| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

The major indexes continued to rally this week on the strength of the $850 billion stimulus contained in the agreement President Obama has reached with theRepublicans. While the Democrats threaten opposition and/or modifications to the deal, it seems that ultimately they will get on board. If not, or if the stimulus amount gets whittled back, then we can expect a sell-off.

Other factors helping move the markets higher were a lower than expected trade deficit, initial unemployment claims 4 week average fell to its lowest since Aug ’08 and University of Michigan consumer confidence rose the best since June

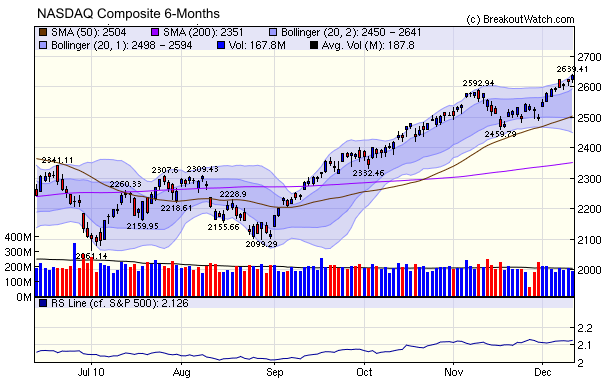

The NASDAQ Composite chart shows the index at new post crash highs despite volume continuing to be below the 50 day average. We have added a relative strength line versus the S&P 500 which shows the extent to which the NASDAQ has outperformed the S&P 500 since September.

The low volume levels are suppressing the number of successful breakouts which were just half the thirteen week average this week. Average gains for breakouts were well above the weekly gains for the indexes, however.

Industry Rank Filter in CwH Backtest

A subscriber asked us to run a backtest on cup-with-handle breakouts that were ranked between 1 and 137 on our industry rankings.

While this is easy for us to do, we thought it better to give our subscribers the power to do this themselves.

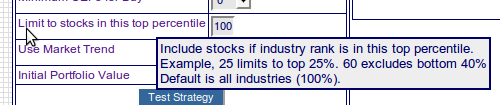

We have now added a new filter to the backtest which allows you to limit the backtest to stocks that belong to industries that fell within the top x % of the industry rankings on the day of breakout.

For example, there are 215 industries that on any day are ranked from 1 (highest) to 215 (lowest). Selecting the top 25% of industries will limit the backtest to stocks ranked from 1 to 53. Selecting the top 60% will limit the backtest to stocks ranked from 1 to 129.

Preliminary Industry Filter Results are Promising

We completed adding the industry filter to the backtest on

Friday afternoon and were eager to to try it out.

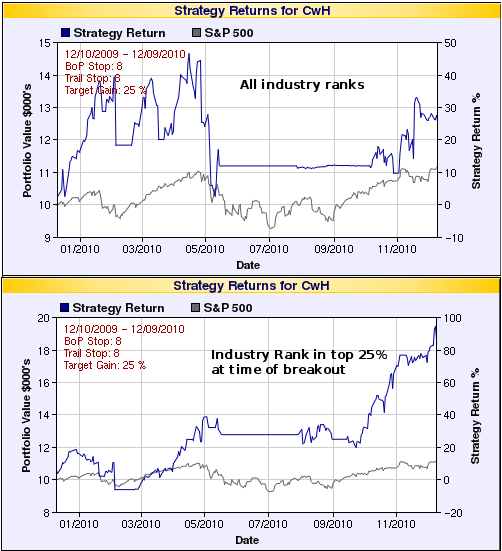

The results of using the industry filter in our CwH backtest surprised us. Previously, we have never found a relationship between industry rank and performance after breakout using standard statistical techniques. However, our backtest tool does allow us examine a potential relationship more precisely and this time we found that breakouts in higher ranked industries at the time of breakout did perform better.

Our first trial run was made using our default CwH Backtest (no MTC criteria) with a filter on the top 25% industries. We found it improved the 1 year return from 26% to 87%. The results are shown in these charts.

The results of using the industry filter in our CwH backtest surprised us. Previously, we have never found a relationship between industry rank and performance after breakout using standard statistical techniques. However, our backtest tool does allow us examine a potential relationship more precisely and this time we found that breakouts in higher ranked industries at the time of breakout did perform better.

Our first trial run was made using our default CwH Backtest (no MTC criteria) with a filter on the top 25% industries. We found it improved the 1 year return from 26% to 87%. The results are shown in these charts.

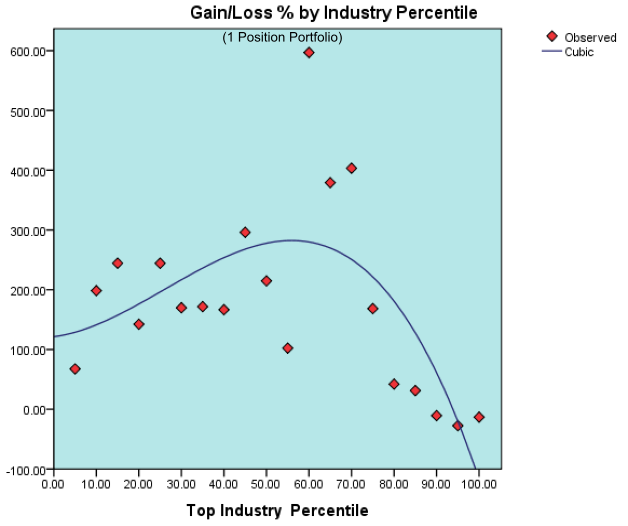

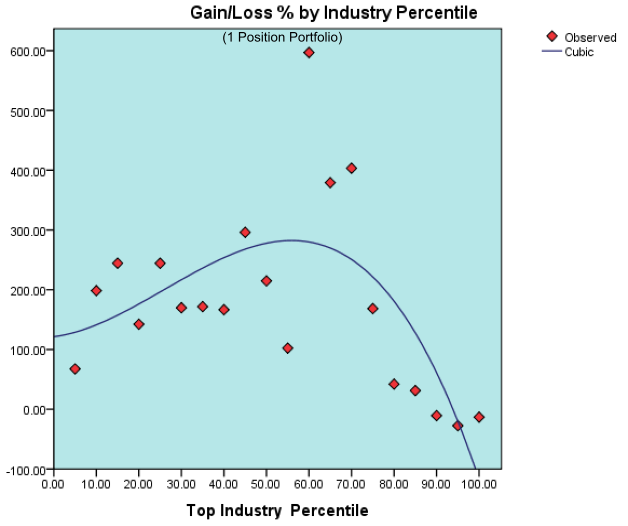

Our next trial was to run the test over

all our backtest data. Our the industry ranking methodology dates back

to October 2005 so we were able to run a backtest over 5 years. We did

so once again using our default criteria but with industry filters on

the top 5%, 10%, 15% and so on up to 100%. We plotted the gain

against the industry filter and obtained the following graph.

The red diamonds are the actual returns

for each industry filter and the blue line is the best fit curve

through the data points.

The conclusion from this limited set of tests is that stocks in the top 60% of the industry rankings will provide better returns.

We will do more work on this in the coming days to confirm these conclusions and possibly modify our MTC metric.

The conclusion from this limited set of tests is that stocks in the top 60% of the industry rankings will provide better returns.

We will do more work on this in the coming days to confirm these conclusions and possibly modify our MTC metric.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 11410.3 | 0.25% | 9.42% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2637.54 | 1.78% | 16.23% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1240.4 | 1.28% | 11.24% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 776.83 | 2.7% | 22.51% | Up | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 13105.5 | 1.35% | 13.99% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is described on the

site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 14 | 27.46 | 4.92% | 3.16% |

| Last Week | 22 | 27.38 | 9.39% | 5.67% |

| 13 Weeks | 399 | 28.46 | 18.43% |

11.23% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | CPE | Callon Petroleum Company | 114 |

| Top Technical | CBLI | Cleveland BioLabs, Inc. | 89 |

| Top Fundamental | CTSH | Cognizant Technology Solutions Corp. | 42 |

| Top Tech. & Fund. | MNRO | Monro Muffler Brake, Inc. | 33 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | CLFC | Center Financial Corporation | 100 |

| Top Technical | CLFC | Center Financial Corporation | 100 |

| Top Fundamental | SHOO | Steven Madden, Ltd. | 53 |

| Top Tech. & Fund. | SHOO | Steven Madden, Ltd. | 53 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2010 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All

other marks are the property of their respective owners, and are used

for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily

or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription

and is free from advertising.