| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

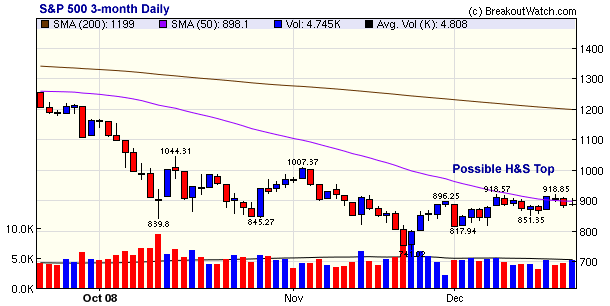

The rally that began on November 23 is looking tired, especially for

large cap stocks. Despite big gains on Tuesday following the Federal

Reserve's surprisingly large drop in interest rates and a morning rally

on Friday after the Administration announced a loan to the auto makers,

the major indexes have not closed above the recent high set on December

8. The DJI, S&P 500 and NASDAQ Composite all failed to sustain a

rise above their 50 day moving average and volume, except for Friday,

remains weak. In contrast, the Russell 2000 has held, just, above its

50 day moving average and has significantly outpaced the other indexes.

Although the S&P 500 is technically in a 'bull market' after it rose 20% from its lows, it now looks as though that was a bear market rally and the index is now forming a possible head and shoulders top. This is a bearish pattern and reinforces our view that the rally, at least in large cap stocks, may be rolling over. Note also that volume has been below average throughout December, even on days of significant gains indicating that the recent rally lacks conviction.

Although the S&P 500 is technically in a 'bull market' after it rose 20% from its lows, it now looks as though that was a bear market rally and the index is now forming a possible head and shoulders top. This is a bearish pattern and reinforces our view that the rally, at least in large cap stocks, may be rolling over. Note also that volume has been below average throughout December, even on days of significant gains indicating that the recent rally lacks conviction.

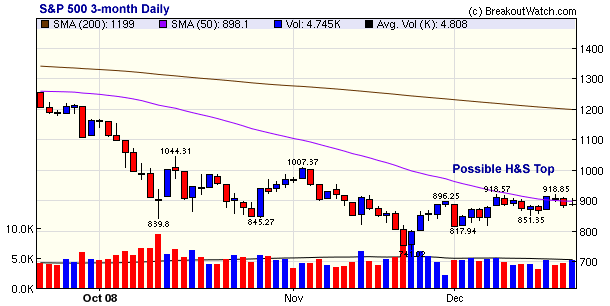

The

Russell 2000 continues to set new highs. In contrast to the S&P 500

chart, note that the right shoulder is higher than the 'head' and that

Friday's volume was significantly above the 50 day moving average.

As

part of the small cap recovery we are starting to see some significant

small cap breakouts. The number increased to six this week after just

two the week before and none before that. Average gain by week's end

was a significant 3.3%. The star this week was

ULBI (Ultralife Batteries) which broke out from a High Tight Flag Base

to gain 10.47% by Friday's close. Another high flier was CSKI (China

Sky One Medical) which gained 9% after breaking out from a

cup-with-handle base.

No new features this week.

No tip this week.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 8579.11 | -0.59% | -35.32% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 1564.32 | 1.53% | -41.02% | Down | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 887.88 | 0.93% | -39.53% | Down | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 486.26 | 3.81% | -36.52% | Down | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 8924.03 | 1.41% | -39.78% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 6 | 3.23 | 4.71% | 3.32% |

| Last Week | 2 | 9.85 | 1.38% | -3.37% |

| 13 Weeks | 43 | 10.31 | 15.59% |

-2.19% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | HLD | SECURE AMERICA AC | 104 |

| Top Technical | COGT | Cogent Systems | 49 |

| Top Fundamental | HTS | HATTERAS FINANCIAL CORP | 60 |

| Top Tech. & Fund. | HTS | HATTERAS FINANCIAL CORP | 60 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | VPHM | Viropharma Inc | 74 |

| Top Technical | TOWN | TOWNE BANK (VA) | 54 |

| Top Fundamental | VPHM | Viropharma Inc | 74 |

| Top Tech. & Fund. | SHEN | Shenandoah Telecomm | 74 |

If you received this newletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2008 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.