| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

Market Summary

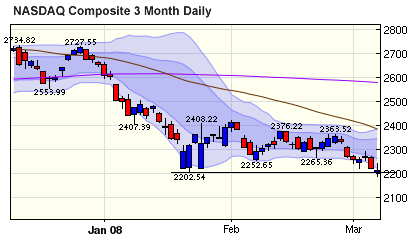

NASDAQ Composite Tests January Support Level

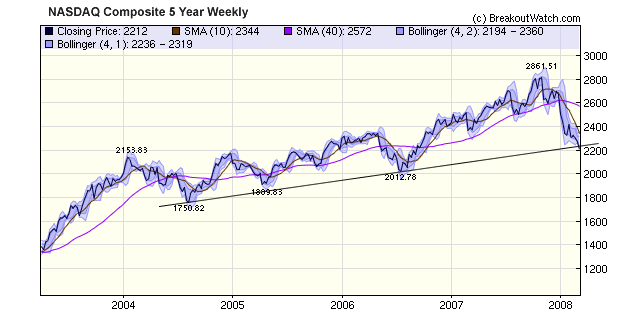

The market's decline continued this week as the economy weakened and the parlous condition of the banking industry became more acute. We have become accustomed recently to late afternoon rallys (usually sparked by CNBC reporting a new monoline rescue - see below) and Friday's trading didn't disappoint, except this time the rally didn't hold and the major indexes suffered another distribution day. The rally came just as the NASDAQ was testing its January 23 low. Although it closed just above that level, a 5-year chart shows that the index broke through its 5-year trend line with the next support level at 2012, a decline of another 10%.

The market's decline continued this week as the economy weakened and the parlous condition of the banking industry became more acute. We have become accustomed recently to late afternoon rallys (usually sparked by CNBC reporting a new monoline rescue - see below) and Friday's trading didn't disappoint, except this time the rally didn't hold and the major indexes suffered another distribution day. The rally came just as the NASDAQ was testing its January 23 low. Although it closed just above that level, a 5-year chart shows that the index broke through its 5-year trend line with the next support level at 2012, a decline of another 10%.

You will recall that the rally that started on January 23 was sparked by the stimulus package and a 0.5% rate cut by the Fed. We can now say that those measures have failed to support the markets. More intervention is on the way, as we saw on Friday morning when the markets rallied early, despite the larger than expected job losses, as the Fed announced an extra $100 billion in the next month to support bank lending and overcome a worsening liquidity crisis, but the rally was short lived and it looks increasingly likely that the Fed will act to lower interest rates further before the March 18 meeting. This is not likely to improve matters however as financial institutions are lowering their exposure to risk (de-leveraging is the in-vogue phrase of the day) rather than taking on new ones. More rate cuts will only serve to damage the dollar further and increase the inflation rate. Cuts may promote investment but can do little to solve the vicious circle of falling asset prices forcing asset sales that further reduce asset values.

The Group of Ten meet in Basle this weekend and we must hope that they can produce a rabbit out of a hat. Gillian Tett of the Financial Times has an analysis of the challenges they face. Solving the S&L crises was easy by comparison.

In the face of this doom and gloom I'll share some levity with you from The Big Picture:

Rumour of second bail out rumour coming in Ambac.

Word is that CNBC have heard from a source close to the fire escape that the Monolines are worried that there will be no new rumours about possible rescues around until the recent rescues are proved to have failed.

That means that there'll be no Friday evening prop for the stock markets.

A source close to the industry said that a consortium is "being put in place to work on new rumours but we can't be sure that these rumours will actually be ready for another five business days."

News of the rumoured rumour of salvation sent MBIA and AMBAC up .01% in pre-market trading. Hank Paulson was rumoured to be delighted with the patriotic rumours, a source close to him on his lifeboat off the coast of Hawaii said Thursday. Ben Bernake has placed pencils in his ears and is wearing his favourite underpants on his head.

-David McCreadie and Dan Davies

No New Features this Week

Investment Advisors Using our Service

TradeRight Securities, located in a suburb of Chicago, is a full services investment management company and broker/dealer. They have been a subscriber, and user, of BreakoutWatch.com for some time now. They practice CANTATA and use Breakoutwatch.com as a “research analyst”. You can learn more about TradeRight Securities at: www.traderightsecurities.com. If you’re interested in speaking to a representative, simply call them toll-free at 1-800-308-3938 or e-mail gdragel@traderightsecurities.com.

Note to advisors: If you would like to be listed here, please contact us. As a service to those who subscribe to us, there is no additional charge to be listed here.

Get a 14 day free

Trial of our premium 'Platinum' service and TradeWatch.

No Credit Card Required.

Click

Here for 14 Day Free Trial |

| Index | Value | Change Week | Change YTD | Market1 Signal |

||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 11893.7 | -3.04% | -10.34% | enter | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2212.49 | -2.6% | -16.58% | exit | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1293.37 | -2.8% | -11.92% | enter | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 660.11 | -3.8% | -13.83% | N/A | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone (similar to IBD). The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 20 | 13.62 | 4.36% | -0.52% |

| Last Week | 39 | 13.31 | 4.07% | -2.11% |

| 13 Weeks | 204 | 14.85 | 8.74% |

-5% |

Sector |

Industry |

Breakout Count for Week |

|---|---|---|

FINANCIAL SERVICES |

Closed-End Fund - Equity |

4 |

ENERGY |

Independent Oil & Gas |

2 |

METALS & MINING |

Gold |

2 |

AEROSPACE/DEFENSE |

Aerospace/Defense Products & Services |

1 |

CHEMICALS |

Agricultural Chemicals |

1 |

CONSUMER NON-DURABLES |

Cleaning Products |

1 |

DRUGS |

Drug Delivery |

1 |

ELECTRONICS |

Printed Circuit Boards |

1 |

ENERGY |

Oil & Gas Drilling & Exploration |

1 |

FINANCIAL SERVICES |

Closed-End Fund - Foreign |

1 |

FOOD & BEVERAGE |

Meat Products |

1 |

FOOD & BEVERAGE |

Farm Products |

1 |

MANUFACTURING |

Farm & Construction Machinery |

1 |

SPECIALTY RETAIL |

Specialty Retail, Other |

1 |

WHOLESALE |

Drugs Wholesale |

1 |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | GMET | GeoMet Inc | 104 |

| Top Technical | TUX | Tuxis Corporation | 74 |

| Top Fundamental | OMG | Om Group Inc | 45 |

| Top Tech. & Fund. | OMG | Om Group Inc | 45 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | EGO | El Dorado Gold Corp | 108 |

| Top Technical | COIN | CONVERTED ORGANICS | 69 |

| Top Fundamental | HSP | Hospira Inc | 33 |

| Top Tech. & Fund. | HSP | Hospira Inc | 33 |

If you received this newletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2008 NBIcharts, LLC dba BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan "tomorrow's breakouts today" are service marks of NBIcharts LLC. All other marks are the property of their respective owners, and are used for descriptive purposes only.