Breakoutwatch Weekly Summary 10/01/16

You are receiving this email because you are or were a BreakoutWatch.com subscriber, or have subscribed to our weekly newsletter. This newsletter summarizes the breakout events of the week and provides additional guidance that does not fit into our daily format. It is published each weekend.

Key Takeaways:

|

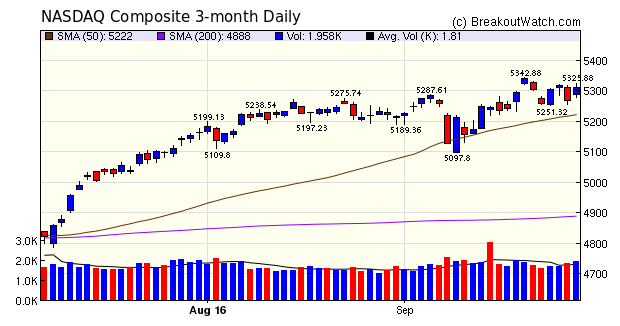

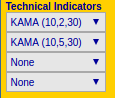

| Kaufman's Adaptive Moving Average (KAMA) added to Technical Analysis Charts  Kaufman's Adaptive Moving Average (KAMA) takes into consideration not only the direction of the market, but also the market volatility. Compared to a simple moving average, KAMA generates fewer false signals. KAMA may be helpful in determining entry and exit points. I've added two versions of KAMA to the chart options:

I'll

have more to say about using KAMA as an exit timing tool

next week.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 15 | 1.97 |

| SQZ | 9 | 2.61 |

| HTF | 0 | |

| HSB | 2 | 2.31 |

| DB | 0 |

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2016-09-28 | WOR | CWH | n | 44.39 | 47 | 92 | 48.03 | 8.2% | 9.19% |

| 2016-09-29 | QCOM | CWH | n | 64.00 | 67 | 81 | 68.5 | 7.03% | 10% |

| 2016-09-29 | TWI | SQZ | y | 9.47 | 10 | 96 | 10.12 | 6.86% | 7.6% |

| 2016-09-26 | MB | SQZ | y | 18.56 | 19 | 84 | 19.66 | 5.93% | 9.81% |

| 2016-09-29 | LL | CWH | n | 18.69 | 19 | 82 | 19.67 | 5.24% | 7.49% |

| 2016-09-30 | FTAI | SQZ | y | 11.91 | 13 | 80 | 12.51 | 5.04% | 5.71% |

| 2016-09-27 | XONE | SQZ | y | 14.54 | 15 | 97 | 15.22 | 4.68% | 6.6% |

| 2016-09-28 | TK | HSB | n | 7.37 | 8 | 7 | 7.71 | 4.61% | 5.83% |

| 2016-09-26 | KNOP | CWH | n | 19.99 | 20 | 86 | 20.89 | 4.5% | 5.05% |

| 2016-09-29 | OAS | CWH | n | 10.99 | 11 | 85 | 11.47 | 4.37% | 4.37% |

| 2016-09-27 | EGRX | CWH | n | 68.14 | 70 | 95 | 70 | 2.73% | 4.74% |

| 2016-09-28 | APA | CWH | n | 62.19 | 64 | 86 | 63.87 | 2.7% | 6.13% |

| 2016-09-30 | IIVI | CWH | n | 23.81 | 24 | 85 | 24.33 | 2.18% | 2.73% |

| 2016-09-28 | PFG | CWH | y | 50.61 | 51 | 82 | 51.51 | 1.78% | 1.78% |

| 2016-09-30 | MMYT | CWH | n | 23.26 | 24 | 92 | 23.6 | 1.46% | 2.32% |

| 2016-09-28 | NAII | CWH | n | 13.00 | 13 | 93 | 13.14 | 1.08% | 4.77% |

| 2016-09-30 | CNCO | SQZ | y | 8.92 | 9 | 85 | 9.01 | 1.01% | 1.91% |

| 2016-09-30 | SLAB | CWH | n | 58.21 | 59 | 84 | 58.8 | 1.01% | 1.96% |

| 2016-09-30 | ARWR | SQZ | y | 7.31 | 7 | 88 | 7.35 | 0.55% | 5.61% |

| 2016-09-30 | NSTG | CWH | n | 19.88 | 20 | 90 | 19.98 | 0.5% | 2.01% |

| 2016-09-28 | BAK | CWH | n | 15.31 | 16 | 93 | 15.38 | 0.46% | 6.14% |

| 2016-09-28 | QUOT | SQZ | y | 13.26 | 14 | 80 | 13.31 | 0.38% | 3.32% |

| 2016-09-28 | MITK | SQZ | y | 8.26 | 9 | 97 | 8.29 | 0.36% | 6.17% |

| 2016-09-30 | VRTU | HSB | n | 24.68 | 25 | 5 | 24.68 | 0% | 1.22% |

| 2016-09-28 | DLNG | SQZ | y | 15.68 | 16 | 86 | 15.48 | -1.28% | 3.32% |

| 2016-09-28 | GOGO | CWH | y | 12.80 | 13 | 88 | 11.04 | -13.75% | 3.75% |

| *RS Rank on day before breakout. | |||||||||

|

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| RIC | 11.66 | 1,091,024 | Richmont Mines - Inc. | Gold | 98 | 10.05 |

| RGLD | 86.93 | 995,535 | Royal Gold - Inc. | Gold | 94 | 77.43 |

| ARLP | 22.32 | 463,038 | Alliance Resource Partners - L.P. | Industrial Metals & Minerals | 94 | 22.22 |

| AEM | 57.35 | 2,735,432 | Agnico Eagle Mines Limited | Gold | 94 | 54.16 |

| ENBL | 16.39 | 335,686 | Enable Midstream Partners - LP | Oil & Gas Pipelines | 94 | 15.25 |

| These stocks meet our suggested screening factors

for our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 18308.2 |

0.26% | 5.07% | Up |

| NASDAQ | 5312 |

0.12% | 6.08% | Up |

| S&P 500 | 2168.27 |

0.17% | 6.08% | Up |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the sitehere.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| Dow Jones |

NASDAQ Composite 9.24 % |

NASDAQ Composite 8.09 % |

S&P 500 6.08 % |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Manufactured Housing |

Manufactured Housing |

Silver |

Silver |

| Small Tools & Accessories 54 |

Basic Materials Wholesale 191 |

Manufactured Housing 213 |

Manufactured Housing 213 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 10/01/2016 NBIcharts, LLC dba BreakoutWatch.com. All

rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All

other marks are the property of their respective owners, and are used

for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.