Breakoutwatch Weekly Summary 10/03/20

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter. This newsletter summarizes the breakout events of the week

and provides additional guidance that does not fit into our daily

format. It is published each weekend.

Newsletter Archive: https://www.breakoutwatch.com/content/newsletters

| Major Indexes Positive for the Week

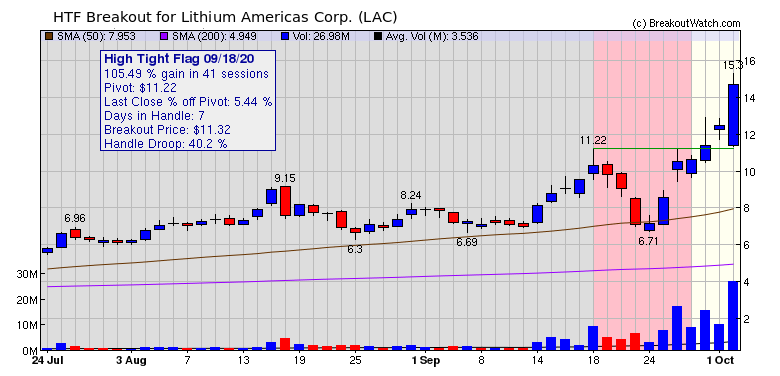

and Breakouts Average 5% Gain The major indexes all moved higher this week and our market trend signals may have turned positive were it not for Friday's declines following news that the President had tested positive for Covid19. Briefing.com summarized the gains as follows: "Prior to Friday, the market

had already established the week's gains, largely on

technically-oriented trading activity in oversold stocks. Early

in the week, cyclical stocks benefited from M&A activity,

better-than-expected economic data ..., analyst upgrades, and

stimulus optimism. "

The number of breakouts this week

surged to 28 with an average gain of 5%. Top performer of the

week was Lithium Americas Corp. (LAC) which broke out from a

High Tight Flag (HTF) formation to gain 31%. Most notable about

this breakout, apart from the huge gain is that the handle fell

40% from its pivot before the breakout. Theoretically this

shouldn't have appeared on or watchlist as our methodology sets

a limit of 20% drop in the handle. There was a bug in the code

which allowed it onto the watchlist. See New Features below for

a further comment.

|

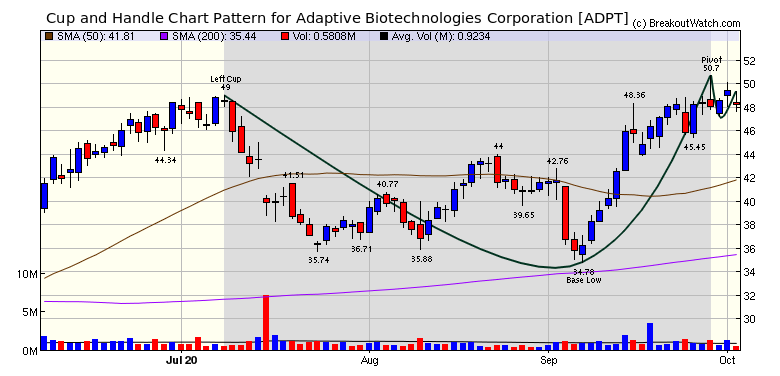

Until Friday's all

round pull back, ADPT was climbing the right side of a short

handle and Thursday's volume was above average indicating

traders are viewing ADPT favorably. Of course, we don't know how

the market will continue to react to the current uncertainty,

but ADPT is one to watch. |

| The breakout of LAC from a deep HTF

handle is the second situation like this that I have seen

lately, Zoom Communications (ZM) was another. Consequently I am

changing the methodology to allow an HTF handle to fall 50% and

still qualify for the watchlist. However, I have added a comment

on the chart for HTF patterns noting the droop % so subscribers

can determine for them selves what amount of decline in the

handle to accept. Another problem with the HTF methodology was that it allowed takeover candidates to appear on the watchlist. To eliminate these I've implemented a minimum handle droop of 5%. |

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 5 | 5.73 |

| SQZ | 20 | 3.5 |

| HTF | 1 | 31.02 |

| HSB | 0 | |

| DB | 2 | 4.91 |

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2020-09-30 | LAC | HTF | n | 11.22 | 11.39 | 98 | 14.7 | 31.02% | 36.36% |

| 2020-09-30 | BGFV | SQZ | y | 6.45 | 7.48 | 98 | 7.86 | 21.86% | 26.67% |

| 2020-09-29 | CDNA | SQZ | y | 34.65 | 36.88 | 86 | 41.78 | 20.58% | 26.55% |

| 2020-10-02 | GDOT | SQZ | y | 52.34 | 59.3 | 91 | 59.3 | 13.3% | 14.37% |

| 2020-09-30 | CDNA | SQZ | y | 36.89 | 37.94 | 87 | 41.78 | 13.26% | 18.87% |

| 2020-10-01 | CULP | SQZ | y | 12.43 | 13.48 | 85 | 13.88 | 11.67% | 14.08% |

| 2020-09-28 | CLDX | CWH | n | 13.43 | 14.98 | 99 | 14.99 | 11.62% | 20.55% |

| 2020-09-30 | EDUC | SQZ | y | 15.51 | 16.77 | 97 | 17.18 | 10.77% | 16.05% |

| 2020-09-29 | DIOD | DB | n | 53.50 | 55.15 | 74 | 57.78 | 8% | 10.84% |

| 2020-10-01 | DECK | CWH | n | 223.24 | 235.6 | 81 | 237.38 | 6.33% | 6.82% |

| 2020-09-30 | THO | SQZ | y | 94.27 | 95.26 | 87 | 99.92 | 5.99% | 8.87% |

| 2020-09-30 | PRSC | SQZ | y | 89.72 | 92.91 | 86 | 94.96 | 5.84% | 7.18% |

| 2020-09-29 | DOOR | SQZ | y | 96.08 | 97.36 | 90 | 101.64 | 5.79% | 6.83% |

| 2020-09-28 | KTCC | CWH | n | 9.27 | 9.58 | 95 | 9.77 | 5.39% | 8.74% |

| 2020-09-29 | FTAI | SQZ | y | 16.54 | 17.06 | 83 | 17.41 | 5.26% | 8.4% |

| 2020-10-02 | APT | SQZ | y | 15.28 | 16.03 | 92 | 16.03 | 4.91% | 9.49% |

| 2020-10-02 | GBX | SQZ | y | 30.25 | 31.35 | 83 | 31.35 | 3.64% | 5.36% |

| 2020-09-30 | LHCG | SQZ | y | 207.71 | 212.56 | 88 | 214.62 | 3.33% | 4.42% |

| 2020-09-29 | APPN | CWH | n | 63.87 | 66.24 | 86 | 65.79 | 3.01% | 5.56% |

| 2020-09-29 | BYND | CWH | n | 162.50 | 165.66 | 88 | 166.24 | 2.3% | 6.26% |

| 2020-10-01 | PRSC | SQZ | y | 92.92 | 94.05 | 87 | 94.96 | 2.2% | 3.49% |

| 2020-10-02 | NGS | SQZ | y | 8.89 | 9.07 | 86 | 9.07 | 2.02% | 2.36% |

| 2020-09-30 | FTAI | SQZ | y | 17.07 | 17.13 | 84 | 17.41 | 1.99% | 5.04% |

| 2020-10-01 | AWK | DB | n | 146.30 | 148.57 | 71 | 148.96 | 1.82% | 2.51% |

| 2020-09-29 | AVNW | SQZ | y | 20.82 | 22.78 | 90 | 21.11 | 1.39% | 12.87% |

| 2020-09-29 | KNDI | SQZ | y | 6.64 | 7.18 | 93 | 6.27 | -5.57% | 11.6% |

| 2020-09-28 | SSSS | SQZ | y | 12.99 | 13 | 95 | 9.21 | -29.1% | 5.35% |

| 2020-09-29 | SSSS | SQZ | y | 13.01 | 13.26 | 94 | 9.21 | -29.21% | 5.19% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| BLNK | 11.55 | 12,171,759 | Blink Charging Co. | Specialty Retail | 99 | 10.86 |

| SURF | 7.75 | 1,281,456 | Surface Oncology - Inc. | Biotechnology | 98 | 6.87 |

| SOGO | 8.90 | 4,852,476 | Sogou Inc. | Internet Content & Information | 96 | 8.89 |

| BE | 18.72 | 7,344,390 | Bloom Energy Corporation Class A | Electrical Equipment & Parts | 94 | 15.97 |

| ALDX | 7.79 | 1,080,870 | Aldeyra Therapeutics - Inc. | Biotechnology | 91 | 6.97 |

| MOBL | 7.06 | 3,074,076 | MobileIron - Inc. | Software - Application | 88 | 7.05 |

| NG | 12.10 | 3,054,144 | Novagold Resources Inc. | Gold | 83 | 11.10 |

| ATEC | 7.28 | 554,631 | Alphatec Holdings - Inc. | Medical Devices | 83 | 6.51 |

| SCPL | 16.98 | 1,276,809 | SciPlay Corporation | Electronic Gaming & Multimedia | 83 | 15.70 |

| These stocks meet our suggested screening factors

for our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 27682.8 |

1.87% | -3% | Down |

| NASDAQ | 11075 |

1.48% | 23.43% | Down |

| S&P 500 | 3348.44 |

1.52% | 3.64% | Down |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| Dow Jones |

NASDAQ Composite 6.15 |

NASDAQ Composite 50.21 |

NASDAQ Composite 23.43 |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Solar |

Silver |

Shell Companies |

| Tobacco 17 |

Coking Coal 74 |

Coking Coal 86 |

Copper 123 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 10/03/2020 NBIcharts, LLC dba BreakoutWatch.com. All

rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All

other marks are the property of their respective owners, and are used

for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.