| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

Server Maintenance this Weekend

We will be upgrading the software that drives our web server, database

and programming languages this weekend. Hopefully any outages will be

brief.Although the major indexes closed higher this week, the NASDAQ chart still shows that there is resistance ahead and we are pessimistic about prospects as we enter the New Year. Apart from the purely technical indicators of resistance (the 200 dma and lower highs), there is also evidence of a global economic slowdown (see Dr. Copper Flashes a Warning). This is reflected in the Dupont earnings warning issued on Friday which said “we are seeing slower growth in certain segments during the 4th Q, driven by global economic uncertainty.” Volatility is also likely to continue as we still do not have a solution to the European sovereign debt crisis, other than promises to control debt levels in the future without a convincing plan to address debt problems in the present. The hope is that if confidence can be restored then there will be a downward trend in the interest rates that the debtor countries must pay if non-European countries such as China can be induced to purchase European sovereign debt. The markets rose on that prospect today, having quickly forgotten that on Thursday they fell because the European Central Bank refused to be a lender of last resort. This report from Bloomberg News shows that hopes that the crisis is resolved are premature given the growth stifling austerity measures in place and the huge debt repayments due early next year.

The number of breakouts fell to

seventeen this week with only modest gains although on average they

comfortably outpaced the indexes.

No new features this week

More about trading in this volatile market.

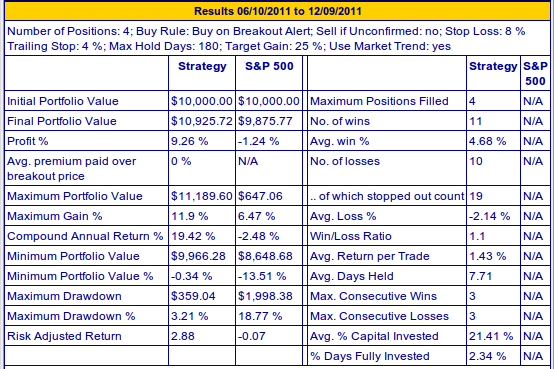

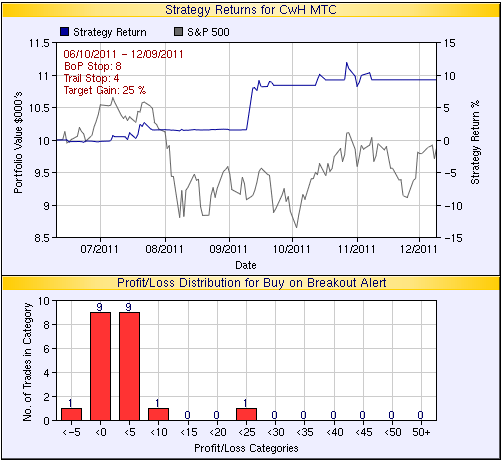

Last week we showed the importance of setting a tight trailing stop. This week we look at the implications in terms of hold days. Using the CWH with buy on alert MTC strategy, 4 positions and a 4% trailing stop over the last 6 months, our average number of hold days would have been just under 8 days. Our average win would have been just 4.7% and this is shown in the bar chart where almost all our winners are clustered in the 0-10% range.

What this shows is that we are very much in a swing trade market - get in quickly, take your winners and run but don't stay around for the medium or long term (you'll be dead! - JMK). The gains were not spectacular, just 9.3% in 6 months, but way better than the S&P 500. SPQR - small profits , quick returns.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 12184.3 | 1.37% | 5.24% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2646.85 | 0.76% | -0.23% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1255.19 | 0.88% | -0.19% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 745.4 | 1.41% | -4.88% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 17 | 21.08 | 5.42% | 3.08% |

| Last Week | 42 | 20.69 | 5.34% | 2.34% |

| 13 Weeks | 285 | 21.62 | 8.74% |

1.64% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | PDFS | 103 | |

| Top Technical | BBW | Build-A-Bear Workshop, Inc | 75 |

| Top Fundamental | BOFI | BofI Holding, Inc. | 54 |

| Top Tech. & Fund. | MELI | MercadoLibre, Inc. | 0 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | MITI | Micromet Inc. | 91 |

| Top Technical | TAST | Carrols Restaurant Group, Inc. | 76 |

| Top Fundamental | MELI | MercadoLibre, Inc. | 45 |

| Top Tech. & Fund. | MELI | MercadoLibre, Inc. | 45 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2011 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.