| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

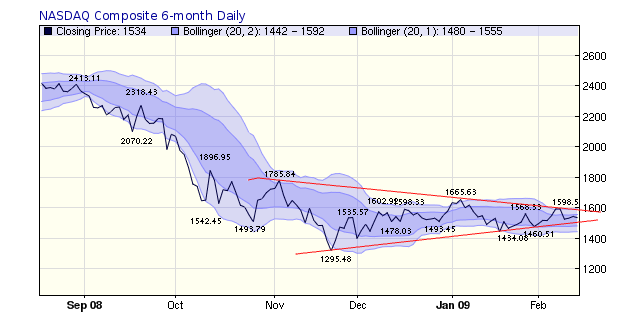

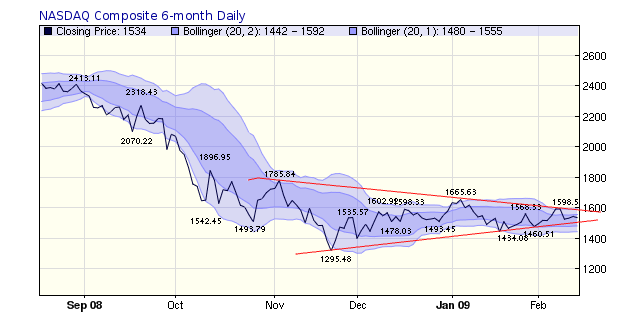

The markets gave their opinion on the revised TARP plan and economic

stimulus package this week with losses of over 5% for the DJI and

4.8% for the S&P 500. The NASDAQ Composite was the least damaged of the major indexes with a loss of

3.6%. If we are to avoid a prolonged and deep recession it is

important that the stimulus act quickly and that the banks feel secure

so that they can lend again. At this juncture, neither seems likely in

the near future.

The revised TARP proposal was little more than a conceptual plan at this time with many details still to be filled-in, not the least of which was how to value the 'toxic' assets. There is no way to do this that will not either hurt taxpayers, on the one hand, or the private investors that are expected to buy the assets on the other. Since the private investors are not going to buy the assets unless they perceive a positive reward/risk it seems inevitable that any plan to take toxic assets off the bank's books will leave taxpayers at risk. The Administration is at odds with itself as the political advisors weigh in on the side of the taxpayers and the Treasury, led by Geithner, presumably has the bank's interest at heart (he is on record as saying that we have a private banking system and it should remain so). Some elements of the plan seem superficially sound, such as auditing the banks and "triaging" the sick from the mortally wounded with the FDIC making small depositors whole. What will happen if Citi, B of A, J. P. Morgan Chase and possibly Wells Fargo are among the mortally wounded is something the Adminsitration still has to face up to. Nouriel Roubini has argued for some time that the big banks are effectively insolvent and in the Washinton Post yesterday argues for 'receivership' (a more PC word than 'Nationalization'). Obama has already laughed at that proposal, saying "Sweden looks like a good model. Here's the problem; Sweden had like five banks. [LAUGHS] We've got thousands of banks", so that option is not going to happen anytime soon.

The stimulus plan suffers from being too little and will arrive too late. Whether you think that there should have been more tax cuts or more spending is somewhat beside the point if the size of the package is too small. Many economists see the shortfall in demand in the economy in the next two years to be in excess of $2 trillion and argue therefore that $787 billion is insufficient.

So with the financial system still on life-support and a knee-capped stimulus package, it doesn't appear that the markets will arrest their decline any time soon.

Consistent with this view, the NASDAQ Composite failed to breakout to the upside of the descending triangle and the bearish outcome associated with this pattern remains likely. But with new initiatives rumored daily, nothing is certain.

The revised TARP proposal was little more than a conceptual plan at this time with many details still to be filled-in, not the least of which was how to value the 'toxic' assets. There is no way to do this that will not either hurt taxpayers, on the one hand, or the private investors that are expected to buy the assets on the other. Since the private investors are not going to buy the assets unless they perceive a positive reward/risk it seems inevitable that any plan to take toxic assets off the bank's books will leave taxpayers at risk. The Administration is at odds with itself as the political advisors weigh in on the side of the taxpayers and the Treasury, led by Geithner, presumably has the bank's interest at heart (he is on record as saying that we have a private banking system and it should remain so). Some elements of the plan seem superficially sound, such as auditing the banks and "triaging" the sick from the mortally wounded with the FDIC making small depositors whole. What will happen if Citi, B of A, J. P. Morgan Chase and possibly Wells Fargo are among the mortally wounded is something the Adminsitration still has to face up to. Nouriel Roubini has argued for some time that the big banks are effectively insolvent and in the Washinton Post yesterday argues for 'receivership' (a more PC word than 'Nationalization'). Obama has already laughed at that proposal, saying "Sweden looks like a good model. Here's the problem; Sweden had like five banks. [LAUGHS] We've got thousands of banks", so that option is not going to happen anytime soon.

The stimulus plan suffers from being too little and will arrive too late. Whether you think that there should have been more tax cuts or more spending is somewhat beside the point if the size of the package is too small. Many economists see the shortfall in demand in the economy in the next two years to be in excess of $2 trillion and argue therefore that $787 billion is insufficient.

So with the financial system still on life-support and a knee-capped stimulus package, it doesn't appear that the markets will arrest their decline any time soon.

Consistent with this view, the NASDAQ Composite failed to breakout to the upside of the descending triangle and the bearish outcome associated with this pattern remains likely. But with new initiatives rumored daily, nothing is certain.

No new features this week.

No tip this week.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 7850.41 | -5.2% | -10.55% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 1534.36 | -3.6% | -2.71% | Down | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 826.84 | -4.81% | -8.46% | Down | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 448.36 | -4.75% | -10.23% | Down | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 8385.74 | -4.55% | -7.72% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 6 | 9.08 | 4.05% | 1.55% |

| Last Week | 15 | 9.62 | 10.49% | 4.57% |

| 13 Weeks | 106 | 10.15 | 15.91% |

1.01% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | EGY | VAALCO ENERGY INC | 115 |

| Top Technical | SXL | Sunoco Logistics Ptnrs Lp | 49 |

| Top Fundamental | WES | WESTERN GAS PARTNERS | 73 |

| Top Tech. & Fund. | WES | WESTERN GAS PARTNERS | 73 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | PEGA | Pegasystems Inc | 71 |

| Top Technical | GLD | streetTRACKS Gold Shares ETF | 29 |

| Top Fundamental | ICUI | Icu Medical Inc | 58 |

| Top Tech. & Fund. | ICUI | Icu Medical Inc | 58 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2009 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.