| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

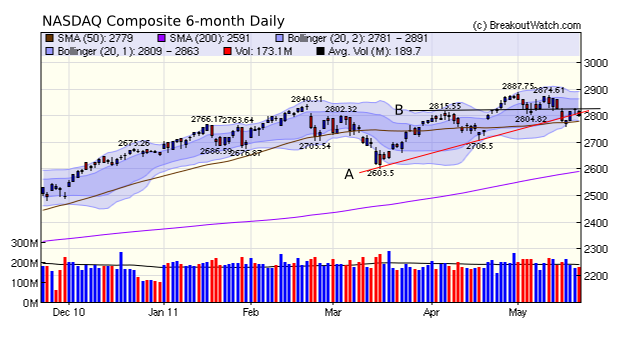

Last week I said "a fall through support line B would signal weakness and a failure to find support at ascending triangle A would be distinctly bearish". In fact, support line B was breached as early as Monday of this week and the index then bounced around line B with that prior support level now posing resistance. Friday's distribution day left the index well below support line A, so we must conclude that a correction will follow, at least down to Tuesday's low of 2760.

The number of successful breakouts fell to 7, reflecting the negative short term trend. The average gain of breakouts for the week was 5.1% but this was distorted by Red Robin Gourmet Burgers (RRGB) which gapped up on Friday for a gain of 17.9%.

New Features this Week

No new features this week.

Several weeks ago (Newsletter 04/01/11) we analysed the value of using follow through days as a reliable predictor of a downward trend reversal. We concluded that using that indicator, you would have missed 45% of the trend reversals over the last five years and so we began a search for a better indicator.

I started with the Stochastic RSI which a price-based indicator used to determine overbought and oversold levels with more frequency than the standard RSI. To this I added the Accumulation/Distribution (AccDis) indicator which is volume based. The rationale was to combine the two to derive an indicator in which price trend reversals were confirmed by an increase in volume. While this approach certainly held promise, I found that the results produced whipsawing due to the frequency of the overbought/oversold indicators produced by the Stochastic RSI.

The next step was to slow down the signals by smoothing them with an exponential moving average. The advantage of an exponential MA (EMA) over a simple MA (SMA) is that it gives more weight to recent data whereas the SMA gives equal weight to all days in the chosen period. This now raised the question of what period and what weight to give to the EMA for the Stochastic RSI and AccDis.

Testing various values over the last five years for the DJI, S&P 500, and NASDAQ showed that the degree of smoothing necessary was dependant on the volatility of the index. A high volatility index such as the NASDAQ required more smoothing than a low volatility index such as the DJI or S&P 500.

This suggested that the next step should be to combine volatility into the formula in some way. The usual measure of volatility is the 'beta' value for a stock which compares the volatility of the stock to the volatility of the underlying market.

Our goal now is to have an indicator which will flash buy/sell signals for each stock based on its beta value. That still requires more work but already we can see that the indicator for each index will outperform our current market trend model. The table below shows how the new indicator for each major index compares to our current market trend model. The comparison assumes that we go long when the indicators says the trend is up and sell when the indicators say the trand is down.

| 5 Year Profit Comparison: New Model Versus Current Trend Model |

|||

|---|---|---|---|

| New Model | Current Trend Model | Improvement | |

| IXIC | $1,210 | $1,112 | 8.8% |

| SPX | $464 | $297 | 56.3% |

| DJI | $5,789 | $3,189 | 81.5% |

We will keep our current trend model in place until the new one is completed.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 12512 | -0.67% | 8.07% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2803.32 | -0.89% | 5.67% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1333.27 | -0.34% | 6.01% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 829.06 | -0.79% | 5.79% | Up | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 14086.4 | -0.37% | 5.99% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 7 | 12.77 | 7.71% | 5.08% |

| Last Week | 11 | 13.62 | 8.91% | 3.12% |

| 13 Weeks | 206 | 14 | 12.41% |

0.84% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | CLFD | Clearfield, Inc. | 125 |

| Top Technical | WMG | Warner Music Group Corp. | 83 |

| Top Fundamental | SWI | SolarWinds, Inc. | 54 |

| Top Tech. & Fund. | ZAGG | Zagg Inc | 91 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | TRIB | Trinity Biotech plc (ADR) | 72 |

| Top Technical | MPAA | Motorcar Parts of America, Inc. | 64 |

| Top Fundamental | HIBB | Hibbett Sports, Inc. | 47 |

| Top Tech. & Fund. | MPAA | Motorcar Parts of America, Inc. | 64 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2011 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.