| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

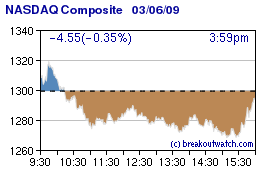

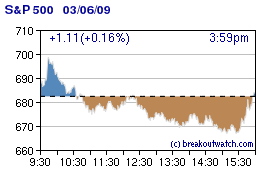

The images below show the dramatic recovery of the NASDAQ Composite and S&P 500 in the last 30 minutes of trading yesterday. Simalar gains were made by the Russell 2000 so the rally was broad based. Analysts explained the sudden recovery as due to a rise in the price of oil that lifted Exxon and Chevron and a report that the finance unit of GE had adequate funding. We find that explanation insufficient to explain the broad-based recovery and think the dramatic move upwards was more likely a result of short covering.Two explanations for short covering occur to us. The first is that the market was heavily shorted and that traders wished to cover their positions before going into the weekend, which has frequently been a time when new Government intervention has been announced. The second is that insiders got wind of a new initiative to be announced on Sunday or Monday morning before the market opens so had a sound reason to cover. Either way, it shows the difficulty of trading in this volatile market.

|

|

Our new watchlist format has now been extended to all of our watchlist chart patterns. The result is a simpler, consistent presentation across all watchlists with features that were previously only available for the cup-with-handle list now available on all watchlists. These features are:

- Watchlist Filtering

- Watchlist alerts based on filters (not presently available for short position lists)

- Filter backtesting

- the Chart Browser makes for quick visual analysis of all stocks in the pattern

- TA charts are now the default chart presentation style for all watchlists

- Watchlist download

The new format is still on beta test and is available to all Subscription levels. We hope to complete the beta test in one week and access to the new features will then be limited by subscription level. During this time the new filter alert settings will not be used and alerts will continue to be sent as at present.

After you login, the new watchlist formats are available from the Mine for Candidates > New Watchlists (Beta) menu choice. The old format lists are still available under the Mine for Candidates > Legacy Watchlists menu choice.

If all goes well, we will implement the new features on the week beginning March 16. Please tell us what you like and do not like about the new format before then.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 6626.94 | -6.17% | -24.49% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 1293.85 | -6.1% | -17.96% | Down | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 683.38 | -7.03% | -24.34% | Down | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 351.05 | -9.76% | -29.71% | Down | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 6935.36 | -7.21% | -23.68% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 3 | 9.31 | 11.08% | 4.56% |

| Last Week | 10 | 9.08 | 13.12% | 0.29% |

| 13 Weeks | 113 | 9.77 | 15.61% |

-13.92% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | CYCL | Centennial Communications Corp | 71 |

| Top Technical | CYCL | Centennial Communications Corp | 71 |

| Top Fundamental | HMSY | Hms Holdings Corp | 37 |

| Top Tech. & Fund. | HMSY | Hms Holdings Corp | 37 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2009 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.