| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

|

Despite the negative trend,

there were several highly successful breakouts this week with four

closing the week with gains of over 10%. and eight making intra-day

gains above that level. As we recommended last week, breakouts can be

profitable in this market but you must take your gains quickly. The markets closed their worst January performance ever with another distribution day on Friday. To put that in perspective, the S&P history goes back 81 years and the DJI 113 years. A flurry of buying (by the PPT?) allowed the DJI to close just above the 8,000 level for the weekend. 8,000 is seen as an important psychological level. The fourth quarter GDP numbers confirmed the recession and we are likely in for a worse first quarter ahead. GDP will probably stay negative through 2009. But this doesn't mean the markets will continue downward during 2009 as a change in sentiment could rapidly turn things around as fear turns to greed. Sentiment turned increasingly negative this week due to the pummeling the proposed stimulus plan has taken from Republican Congressmen and many economists on the right and the left. The mantra that tax cuts are necessary to help small businesses is meaningless unless there is demand for the products and services small businesses have to offer. Unfortunately, there seems to be too little in the stimulus package to help demand in the short term. RGE Monitor had the following assessment of the plan yesterday:

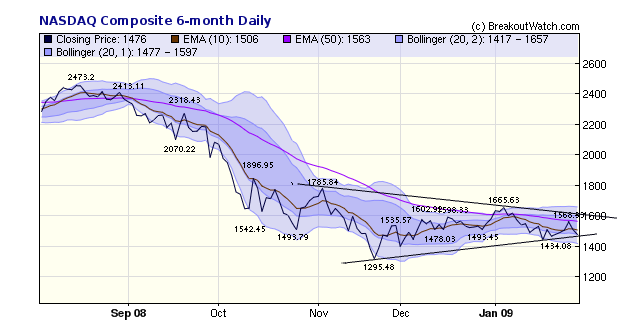

We expect that the plan will be improved and investor sentiment will turn around as the plan is signed into law. Until then, the outlook for stocks is bearish. The chart of the NASDAQ shows a descending triangle which usually leads to a downside breakout. However, patterns that have worked in the past are no longer reliable as intervention and manipulation have been commonplace over the last year.  |

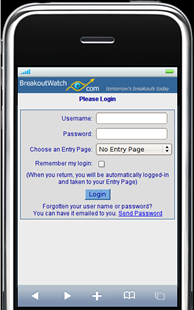

iPhone Interface Under Development

We are making an early version of an iPhone-ready version of the site available to subscribers. You can use it at http://www.breakoutwatch.com/mobile. After logging in, using your normal username and password, you will see a menu which will expand as you tap each line to show you the sub-menus. Tapping the item, or any other main menu line, will collapse the sub-menu and show the new one. Tapping a sub-menu will take you to the relevant page. Using the tap and/or pinch gestures on each page makes the site quite useable on most pages. To return to the menu, tap the menu button at the top of the screen.

Let us know what you think. Here are a couple of screen shots.

We are making an early version of an iPhone-ready version of the site available to subscribers. You can use it at http://www.breakoutwatch.com/mobile. After logging in, using your normal username and password, you will see a menu which will expand as you tap each line to show you the sub-menus. Tapping the item, or any other main menu line, will collapse the sub-menu and show the new one. Tapping a sub-menu will take you to the relevant page. Using the tap and/or pinch gestures on each page makes the site quite useable on most pages. To return to the menu, tap the menu button at the top of the screen.

Let us know what you think. Here are a couple of screen shots.

|  |

Take profits early and cut your losses quickly.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 8000.86 | -6.96% | -8.84% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 1476.42 | -6.06% | -6.38% | Down | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 825.88 | -7.24% | -8.57% | Down | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 443.53 | -7.85% | -11.2% | Down | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 8335.63 | -7.24% | -8.27% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 10 | 8.92 | 12.87% | 5.05% |

| Last Week | 5 | 8.31 | 15.02% | 7.66% |

| 13 Weeks | 113 | 9 | 18.06% |

-1.44% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | ALTH | Allos Therapeutics Inc. | 107 |

| Top Technical | JJSF | J&J Snack Foods Corp | 47 |

| Top Fundamental | GMCR | Green Mountain Coffee Roasters | 59 |

| Top Tech. & Fund. | GMCR | Green Mountain Coffee Roasters | 59 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | NNDS | Nds Group Plc Ads | 58 |

| Top Technical | GLD | streetTRACKS Gold Shares ETF | 27 |

| Top Fundamental | GLD | streetTRACKS Gold Shares ETF | 27 |

| Top Tech. & Fund. | GLD | streetTRACKS Gold Shares ETF | 27 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2009 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.