| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

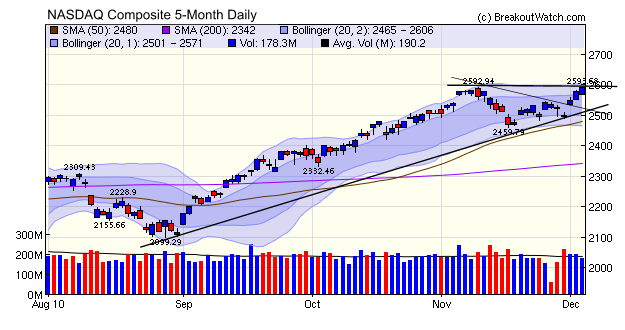

The NASDAQ Composite broke out of the symmetrical triangle we discussed last week and has now formed an ascending triangle. This is usually a bullish pattern, particularly when the underlying trend is well established. Our trend model for the NASDAQ has been positive since early September so we can be confident that this is the case. Consequently, we consider that there is a high probability that the NASDAQ Composite will break through resistance in the near future to set a new post-crash high.

While Friday's unemployment data was

deeply disappointing, other economic indicators show that the economy

is recovering, albeit slowly. The ISM non-manufacturing index, which

covers 90% of the economy continues to improve; Spain and Portugal were

able to sell some bonds at not too dramatic interest rates; China

continues to be the engine which is pulling the world out of recession,

and surprise, surprise, pending home sales jumped up by 10%.

The number of breakouts this week jumped up to 20. This is short of the 13 week average, but pretty good considering the first two days of the week produced distribution days for the NASDAQ.

All in all, conditions seem to be pretty favorable for further short term gains.

The number of breakouts this week jumped up to 20. This is short of the 13 week average, but pretty good considering the first two days of the week produced distribution days for the NASDAQ.

All in all, conditions seem to be pretty favorable for further short term gains.

No new features this week.

Buy at Open Strategy

We were asked if the use of buy stops is useful when it is not possible to monitor the market intra-day.

While this is possible, it is not a strategy we recommend for a couple of reasons.

1. We know that the likelihood of significant gains after breakout is increased if the volume is well above the daily average. A buy stop is triggered when the stop price is met regardless of volume, so you may end up buying a stock that is not a strong candidate for future gains.

2. The number of orders you place cannot exceed your available account balance if they were all to be executed. This makes position sizing and portfolio management less than optimum.

An alternative is to review the days breakouts after the close and select those that have shown significant volume on breakout. You can then place a market order which will be executed at the open of the next session.

In this case you will usually pay a premium above the breakout price. Backtesting using our cup-with-handle backtesting tool shows that on average this premium is of the order of 2.6%. Since this has already eroded your potential gain on the stock, it is prudent to tighten your buy stop and trailing stop percentages. Instead of using the 8% buy stop and trailing stop we have suggested for the buy on breakout strategy, we suggest you use 6% buy and trailing stops when placing a market order to buy at open.

If you run our backtest using the CwH with MTC strategy using these values, you would have had an ROI of 57% over the last year (12/3/2009 - 12/2/2010).

You can run our CwH backtest at http://www.breakoutwatch.com/Mike/cwhStrategyTest.php.

We were asked if the use of buy stops is useful when it is not possible to monitor the market intra-day.

While this is possible, it is not a strategy we recommend for a couple of reasons.

1. We know that the likelihood of significant gains after breakout is increased if the volume is well above the daily average. A buy stop is triggered when the stop price is met regardless of volume, so you may end up buying a stock that is not a strong candidate for future gains.

2. The number of orders you place cannot exceed your available account balance if they were all to be executed. This makes position sizing and portfolio management less than optimum.

An alternative is to review the days breakouts after the close and select those that have shown significant volume on breakout. You can then place a market order which will be executed at the open of the next session.

In this case you will usually pay a premium above the breakout price. Backtesting using our cup-with-handle backtesting tool shows that on average this premium is of the order of 2.6%. Since this has already eroded your potential gain on the stock, it is prudent to tighten your buy stop and trailing stop percentages. Instead of using the 8% buy stop and trailing stop we have suggested for the buy on breakout strategy, we suggest you use 6% buy and trailing stops when placing a market order to buy at open.

If you run our backtest using the CwH with MTC strategy using these values, you would have had an ROI of 57% over the last year (12/3/2009 - 12/2/2010).

You can run our CwH backtest at http://www.breakoutwatch.com/Mike/cwhStrategyTest.php.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 11382.1 | 2.62% | 9.15% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2591.46 | 2.24% | 14.2% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1224.71 | 2.97% | 9.83% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 756.42 | 3.23% | 19.3% | Up | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 12931 | 2.95% | 12.47% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 20 | 27.38 | 7.46% | 4.49% |

| Last Week | 6 | 28.08 | 12.11% | 10.75% |

| 13 Weeks | 392 | 29.46 | 16.94% |

10.54% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | REXI | Resource America, Inc. | 115 |

| Top Technical | MDTH | MedCath Corporation | 64 |

| Top Fundamental | SCSS | Select Comfort Corp. | 88 |

| Top Tech. & Fund. | SHOO | Steven Madden, Ltd. | 52 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | BTX | BioTime, Inc. | 95 |

| Top Technical | BTX | BioTime, Inc. | 95 |

| Top Fundamental | UTEK | Ultratech, Inc. | 58 |

| Top Tech. & Fund. | UTEK | Ultratech, Inc. | 58 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2010 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.