Breakoutwatch Weekly Summary 05/23/20

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter. This newsletter summarizes the breakout events of the week

and provides additional guidance that does not fit into our daily

format. It is published each weekend.

Newsletter Archive: https://www.breakoutwatch.com/content/newsletters

| New Feature: Alert Only if Breakout

Volume Reached The NASDAQ gained 3.4% this week, mostly on Monday when the the markets surged in response to a report that Moderna (MRNA) reported a Phase 1 study for its COVID-19 vaccine candidate yielded positive interim clinical results. There was also support from the Fed on Wednesday as Chairman Powell said the Fed had plenty of ammunition in reserve. Thursday brought a downturn as a further 2.4 million jobless claims were reported and Friday saw profit taking ahead of the 3 day weekend. The NASDAQ Chart shows the index has set up its fourth cup and handle pattern since the recovery, each followed by a breakout to the upside. The outcome of this one may depend on how successful the reopening is seen in contrast to the expected resurgence of the virus outbreak, particularly in southern states. If cases and deaths mount the markets may take a more cautious view.  Successful breakouts fell to 15

this week with cup and handle pattern breakouts dominating.

Average gains to Friday's close were constrained by the pullback

on Thursday and Friday.

|

Real Page Inc. (RP)

shows a strong V shaped recovery and is now in a 'high handle'

formation. The handle action looks very promising with 3 days of

above average volume since the handle low. While we do not

recommend RP as a buy, it is certainly a stock to watch. |

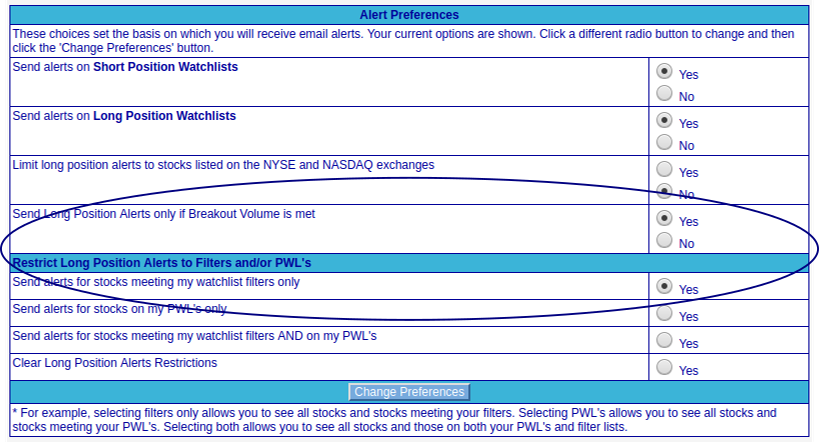

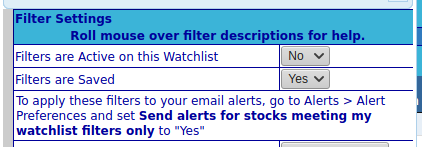

| Beta Test: Alert Only if

Breakout Volume Reached: Many subscribers complain that they receive too many emails. While the number can be constrained by limiting alerts to those only matching filter settings, there can still be a high volume of alerts. I am now introducing a new constraint, which is only to receive alerts when the daily volume has reached the breakout volume level. To implement this feature, 2 changes have been introduced: 1. New Option on Alert Preferences page: specify that you want to receive alerts only if the breakout volume has been reached.   This has required some

complicated coding changes so I ask your indulgence if this

does not work as expected, as testing of this feature can only

be done in real time. Please let me know through the Support

Forum if it does not work for you as expected.

|

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 10 | 3.4 |

| SQZ | 5 | 4.6 |

| HTF | 0 | |

| HSB | 0 | |

| DB | 0 |

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2020-05-19 | SPOT | CWH | n | 163.94 | 175.03 | 87 | 190.17 | 16% | 20.01% |

| 2020-05-22 | BHVN | SQZ | y | 52.22 | 58.38 | 85 | 58.38 | 11.8% | 14% |

| 2020-05-21 | KMDA | CWH | n | 7.70 | 8.34 | 91 | 8.58 | 11.43% | 26.62% |

| 2020-05-20 | KEYS | SQZ | y | 96.01 | 102.92 | 81 | 102.06 | 6.3% | 8.11% |

| 2020-05-18 | NBIX | CWH | n | 117.60 | 124.41 | 90 | 124.8 | 6.12% | 8.23% |

| 2020-05-18 | CAMT | CWH | n | 12.25 | 12.57 | 89 | 12.9 | 5.31% | 7.67% |

| 2020-05-18 | RARE | SQZ | y | 71.30 | 72.59 | 93 | 73.81 | 3.52% | 6.59% |

| 2020-05-19 | AXNX | SQZ | y | 38.27 | 39.82 | 90 | 38.84 | 1.49% | 5.57% |

| 2020-05-21 | POOL | CWH | y | 234.76 | 238.35 | 85 | 238.18 | 1.46% | 1.84% |

| 2020-05-22 | A | CWH | n | 84.39 | 84.98 | 82 | 84.98 | 0.7% | 3.89% |

| 2020-05-22 | OCUL | CWH | n | 7.20 | 7.22 | 96 | 7.22 | 0.28% | 5.28% |

| 2020-05-18 | BLK | SQZ | y | 513.74 | 516.43 | 85 | 513.3 | -0.09% | 2.93% |

| 2020-05-21 | FG | CWH | y | 10.64 | 10.65 | 85 | 10.57 | -0.66% | 0.28% |

| 2020-05-19 | DAO | CWH | n | 25.20 | 26.37 | 92 | 24.48 | -2.86% | 15.36% |

| 2020-05-19 | SIMO | CWH | y | 47.35 | 49.49 | 86 | 45.56 | -3.78% | 10.79% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| APT | 17.00 | 6,305,710 | Alpha Pro Tech - Ltd. Common Stock | Building Products & Equipment | 99 | 13.22 |

| APTO | 9.00 | 1,393,854 | Aptose Biosciences - Inc. - Common Shares | Biotechnology | 98 | 7.62 |

| AUPH | 18.72 | 2,135,661 | Aurinia Pharmaceuticals Inc - Common Shares | Biotechnology | 97 | 16.24 |

| GCAP | 6.72 | 913,302 | GAIN Capital Holdings - Inc. Common Stock | Capital Markets | 96 | 6.34 |

| ARDX | 8.17 | 1,158,700 | Ardelyx - Inc. - Common Stock | Biotechnology | 96 | 7.86 |

| VHC | 7.28 | 1,047,350 | VirnetX Holding Corp Common Stock | Software - Infrastructure | 94 | 7.19 |

| IOTS | 12.22 | 931,384 | Adesto Technologies Corporation - Common Stock | Semiconductors | 91 | 11.99 |

| FIT | 6.96 | 10,655,826 | Fitbit - Inc. Class A Common Stock | Scientific & Technical Instruments | 90 | 6.43 |

| SNAP | 18.46 | 49,118,724 | Snap Inc. Class A Common Stock | Internet Content & Information | 88 | 17.67 |

| FOLD | 12.98 | 5,098,719 | Amicus Therapeutics - Inc. - Common Stock | Biotechnology | 88 | 12.68 |

| These stocks meet our suggested screening factors

for our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 24465.2 |

3.29% | -14.27% | Up |

| NASDAQ | 9324.59 |

3.44% | 3.92% | Up |

| S&P 500 | 2955.45 |

3.2% | -8.52% | Up |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| NASDAQ Composite |

NASDAQ Composite -2.63 |

NASDAQ Composite 9.45 |

NASDAQ Composite 3.92 |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Grocery Stores |

Shell Companies |

| REIT - Healthcare Facilities 34 |

Recreational Vehicles 77 |

Grocery Stores 118 |

Gold 188 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 05/23/2020 NBIcharts, LLC dba BreakoutWatch.com. All

rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All

other marks are the property of their respective owners, and are used

for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.