| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

Market Summary

New Bull Market or Bear Market Rally?

The markets gapped-up at the open twice this week (Wednesday and Friday) and delivered accumulation days on each of them. A gap up often indicates a bullish change in sentiment so its possible that this week marks a real turnaround. Another indication that there may be mood shift is the number of breakouts seen this week. The successful breakout count jumped to 30 after just 12 last week and an average of 14 over the last 13 weeks. This was the highest number of breakouts for the year. The average gain by these breakouts until Friday's close was 5.15% compared the gain of 4.9% for the NASDAQ Composite, 4.8% for the Russell 2000, 4.3% for the S&P 500 and 4.3% for the DJI.

Friday's gains were significant but constrained by resistance at 2419 for the NASDAQ and 1396 for the S&P 500. We commented two weeks ago that the major indexes were on the point of a double-bottom breakout and that remains true for the NASDAQ, S&P 500 and Russell 2000 while the DJI, led by energy stocks, did close above its pivot this week. Due to the influence of energy on the DOW this breakout is suspect until the broader market follows-through. A breakout above the respective pivots for the other two indexes would be a further indication that the current rally has legs. We would like to see higher volumes though. NASDAQ and Russell 2000 volumes have been anemic and have barely reached the 50 day average even on accumulation days. DJI and S&P 500 volumes have only been marginally better.

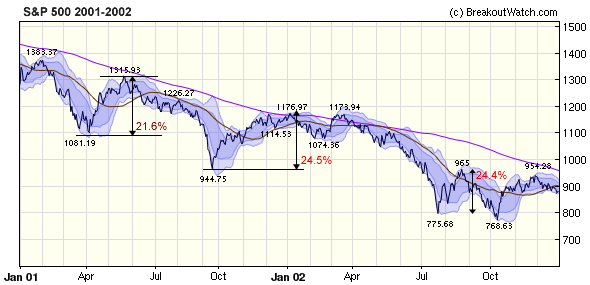

While the indications are that at least a short term rally has begun, it is well to remember that during a bear market, some very strong rallies can occur. The following chart shows the S&P 500 for the 2001-2002 period and you can see that there were three rallies of over 20% before the bear market resumed and set new lows. Many economists believe that the economic fundamentals are much weaker now than they were in 2001 and that an economic recovery will not occur until well into 2009. If so, then we can expect that a bear market will resume after the current rally ends.

This is no reason to stay on the sidelines, however, particularly if your risk tolerance is moderately high. These rallies offer opportunities to make money through agile short term trading but it is not wise to consider long term positions at this time. Many mutual funds have to stay fully invested in the market according to their prospectus so as new cash flows in through 401k plans, that cash has to be put to work. At this time they tend to favor value stocks rather than growth stocks, so stocks with a low PE relative to their industry, but with good fundamentals, have perhaps the best chance of making short term gains. be ready to pull the trigger on signs of a pullback. If you are not able to monitor the pulse of the market, stay on the sidelines.

No New Features this Week

Get a 14 day free

Trial of our premium 'Platinum' service and TradeWatch.

No Credit Card Required.

Click

Here for 14 Day Free Trial |

| Index | Value | Change Week | Change YTD | Market1 Signal |

||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 12849.4 | 4.25% | -3.13% | enter | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2402.97 | 4.92% | -9.4% | exit | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1390.33 | 4.31% | -5.31% | enter | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 721.07 | 4.78% | -5.87% | N/A | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone (similar to IBD). The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 31 | 14.23 | 5% | 3.1% |

| Last Week | 12 | 12.62 | 10.87% | 6.57% |

| 13 Weeks | 201 | 15 | 11.45% |

3.65% |

Sector |

Industry |

Breakout Count for Week |

|---|---|---|

TRANSPORTATION |

Railroads |

3 |

FINANCIAL SERVICES |

Closed-End Fund - Equity |

2 |

METALS & MINING |

Industrial Metals & Minerals |

2 |

AEROSPACE/DEFENSE |

Aerospace/Defense Products & Services |

1 |

BANKING |

Savings & Loans |

1 |

CHEMICALS |

Specialty Chemicals |

1 |

CHEMICALS |

Synthetics |

1 |

COMPUTER HARDWARE |

Diversified Computer Systems |

1 |

COMPUTER SOFTWARE & SERVICES |

Application Software |

1 |

CONSUMER NON-DURABLES |

Paper & Paper Products |

1 |

CONSUMER NON-DURABLES |

Packaging & Containers |

1 |

ELECTRONICS |

Scientific & Technical Instruments |

1 |

ENERGY |

Major Integrated Oil & Gas |

1 |

INTERNET |

Internet Software & Services |

1 |

INTERNET |

Internet Service Providers |

1 |

INTERNET |

Internet Information Providers |

1 |

MANUFACTURING |

Diversified Machinery |

1 |

MANUFACTURING |

Industrial Electrical Equipment |

1 |

MANUFACTURING |

Farm & Construction Machinery |

1 |

MATERIALS & CONSTRUCTION |

Waste Management |

1 |

MEDIA |

Marketing Services |

1 |

METALS & MINING |

Aluminum |

1 |

REAL ESTATE |

REIT - Diversified |

1 |

TRANSPORTATION |

Air Delivery & Freight Services |

1 |

TRANSPORTATION |

Shipping |

1 |

TRANSPORTATION |

Air Services, Other |

1 |

WHOLESALE |

Industrial Equipment Wholesale |

1 |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | CNTF | China Techfaith Wireless Communication Technology | 115 |

| Top Technical | PMC | PMC CAP INC | 61 |

| Top Fundamental | BAP | Credicorp Ltd | 39 |

| Top Tech. & Fund. | BAP | Credicorp Ltd | 39 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | ASIA | Asiainfo Holdings Inc | 76 |

| Top Technical | CFFN | Capitol Federal Fncl | 20 |

| Top Fundamental | ASIA | Asiainfo Holdings Inc | 76 |

| Top Tech. & Fund. | ASIA | Asiainfo Holdings Inc | 76 |

If you received this newletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2008 NBIcharts, LLC dba BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan "tomorrow's breakouts today" are service marks of NBIcharts LLC. All other marks are the property of their respective owners, and are used for descriptive purposes only.