| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

The NASDAQ Composite moved moderately higher this week and our trend indicator continues to point upwards. During the week the index was range-bound between resistance at 3170 and support at 3112.

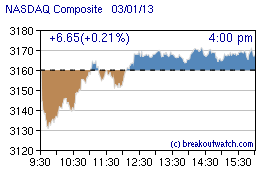

Friday's action (intraday chart below), as the sequester went into effect, showed resilience with the bulls winning the day after the morning's sell-off. This shows that, at least in the short term, the market does not believe the sequester will constrain corporate profits. Note how the market saw 3170 as the upper limit for now. A breakthrough at that level will signal that more upside is possible.

After a strong start to the year, the

number of breakouts has fallen back to about

half the recent average. While the markets continue to

be range-bound we should not expect a higher number,

or better average profits from each breakout. That

said, this week's average gains were impacted by the

collapse of IMPAC mortgage holdings (IMH) which fell

22% after an initially strong breakout of over 6%

above BoP..

No new

features this week.

The importance of

Trailing Stop Loss Orders

The example cited above of IMH's cratering after a 6% gain is an excellent example of how the adjustment of your trailing stops can protect some of your breakout gains.

Our current recommendation for a trailing stop is 7% of the highest intraday high since breakout. (see newsletter 2/10/13). After breakout on Wednesday (BoP 14.27) the share peaked at 15.17 (a gain of 6.3%). That evening, if a stop loss order of 7% below 15.17 (14.12) had been placed the potential loss the next day would have been limited to 1.1% of the breakout price instead of the 21% loss at the day's close.

Our stop loss recommendations have two tiers:

The example cited above of IMH's cratering after a 6% gain is an excellent example of how the adjustment of your trailing stops can protect some of your breakout gains.

Our current recommendation for a trailing stop is 7% of the highest intraday high since breakout. (see newsletter 2/10/13). After breakout on Wednesday (BoP 14.27) the share peaked at 15.17 (a gain of 6.3%). That evening, if a stop loss order of 7% below 15.17 (14.12) had been placed the potential loss the next day would have been limited to 1.1% of the breakout price instead of the 21% loss at the day's close.

Our stop loss recommendations have two tiers:

- if a stock fails to rise by 5% above the BoP then the stop loss is set at 5% below the BoP.

- If the stock rises at least 5%, then the stop less is set at 7% below the highest intraday high since breakout.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 14089.7 | 0.64% | 7.52% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 3169.74 | 0.25% | 4.98% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1518.2 | 0.17% | 6.45% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is

derived from our proprietary market model. The

market model is described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 10 | 19.08 | 4.58% | 1.37% |

| Last Week | 9 | 19.62 | 2.7% | -0.11% |

| 13 Weeks | 262 | 20.38 | 12.08% |

5.51% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | CRTX | Cornerstone Therapeutics, Inc. | 103 |

| Top Technical | CRTX | Cornerstone Therapeutics, Inc. | 103 |

| Top Fundamental | MTH | Meritage Homes Corp | 37 |

| Top Tech. & Fund. | MTH | Meritage Homes Corp | 37 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | CNDO | Coronado Biosciences Inc | 69 |

| Top Technical | CNDO | Coronado Biosciences Inc | 69 |

| Top Fundamental | IMPV | Imperva Inc | 30 |

| Top Tech. & Fund. | IMPV | Imperva Inc | 30 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2013 NBIcharts, LLC dba

BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and

the slogan "tomorrow's breakouts today" are service marks

of NBIcharts LLC. All other marks are the property of

their respective owners, and are used for descriptive

purposes only.

BreakoutWatch is not affiliated with Investor's Business

Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by

subscription and is free from advertising.