| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

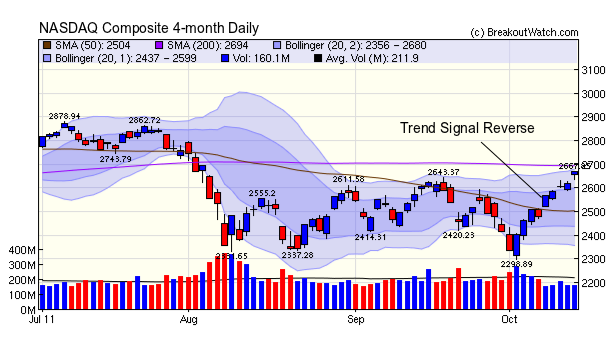

Our trend reversal signal (TRS) for the NASDAQ Composite reversed itself to upward mode on Monday. Over at The Big Picture, the consensus is that this a bear market rally from an oversold position. Perhaps the strongest technical support for this view is that the index has risen 7.6% for the week on volume that was 30% below the 50 day average and rallies built on weak volume rarely last. Certainly threats, both technical and fundamental, remain. The next technical resistance level is at the 200 dma level, less than 1% above Friday's close, and after that 2862, 7.3% higher.

The fundamental threats to a continued rally are the lack of consumer spending to create demand and the continued threat of bank failures in Europe and the risk of contagion to domestic banks. Although the Commerce Department reported an increase in retail sales in September - and by extension an increase in demand - these were seasonally adjusted numbers and the raw data actually shows a decrease in spending (382 billion in September vs 402 billion in August). Consumer spending will continue to be constrained until the unemployment rate comes down and the housing market begins to recover (some estimates are that it has another 7% to fall). By Sunday we should know the outcome of the G20 meeting, which is sure to produce an optimistic press release, but the doubts about the stability of the banks, and therefore market volatility, will likely remain.

We sent out 55 breakout alerts this week

but despite the healthy gains for the NASDAQ Composite and the Russell

2000, the number of confirmed breakouts this week was only four. This

is because volumes were so low that few stocks met the daily volume

requirement to be confirmed.

No new features this week.

We are working on extending our TRS methodology to individual stocks and hope to have some preliminary results next week. In the interim, use the Stock Timeliness Checkup tool as an guide to when to enter or exit a short or long position.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 11644.5 | 4.88% | 0.58% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2667.85 | 7.6% | 0.56% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1224.58 | 5.98% | -2.63% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 712.46 | 8.57% | -9.08% | Up | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 12783.6 | 6.35% | -3.81% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 4 | 11.15 | 25.11% | 24.6% |

| Last Week | 10 | 12.08 | 3.77% | -3.39% |

| 13 Weeks | 245 | 12.23 | 6.64% |

-6.81% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | INWK | InnerWorkings, Inc. | 91 |

| Top Technical | TIN | Temple-Inland, Inc. | 58 |

| Top Fundamental | OPNT | 52 | |

| Top Tech. & Fund. | CELL | 0 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | PPDI | Pharmaceutical Product Development, Inc. | 55 |

| Top Technical | PPDI | Pharmaceutical Product Development, Inc. | 55 |

| Top Fundamental | PPDI | Pharmaceutical Product Development, Inc. | 55 |

| Top Tech. & Fund. | PPDI | Pharmaceutical Product Development, Inc. | 55 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2011 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.