| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

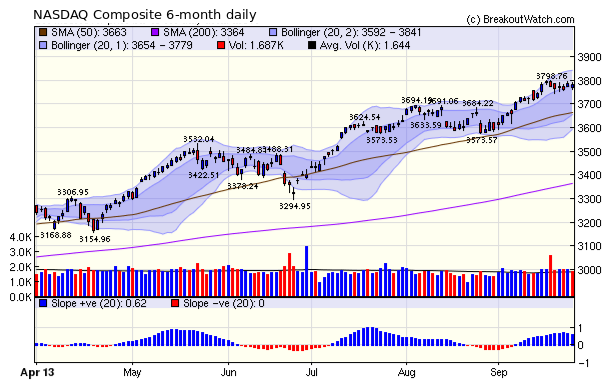

The NASDAQ Composite held up quite well this week despite the political uncertainty, as the chart shows. The index dropped just 0.2 percent while the Dow and S&P 500 each lost more than 1%. The upward trend, as measured by the slope of a 20 day moving linear regression, remains positive although the trend is weakening as the slope chart shows. As I write this, on Saturday afternoon in Hawaii, it appears almost certain that there will be some form of government shutdown beginning on Tuesday, so we can anticipate that Monday will be a fairly strong down day which could set the market direction for several days to come.

As a result of the NASDAQ's relative strength, there were quite a few more breakouts than I expected when I issued last week's warning to stay on the sidelines until votes in the Congress are finalized. !4 breakouts for the week was considerably higher than the recent average and an average gain of almost 6% until Friday's close was remarkably healthy. Pharmaceutical company Cempra (CEMP) was the strongest performer with a 17% gain to Friday's close.

There were no new features this week.

Trend Recognition

This week, a subscriber asked me why our trend signals remain "up" even though the markets are falling.

I answered that the NASDAQ is not clearly in a down trend, as can be seen from the chart above, and that volumes, at least until Friday, for the S&P 500 and DJI were weak, so a downtrend for those indexes was not clearly established either. Trend changes are difficult to identify with certainty, but must always be accompanied by above average volume.

If we were able to accurately identify changes in trend then we would have an incredibly powerful and profitable tool. We would buy when the trend changes to up and sell when it changes to down. We'd then go short and cover when the trend again changes upward.

The challenge we face is, how long do we wait for the trend to be established? If we act too soon, we risk being whipsawed when the trend reverses on us before we have turned a profit. If we act too late, our potential profit is diminished.

Now, I said above that a trend change must always be accompanied by above average volume, which begs the question, what is above average volume? What period should we use over which to determine the average? It's the same problem as how long should we wait to establish the trend. There is again no easy answer to this question.

What we do know, is that once that above average volume has worked its magic, price will respond, so by following price alone perhaps we can ignore the volume question altogether. This is the rationale behind trend recognition systems, such as MACD, that attempt to detect trend changes by looking at divergence between moving averages of different lengths. these systems can be successful when prices move strongly in one direction or another but fail during weakly trending or laterally moving prices as they lead to whipsawing and overall losses.

Our new Trend Reversal algorithm uses fractal geometry to overcome these disadvantages and is the basis of when we determine a trend has changed in one of the major indexes. The system uses a fractal line and a moving average to detect trend changes. An advantage of the fractal line is that it responds slowly when prices are flat, but quickly as pricees start to trend. It will never be 100% accurate, but it should swing the odds slightly in our favor. You can read more and test the system for your self at our Evaluate >Analytical Tools > Trend Reversal Signals menu choice.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 15258.2 | -1.25% | 16.44% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 3781.59 | 0.18% | 25.24% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1691.75 | -1.06% | 18.62% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 14 | 8.85 | 8.36% | 5.93% |

| Last Week | 16 | 8.15 | 8.62% | 3.54% |

| 13 Weeks | 107 | 9.38 | 19.79% |

10.97% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | IMMU | Immunomedics, Inc. | 114 |

| Top Technical | IMMU | Immunomedics, Inc. | 114 |

| Top Fundamental | AMG | Affiliated Managers Group, Inc. | 25 |

| Top Tech. & Fund. | ULTI | The Ultimate Software Group, Inc. | 24 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | RM | Regional Management Corp | 69 |

| Top Technical | WAL | Western Alliance Bancorporation | 57 |

| Top Fundamental | SYNA | Synaptics, Incorporated | 38 |

| Top Tech. & Fund. | SYNA | Synaptics, Incorporated | 38 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2013 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil.

Our site, research and analysis is supported entirely by

subscription and is free from advertising.