Breakoutwatch Weekly Summary 10/19/19

You are receiving this email because you are or were a BreakoutWatch.com subscriber, or have subscribed to our weekly newsletter. This newsletter summarizes the breakout events of the week and provides additional guidance that does not fit into our daily format. It is published each weekend.

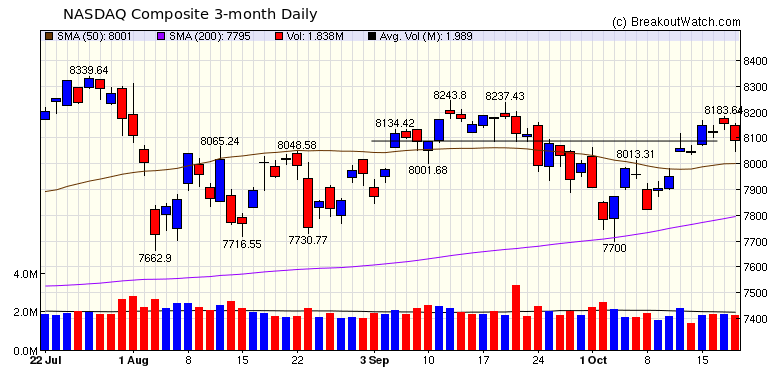

| Trend Signals are Up; NASDAQ

Bearish Double Top Canceled; New Industry Rankings Our trend signals returned to pointing upwards on Tuesday and the NASDAQ closed above the bearish double top confirmation level effectively canceling that bearish signal. The resurgence this week was mostly due to a positive start to the 3rd quarter earnings reports with Healthcare, Financials and Real Estate sectors leading the way higher and a rising tide lifting all boats. Notably volumes were below the 50 day average indicating some doubts remain, particularly relating to China's drop in GDP, unresolved trade deals, threats of higher tariffs, escalating tensions in the middle east,Brexit, the Fed's interest rate direction, impeachment. In short, there is plenty to worry about. The week's action produced an uptick in the number of breakouts with most coming from the Volatility Squeeze pattern than any other with an average gain of a very healthy 5.34%.  |

| Last week I introduced a new Industry Browser page and for this week I've concentrated on improving the industry rankings page. Check it out under the Evaluate > Industry Analysis > Industry Rankings menu choice. |

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 2 | -1.03 |

| SQZ | 9 | 5.34 |

| HTF | 0 | |

| HSB | 0 | |

| DB | 0 |

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2019-10-17 | MTEM | SQZ | y | 7.27 | 7.39 | 88 | 7.86 | 8.12% | 8.67% |

| 2019-10-15 | DOOO | SQZ | y | 39.57 | 40 | 82 | 42.72 | 7.96% | 9.05% |

| 2019-10-18 | MTEM | SQZ | y | 7.40 | 7.86 | 91 | 7.86 | 6.22% | 6.76% |

| 2019-10-15 | APLS | SQZ | y | 26.39 | 26.48 | 95 | 27.83 | 5.46% | 9.02% |

| 2019-10-17 | TCDA | SQZ | y | 33.60 | 34.93 | 80 | 35.4 | 5.36% | 5.83% |

| 2019-10-16 | APLS | SQZ | y | 26.49 | 28.16 | 96 | 27.83 | 5.06% | 8.61% |

| 2019-10-17 | PDFS | SQZ | y | 13.59 | 13.73 | 92 | 14.2 | 4.49% | 5.08% |

| 2019-10-18 | PDFS | SQZ | y | 13.74 | 14.2 | 91 | 14.2 | 3.35% | 3.71% |

| 2019-10-15 | SPAR | SQZ | y | 13.99 | 14.78 | 97 | 14.28 | 2.07% | 7.22% |

| 2019-10-17 | IPHS | CWH | n | 35.20 | 35.38 | 87 | 35.35 | 0.43% | 6.62% |

| 2019-10-15 | HZNP | CWH | n | 28.10 | 28.2 | 90 | 27.4 | -2.49% | 4.23% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| ALDR | 18.99 | 5,410,239 | Alder BioPharmaceuticals - Inc. | Biotechnology | 98 | 18.92 |

| AKTS | 8.77 | 687,108 | Akoustis Technologies - Inc. | Communication Equipment | 96 | 8.17 |

| SPWH | 6.42 | 892,848 | Sportsman's Warehouse Holdings, Inc. | General Entertainment | 94 | 6.26 |

| VRRM | 15.10 | 1,378,640 | Verra Mobility Corporation - Class A Common Stock | Security & Protection Services | 88 | 14.30 |

| PSDO | 16.96 | 2,078,738 | Presidio - Inc. | Information Technology | 87 | 16.72 |

| FLXN | 15.67 | 874,695 | Flexion Therapeutics - Inc. | Drug Manufacturers - Other | 83 | 14.24 |

| SONO | 15.41 | 2,332,048 | Sonos - Inc. | Electronic Equipment | 82 | 13.24 |

| CORT | 15.03 | 998,648 | Corcept Therapeutics Incorporated | Biotechnology | 81 | 13.71 |

| These stocks meet our suggested screening factors

for our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 26770.2 |

-0.17% | 14.76% | Up |

| NASDAQ | 8089.54 |

0.4% | 21.92% | Up |

| S&P 500 | 2986.2 |

0.54% | 19.12% | Up |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| S&P 500 |

S&P 500 0.32 % |

S&P 500 2.69 % |

NASDAQ Composite 21.92 % |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Water Utilities |

Water Utilities |

Auto Dealerships |

Insurance Brokers |

| Electronics Stores 42 |

Medical Practitioners 211 |

Drug Delivery 209 |

Drug Delivery 208 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 10/19/2019 NBIcharts, LLC dba BreakoutWatch.com. All

rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All

other marks are the property of their respective owners, and are used

for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.