| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

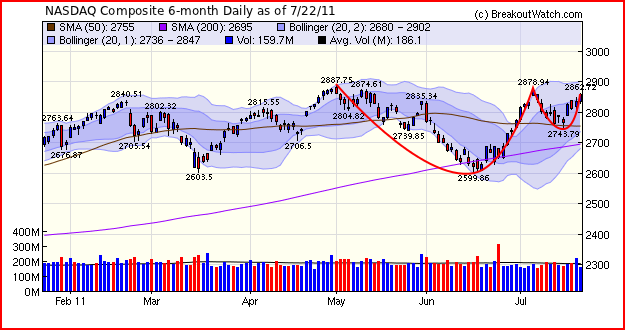

The major indexes made healthy gains for the week but on less than average volume, except for a volume spike on Thursday in response to a new bailout plan for Greece and rumors of a debt ceiling deal. All the major indexes are in a cup-with-handle pattern similar to that shown for the NASDAQ Composite. That means they all face resistance at their pivot and left cup levels. For the NASDAQ that's 2879 and 2888, respectively.

So far, the markets have expected that

the debt ceiling will be raised, but if no plan emerges over the

weekend we may see some selling on Monday. It seems there are three

possible outcomes, in order of those that I perceive are most likely

The number of breakouts jumped from 17 to 34 this week, reflecting the positive moves of the indexes.

Those of you who read the daily email will have noticed that the market commentary appears there only sporadically of late. The reason is that my boys are out of school and daily excursions to beach, forest, etc. leave me far from my computer at mid-morning as market closes here at 10am here in Hawaii

- The debt ceiling will be raised with $1-4 trillion cut over ten years and no increased tax revenues (Obama capitulates).

- The debt ceiling will be raised short term without cuts or tax

increases (either Obama invokes 14th amendment or Reid/McConnel

fallback planadopted)

- The

debt ceiling will be raised with $1-4 trillion cut over ten years with

revenue increases coming from broadening the tax base (house Democrats

join non-TP Republicans to pass gang-of-six type proposal)

The number of breakouts jumped from 17 to 34 this week, reflecting the positive moves of the indexes.

Those of you who read the daily email will have noticed that the market commentary appears there only sporadically of late. The reason is that my boys are out of school and daily excursions to beach, forest, etc. leave me far from my computer at mid-morning as market closes here at 10am here in Hawaii

No new features this week.

This feature wil return next week.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 12681.2 | 1.61% | 9.53% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2858.83 | 2.47% | 7.76% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1345.02 | 2.19% | 6.95% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 841.82 | 1.57% | 7.42% | Up | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 14229.3 | 2.06% | 7.07% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 28 | 12.85 | 6.45% | 3.68% |

| Last Week | 17 | 12.23 | 7.9% | 4.37% |

| 13 Weeks | 200 | 14.54 | 10.66% |

3.45% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | KOG | Kodiak Oil & Gas Corp. | 114 |

| Top Technical | DSCI | Derma Sciences, Inc. | 73 |

| Top Fundamental | PCLN | priceline.com Incorporated | 38 |

| Top Tech. & Fund. | PCLN | priceline.com Incorporated | 38 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | FXEN | FX Energy, Inc. | 88 |

| Top Technical | DBLE | Double Eagle Petroleum Co. | 76 |

| Top Fundamental | DXPE | DXP Enterprises, Inc. | 56 |

| Top Tech. & Fund. | DXPE | DXP Enterprises, Inc. | 56 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2011 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.