| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

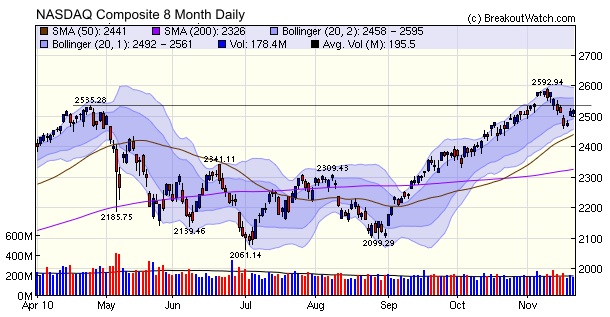

The trend for all the major indexes remains upward as the markets climbed a 'wall of worry' beginning Wednesday in the face of considerable nervousness surrounding:

- a bailout for the bankrupt Irish banks

- international and domestic criticism of the Fed's quantitative easing policy

- Steps by China to constrain inflation

- falling housing starts

- continued weakness in housing as new starts fall, long term interest rates rise and sales and refi's head south

- a 50 Billion Euro aid package for Irish banks appeared near

- the Philadelphia Fed reported expanding industrial activity in its region

- new jobless claims continued to improve

- retail sales showed surprising gains.

Thanksgiving Special

50% Discount on 12 Month Gold and Platinum Subscriptions

Thursday, November 25 to Sunday, November 28 Only

Subscribe, renew, extend or upgrade your subscription for 12 months

and get a 50% discount on the monthly price

50% Discount on 12 Month Gold and Platinum Subscriptions

Thursday, November 25 to Sunday, November 28 Only

Subscribe, renew, extend or upgrade your subscription for 12 months

and get a 50% discount on the monthly price

To take advantage of this offer, log

into your account between Thursday and Sunday of next week and choose

to upgrade or renew for 12 months at the Gold or Silver level. You will

be charged $350 for a Gold subscription or $600 for a Platinum

subscription. The usual rates are $560 and $950 respectively.

Don't have a subscription yet? Subscribe for a Trial and then take out a 12 month Gold or Platinum subscription and you will receive the same great deal.

Don't have a subscription yet? Subscribe for a Trial and then take out a 12 month Gold or Platinum subscription and you will receive the same great deal.

If you are sceptical about Quantitative Easing, you will find this very, very funny: Quantitative Easing Explained

To

make the Cup-with-Handle backtest tool even more realistic, I added a

"transaction cost" option. If you set this to your brokerage fee and an

estimated slippage amount then this will be applied to each buy and

sell transaction in the simulation.

A change was also made to the implementation of the trailing stop. I found that it was being applied if the close was below the trailing stop rather than if the low was below the trailing stop.

A change was also made to the implementation of the trailing stop. I found that it was being applied if the close was below the trailing stop rather than if the low was below the trailing stop.

Following

last weeks progress report on how MTC stocks have fared since the

introduction of the MTC criteria, someone noticed that if the trailing

stop is reduced to 1% then the gains improve considerably and they

questioned the accuracy of the backtest.

I replied that this result was to be expected as the effect is to take small gains often which then accumulate through compounding to give a better return. I suspected that if a transaction cost was applied, then this "churning" would reduce the gains significantly. I was wrong. Although the transaction cost does reduce the gains, the benefits of taking small quick profits are still substantial.

If you run the backtest now with the corrected trailing stop and with a transaction applied ($7.50 is the default) you will see that taking smaller profits often has significant benefits.

For example, using the default settings (8% trailing stop) for the MTC strategy over 12 months gives a return of 76.6% with eleven transactions completed. If the trailing stop is reduced to 1%, the number of transactions goes up to 29 and the profit goes up to 241%!

I replied that this result was to be expected as the effect is to take small gains often which then accumulate through compounding to give a better return. I suspected that if a transaction cost was applied, then this "churning" would reduce the gains significantly. I was wrong. Although the transaction cost does reduce the gains, the benefits of taking small quick profits are still substantial.

If you run the backtest now with the corrected trailing stop and with a transaction applied ($7.50 is the default) you will see that taking smaller profits often has significant benefits.

For example, using the default settings (8% trailing stop) for the MTC strategy over 12 months gives a return of 76.6% with eleven transactions completed. If the trailing stop is reduced to 1%, the number of transactions goes up to 29 and the profit goes up to 241%!

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 11203.5 | 0.1% | 7.44% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2518.12 | -0% | 10.97% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1199.73 | 0.04% | 7.59% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 724.36 | 0.71% | 14.24% | Up | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 12621.5 | 0.2% | 9.78% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 15 | 28.15 | 6.29% | 4.48% |

| Last Week | 27 | 28.31 | 0.32% | -5.15% |

| 13 Weeks | 394 | 29.15 | 16.99% |

7.82% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | PSUN | Pacific Sunwear of California, Inc. | 112 |

| Top Technical | SSCC | Smurfit-Stone Container Corporation | 55 |

| Top Fundamental | TPX | Tempur-Pedic International Inc. | 53 |

| Top Tech. & Fund. | TPX | Tempur-Pedic International Inc. | 53 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | GSIT | GSI Technology, Inc. | 111 |

| Top Technical | N | NetSuite Inc. | 67 |

| Top Fundamental | GSIT | GSI Technology, Inc. | 111 |

| Top Tech. & Fund. | GSIT | GSI Technology, Inc. | 111 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2010 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.