 2 days and <= 90 days * |

Cup:Handle

Ratio |

The length of the cup relative

to the length of the handle. |

>= 3 |

Handle Low |

Lowest intraday low within the Handle. |

>= 99% of 200 day moving average |

Pivot |

Highest intraday high that marks the beginning of the Handle. |

Must exist |

Handle Depth |

Difference between the Pivot and the Handle Low, expressed as a percentage of the Pivot. |

<= 30% |

Pivot % off Left Cup |

Difference between the Left Cup and the Pivot, expressed as a percentage of the Left Cup. |

<= +5% and >= -40% |

Midpoint of Base |

Price which marks half the distance between the Left Cup and the Base Low. |

None |

Midpoint of Handle |

Price which marks half the distance between the Pivot and the Handle Low. |

>= Midpoint of Base |

Additional Metrics that Assist with Determining Breakout Potential and Possible Gains After Breakout

Price/Volume Indicator

We have observed that successful breakouts breakouts are related to the price/volume action on the day before breakout. To capture this indicator of a potential to breakout we develped the Price/Volume Indicator. The PVI classifies the price/volume action on the day the watchlist is published by looking at three conditions :

- did the stock close higher than the day before?

- if so, was the volume greater than the day before?

- if so, was the volume greater than the day before and above average?

the answers to these questions result in 5 possible classifications for the PVI as follows

| Price/Volume Action | PVI |

|---|---|

Price does not rise over previous day |

0 |

Price rises over previous day on lower volume and

volume less than average |

0.2 |

Price rises over previous day on higher volume and

volume less than average |

0.5 |

Price rises over previous day on lower volume and

volume is above average |

0.6 |

Price rises above the previous day and volume is

above average |

0.9 |

It is important to understand that the values assigned to the PVI are to allow us to classify the possibilities and are not intended to imply relativity between the classifications. That is, a PVI of 0.6 is not 3 times better than a PVI of 2, for example.

The Relationship between PVI and Breakout Attempts and Successes

We analysed all cup-with-handle breakouts cases and found that 75% of all breakout attempts occurred where the price had risen over the previous day. Of those breakouts that were successful, the price had risen 72% of the time on the previous day. Of the successful breakouts, 60% rose on higher volume on the day before breakout (PVI classes 0.5 and 0.9).

Results Since April

2003 |

PVI |

Total

|

||||

|---|---|---|---|---|---|---|

0 |

0.2 |

0.5 |

0.6 |

0.9 |

||

Watchlist Cases |

50546 |

22335 |

13419 |

4180 |

1114 |

91594 |

Breakout Attempts |

1272 |

1237 |

909 |

388 |

1296 |

5102 |

Breakout Successes |

819 |

585 |

447 |

264 |

820 |

2935 |

PVI as % of Total Attempts |

24.93% |

24.25% |

17.82% |

7.60% |

25.40% |

100.00% |

% with PVI > 0 |

32.30% |

23.73% |

10.13% |

33.84% |

75.07% |

|

PVI as % of Total Successes |

27.90% |

19.93% |

15.23% |

8.99% |

27.94% |

100.00% |

% with PVI > 0 |

27.65% |

21.12% |

12.48% |

38.75% |

72.10% |

|

The Relationship between PVI and Longer Term Gains

Looking at the average maximum gains after breakout, we see that there is little difference between the average maximum gain between the different PVI classes.

However, if we look at the average gains over a shorter period of 13 weeks, we see that we can improve the maximum gain by filtering for different values of PVI as the following chart shows:

It is important to note that filtering for PVI does not improve the return on the breakout day itself. While this might seem counter intuitive, I postulate that this is because the major price move was made on the day before breakout as aresult of instituional buying.

PVI is a column under the CWH Metrics tab on CwHwatch.

Volume to Average Daily Volume Ratio (VADVR)

Somewhat related to the PVI is the Volume to Average Daily Volume Ratio which is published on each CwH watchlist. The VADVR considerably increases the chance of selecting a successful breakout as we will see. Firstly, we must recognize that we publish many stocks on our CwH watchlist each day and that only a few of them will attempt to breakout on any given day and even fewer of them wil be successful. In fact, the average breakout success rate is just 2.32% of all cases but 46.28% of all breakout attempts. Our research shows that these success rates improve significantly when VADV is considered. This chart represents graphically how the chance of a breakout attempt for all cases increases with VADVR:

Once an alert is issued, the average chance that a breakout will occur is 46%. This chart shows the chance of any particular attempt being confirmed increases with VADVR:

The difference between success and failure in the markets is gained by improving the odds in our favor. We can never be 100% right but if we are right more often than we are wrong then we stand to make outstanding gains if our strategy is coupled with a sound money management policy. So if we are trying to pick successful breakouts from the alerts we receive each day, then we should pay attention to the VADVR because it can significantly improve our chances of picking a winner. To summarize, here's how the chances of picking a successful breakout on an alert improve as the VADVR increases:

| If VADR is: | Chance of Successful Breakout is: |

|---|---|

| > 0 | 46.28% |

| > 0.5 | 47.82% |

| > 0.75 | 50.92% |

| > 1.00 | 53.34% |

| > 1.25 | 55.24% |

| > 1.50 | 56.00% |

| > 1.75 | 56.05% |

| > 2.00 | 54.59% |

| > 2.25 | 54.24% |

| > 2.50 | 52.74% |

| > 2.75 | 54.49% |

| > 3.00 | 55.00% |

You can learn how to use the PVI and VADVR metrics in our newsletter of 11/12/2005.

Investment Advisors Using our Service

TradeRight Securities, located in a suburb of Chicago, is a full services investment management company and broker/dealer. They have been a subscriber, and user, of BreakoutWatch.com for some time now. They practice CANTATA and use Breakoutwatch.com as a “research analyst”. You can learn more about TradeRight Securities at: www.traderightsecurities.com. If you’re interested in speaking to a representative, simply call them toll-free at 1-800-308-3938 or e-mail gdragel@traderightsecurities.com.

Note to advisors: If you would like to be listed here, please contact us. As a service to those who subscribe to us, there is no additional charge to be listed here.

Get a 14 day free

Trial of our premium 'Platinum' service and TradeWatch.

No Credit Card Required.

Click

Here for 14 Day Free Trial |

| Index | Value | Change Week | Change YTD | Market1 Signal |

||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 14093.1 | 0.19% | 13.08% | enter | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2805.68 | 0.91% | 16.16% | enter | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1561.8 | 0.27% | 10.12% | enter | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone (similar to IBD). The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 20 | 13.62 | 7.08% | 3.64% |

| Last Week | 24 | 13.31 | 8.64% | 4.09% |

| 13 Weeks | 235 | 14.85 | 15.45% |

7.27% |

Sector

|

Industry

|

Breakout Count for Week

|

|---|---|---|

FINANCIAL SERVICES

|

Diversified Investments

|

2

|

METALS & MINING

|

Industrial Metals & Minerals

|

2

|

TRANSPORTATION

|

Shipping

|

2

|

AEROSPACE/DEFENSE

|

Aerospace/Defense Products & Services

|

1

|

COMPUTER HARDWARE

|

Computer Peripherals

|

1

|

COMPUTER SOFTWARE & SERVICES

|

Business Software & Services

|

1

|

CONSUMER DURABLES

|

Business Equipment

|

1

|

DIVERSIFIED SERVICES

|

Staffing & Outsourcing Services

|

1

|

ELECTRONICS

|

Semiconductor - Integrated Circuits

|

1

|

MANUFACTURING

|

Farm & Construction Machinery

|

1

|

MANUFACTURING

|

Diversified Machinery

|

1

|

MANUFACTURING

|

Industrial Electrical Equipment

|

1

|

MANUFACTURING

|

Machine Tools & Accessories

|

1

|

MEDIA

|

CATV Systems

|

1

|

METALS & MINING

|

Silver

|

1

|

TELECOMMUNICATIONS

|

Wireless Communications

|

1

|

UTILITIES

|

Electric Utilities

|

1

|

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | ALLI | Allion Healthcare Inc | 102 |

| Top Technical | EHTH | Ehealth Inc | 32 |

| Top Fundamental | EPHC | Epoch Holding Corp | 64 |

| Top Tech. & Fund. | EHTH | Ehealth Inc | 32 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | URRE | URANIUM RESOURCES | 84 |

| Top Technical | TPC | SunCom Wireless Holdings Inc | 39 |

| Top Fundamental | JOBS | 51job Inc Ads | 61 |

| Top Tech. & Fund. | JOBS | 51job Inc Ads | 61 |

If you received this newletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2007 NBIcharts, LLC dba BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan "tomorrow's breakouts today" are service marks of NBIcharts LLC. All other marks are the property of their respective owners, and are used for descriptive purposes only.