| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

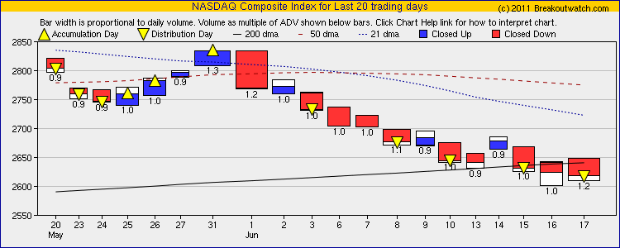

Our equivolume charts provide a succinct picture of the damage done to the NASDAQ Composite in June with five distribution days since the start of the month. As we expected, the 200 dma level for the NASDAQ Composite provided only brief support on Monday until the index sank to its previous support level of around 2603 on Thursday. Support came in at that level but Friday brought disappointing earnings from Research in Motion (RIMM) and the index fell again on heavy volume.

The equivolume chart clearly shows the bounce off the support level on Thursday and again on Friday which gives some hope that the current correction may be over. Also the NASDAQ was the only index in the red at Friday's close and the other major indexes closed the week for a slight gain, so the rising tide could lift the NASDAQ's boat on Monday.

With the NASDAQ in decline, the number of breakouts was inevitably low with just three confirmed and only one, BGS, staying positive through Friday's close. Last weeks standouts, JVA anc PCYC, continued strongly with gains of 85% and 28% respectively.

Beware of Stop Loss Orders

The May edition of the AAII Journal contained an excellent discussion of how Buy and Sell order get filled. If you are an AAII member, you can read the article How Your Buy and Sell Orders Get Filled on their web site.

The main take-away from the article is the risk posed by Stop Loss orders. We may naively think that a stop loss order protects our downside risk, but the article teaches us otherwise:

I would say stop orders on the very surface sound like a really great thing. If my stock goes down while I’m on vacation, I’m going to stop myself out, or in other words limit my downside losses on a particular security by utilizing this order type. It is a very popular order type among individual investors because no one is standing in front of their quote terminal all the time.

However, it’s very important to understand what this means. There are a few different types of stop orders that you can enter. We’ll just talk about downside stop orders (there are actually upside stop orders that you can enter, too). In the case of a downside stop order, you could say, “I bought my stock XYZ at $20.00 per share,” and once you completed that sale, if XYZ drops to $18.00 per share, then you could decide, “I don’t want to own it any more, because in my mind the fundamentals of that stock changed and I want to get out of it.” So you enter an order to stop yourself out at $18.00.

What most people don’t understand is that stock prices can move very quickly in a very short amount of time. And stock prices can open at the start of trading on one day at very different prices than where they closed at the end of trading the previous day.

Let’s say you enter a plain stop order that says, “If the stock trades at $18.00 per share, I want to make this a market order and get out at the best prevailing price.” During the order life cycle process, there is actually an activation phase and an order execution phase. The activation phase takes place when the order trades at $18.00 or less. If the stock then opens at $16.00, your stop order is activated, because it is lower than your $18.00 stop price. And the stock sells at the best available market price. In a quickly moving situation, the best price available might be $15.00. You see this happen in circumstances like the flash crash and in circumstances where trading in a stock is halted because of an impending news situation that will have material changes in the company, and the stock opens at a very different price. It is very discouraging for the investor when that happens, but those were the exact instructions provided on the stop order.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 12004.4 | 0.44% | 3.69% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2616.48 | -1.03% | -1.37% | Down | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1271.5 | 0.04% | 1.1% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 781.75 | 0.28% | -0.24% | Down | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 13397.3 | -0.05% | 0.81% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 3 | 11.31 | 1.76% | -1.1% |

| Last Week | 21 | 11.46 | 4.33% | -0.87% |

| 13 Weeks | 178 | 11.62 | 11.46% |

-3.73% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | CLFD | Clearfield, Inc. | 113 |

| Top Technical | NSTC | Ness Technologies, Inc. | 78 |

| Top Fundamental | CFX | Colfax Corporation | 42 |

| Top Tech. & Fund. | CFX | Colfax Corporation | 42 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | BGS | B&G Foods, Inc. | 56 |

| Top Technical | HOC | Holly Corporation | 41 |

| Top Fundamental | BGS | B&G Foods, Inc. | 56 |

| Top Tech. & Fund. | BGS | B&G Foods, Inc. | 56 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2011 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.