Breakoutwatch Weekly Summary 02/22/20

You are receiving this email because you are or were a BreakoutWatch.com subscriber, or have subscribed to our weekly newsletter. This newsletter summarizes the breakout events of the week and provides additional guidance that does not fit into our daily format. It is published each weekend.

| Breakout Gains for the Week Exceed

8% Despite Profit Taking The week began strongly with the NASDAQ and other major indexes hitting new highs again on Wednesday but profit taking on Thursday and Friday left the three major indexes with losses for the week. The NASDAQ was the most affected with a loss of 1.6%. Despite the heavy selling on Thursday and Friday as evidenced by the above average volume levels, our trend indicators remain positive. Where we go from here, however, will be largely affected in the short term by the economic impact of the coronavirus. With the virus now affecting 28 countries and 1500 cases outside China, the effect on international travel and commerce will likely continue to depress markets already jittery about elevated valuation levels.  This weeks breakouts were equally

split between cup and handle (CWH) and volatility squeeze

patterns with 8 each. Average gains were substantial with 9%

average for CWH and 8.4% for volatility squeeze. Of the 8 CWH

breakouts, 2 were in a volatility squeeze within the handle.

This combination is rare, but when it does occur, the breakout

day "pop" is on average twice as high as a normal cup and handle

breakout (6% compared to 3.1%). The momentum isn't maintained,

however, and when we look at the average high within the next 7

and 30 days we see that the squeeze breakouts under-perform the

non-squeeze breakouts.

|

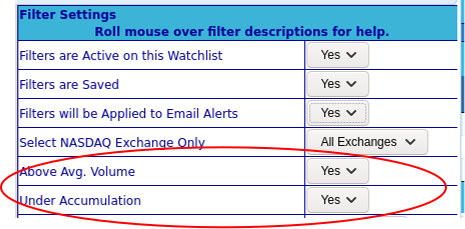

| The purpose of this

section is to suggest how a profitable breakout could have been

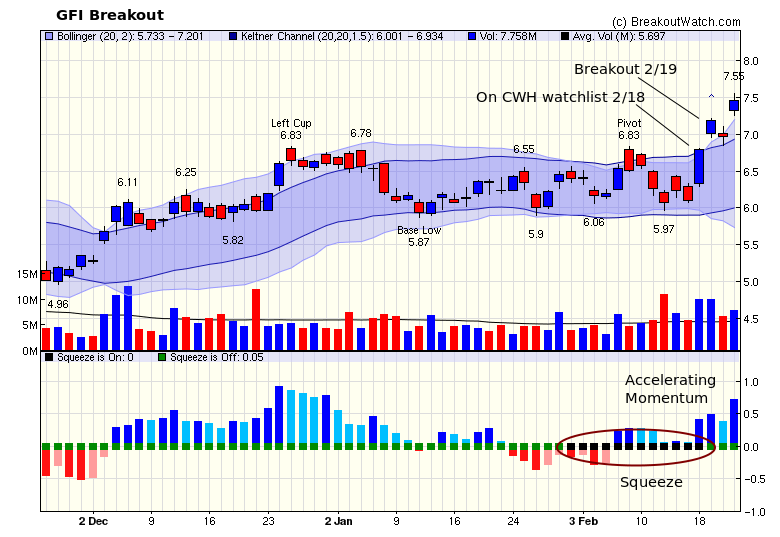

probable from examining the charts on our watchlists. In previous newsletters, I have suggested using a filter that selects stocks that have above average volume on the watchlist date and are also under accumulation:  This filter would have selected

GFI from the CWH watchlist on 2/18. The stock broke out the

next day and went on to gain 9.2% by Friday's close. As the

chart shows the filter conditions were met and the handle was

also in a volatility squeeze.

|

| No new features this week |

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 8 | 9.04 |

| SQZ | 8 | 8.36 |

| HTF | 0 | |

| HSB | 0 | |

| DB | 0 |

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2020-02-18 | RCUS | CWH | n | 12.06 | 12.43 | 86 | 17.32 | 43.62% | 52.82% |

| 2020-02-18 | FVRR | SQZ | y | 27.91 | 28 | 84 | 33.71 | 20.78% | 25.87% |

| 2020-02-19 | FVRR | SQZ | y | 28.01 | 30 | 86 | 33.71 | 20.35% | 25.42% |

| 2020-02-18 | WPM | SQZ | y | 30.00 | 31.4 | 85 | 32.91 | 9.7% | 10.57% |

| 2020-02-19 | GFI | CWH | y | 6.83 | 7.18 | 93 | 7.46 | 9.22% | 10.54% |

| 2020-02-18 | ZM | CWH | n | 93.30 | 96.39 | 82 | 101.76 | 9.07% | 18.7% |

| 2020-02-20 | UFPI | CWH | y | 52.09 | 56.99 | 84 | 56.69 | 8.83% | 11.54% |

| 2020-02-21 | ZYXI | SQZ | y | 10.99 | 11.86 | 91 | 11.86 | 7.92% | 11.56% |

| 2020-02-21 | NBSE | SQZ | y | 7.06 | 7.56 | 82 | 7.56 | 7.08% | 8.62% |

| 2020-02-19 | ITGR | CWH | n | 91.64 | 93.24 | 80 | 97.85 | 6.78% | 9.07% |

| 2020-02-20 | AGI | SQZ | y | 6.54 | 6.79 | 81 | 6.97 | 6.57% | 7.95% |

| 2020-02-20 | ALB | CWH | n | 91.93 | 94.31 | 87 | 92.43 | 0.54% | 8.13% |

| 2020-02-20 | CALX | CWH | n | 10.39 | 10.51 | 92 | 10.39 | 0% | 1.54% |

| 2020-02-19 | NERV | SQZ | y | 9.09 | 9.23 | 94 | 8.93 | -1.76% | 5.17% |

| 2020-02-19 | CATS | SQZ | y | 17.98 | 18.72 | 81 | 17.31 | -3.73% | 4.84% |

| 2020-02-19 | CSIQ | CWH | n | 24.42 | 24.64 | 88 | 23.01 | -5.77% | 3.81% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| CDMO | 7.44 | 652,203 | Avid Bioservices - Inc. - Common Stock | Biotechnology | 94 | 7.18 |

| ELF | 20.00 | 1,178,391 | e.l.f. Beauty - Inc. Common Stock | Household & Personal Products | 91 | 19.07 |

| DDD | 12.56 | 2,838,072 | 3D Systems Corporation Common Stock | Computer Hardware | 90 | 11.96 |

| PRMW | 15.50 | 1,649,716 | Primo Water Corporation - Common Stock | Beverages - Non-Alcoholic | 90 | 15.39 |

| HABT | 14.10 | 806,097 | The Habit Restaurants - Inc. - Class A Common Stock | Restaurants | 89 | 13.98 |

| SNR | 8.35 | 605,337 | New Senior Investment Group Inc. Common Stock | REIT - Residential | 87 | 8.29 |

| AMKR | 14.82 | 1,835,474 | Amkor Technology - Inc. - Common Stock | Semiconductors | 87 | 12.32 |

| VGR | 13.86 | 1,541,178 | Vector Group Ltd. Common Stock | Tobacco | 86 | 13.47 |

| IBN | 15.42 | 8,828,166 | ICICI Bank Limited Common Stock | Banks - Regional | 85 | 15.05 |

| VSTO | 10.27 | 867,513 | Vista Outdoor Inc. Common Stock | Leisure | 83 | 9.38 |

| These stocks meet our suggested screening factors

for our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 28992.4 |

-1.38% | 1.59% | Up |

| NASDAQ | 9576.59 |

-1.59% | 6.73% | Up |

| S&P 500 | 3337.75 |

-1.25% | 3.31% | Up |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| S&P 500 |

NASDAQ Composite 12.4 |

NASDAQ Composite 23.54 |

NASDAQ Composite 6.73 |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Medical Distribution |

| Farm & Heavy Construction

Machinery 55 |

Farm & Heavy Construction Machinery 53 |

Financial Conglomerates 167 |

Closed-End Fund - Debt 182 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 02/22/2020 NBIcharts, LLC dba BreakoutWatch.com. All

rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All

other marks are the property of their respective owners, and are used

for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.