| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

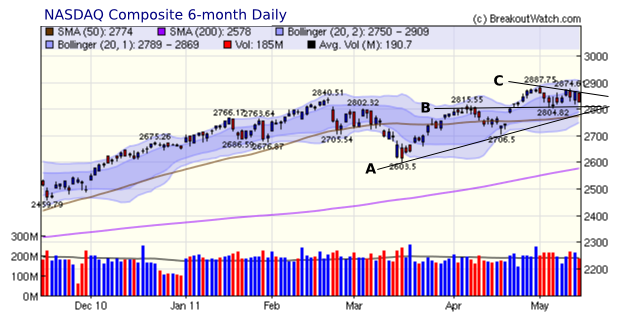

NASDAQ in Equilibrium (Almost)

The NASDAQ Composite bounced off support at the 2015 level (line B) last week but has been constrained by the descending triangle (line C). A breakout above trend line C would confirm that the rally still has legs despite gathering headwinds (see below) while a fall through support line B would signal weakness and a failure to find support at ascending triangle A would be distinctly bearish.

Speaking of headwinds, here are the threats facing the economy as seen by Peter Brookvar of The Big Picture

1) CPI, PPI

continue to rise with CPI now back above 3% y/o/y

2) Inflation takes bite out of April retail sales as sales ex gasoline rise just .2%

3) Initial Jobless Claims above 400k for a 5th straight week and 4 week average now at the highest since Nov

4) Weak US$, energy prices and higher Chinese labor costs lead to 11.1% y/o/y gain in Import Prices

5) NFIB small business optimism index falls to lowest since Sept with most growth categories lower and price index higher

6) BoE’s King says UK in stagflationary environment, is it headed here?

7) Political infighting amongst the EU, IMF, ECB and individual country members continue to drag out the fate of the Greek’s.

2) Inflation takes bite out of April retail sales as sales ex gasoline rise just .2%

3) Initial Jobless Claims above 400k for a 5th straight week and 4 week average now at the highest since Nov

4) Weak US$, energy prices and higher Chinese labor costs lead to 11.1% y/o/y gain in Import Prices

5) NFIB small business optimism index falls to lowest since Sept with most growth categories lower and price index higher

6) BoE’s King says UK in stagflationary environment, is it headed here?

7) Political infighting amongst the EU, IMF, ECB and individual country members continue to drag out the fate of the Greek’s.

I highlighted number seven because the Tea Party wants the US to follow similar austerity measures to the UK which I believe would be disasterous inthe short term.

No new features this week.

I buy almost all my toys - cycling accessories, books, computer hardware, on-line and usually at Amazon.com. They usually have the best prices and free shipping if you spend at least $25 (which encourages you to buy more to meet the threshold - smart). Because of this I had already bought some AMZN stock and was pleased to see the big breakout on 4/27. Unfortunately, AMZN didn't figure on our watchlists on that date because its RS Rank was only 73 and we have a minimum requirement of 80. We did confirm it as a breakout three days later, though.

AMZN

I think Amazon has a compelling

business model with no major competitors and because of the

infrastructure they have built. a high barrier to entry. Click this

image to see a slide

show that shows a breadth to their business that I wasn't aware of amd

makes

a strong case that there is further value to be derived.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 12595.8 | -0.34% | 8.8% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2828.47 | 0.03% | 6.62% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1337.77 | -0.18% | 6.37% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 835.67 | 0.28% | 6.64% | Up | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 14138.8 | -0.1% | 6.39% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is described on the

site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 11 | 13.38 | 5.36% | 2.1% |

| Last Week | 15 | 14.38 | 5.28% | 2.41% |

| 13 Weeks | 211 | 15.23 | 12.39% |

0.9% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | CLFD | Clearfield, Inc. | 127 |

| Top Technical | WMG | Warner Music Group Corp. | 82 |

| Top Fundamental | SWI | SolarWinds, Inc. | 56 |

| Top Tech. & Fund. | SWI | SolarWinds, Inc. | 56 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | CALX | Calix, Inc. | 67 |

| Top Technical | KEM | KEMET Corporation | 65 |

| Top Fundamental | BIP | Brookfield Infrastructure Partners L.P. | 49 |

| Top Tech. & Fund. | KH | China Kanghui Holdings | 53 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2011 NBIcharts, LLC dba BreakoutWatch.com. All

rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All

other marks are the property of their respective owners, and are used

for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily

or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription

and is free from advertising.