Breakoutwatch Weekly Summary 12/05/20

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter. This newsletter summarizes the breakout events of the week

and provides additional guidance that does not fit into our daily

format. It is published each weekend.

Newsletter Archive: https://www.breakoutwatch.com/content/newsletters

| 50 Stocks Meet their Breakout

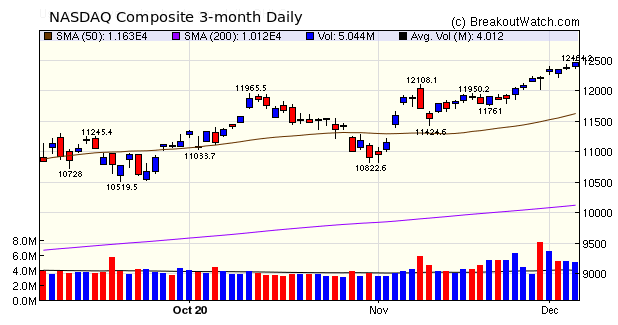

Price + New Predictive Model The three major indexes all set new highs this week with the NASDAQ again leading the way with a 2.1% gain. The market has a momentum all of its own as talk of a modest stimulus package and imminent vaccine delivery provide optimism that 2021 will see a strong recovery. The gains in the indexes was reflected by the record number of stocks that met their breakout price this week (see table below) for an average gain of 2.3%. Of particular note were 5 breakouts from a High Tight Flag pattern with an average gain of 4.8%  |

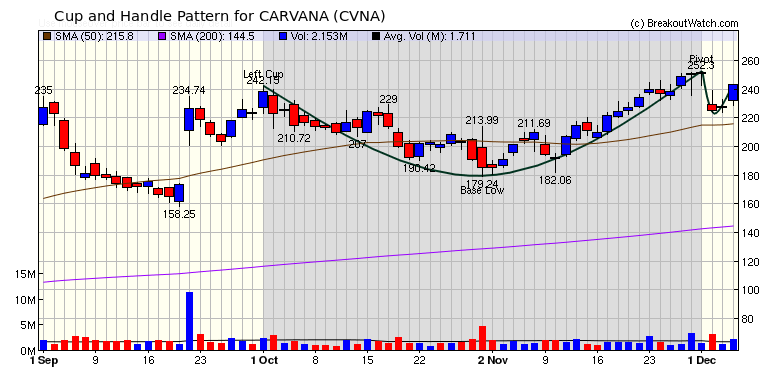

| CARVANA (CVNA) Carvana is heavily advertised on TV currently and is another (relatively) new company operating in the cloud by selling cars on the internet. Profit taking after setting the CWH pivot appears to be over and CVNA is ready to move higher.  |

| New Price Breakout

Model For several weeks since publishing my findings on the minimal importance of the 1.5 times average daily volume requirement for designating a breakout, I have been working on developing a model for predicting those CWH stocks that could meet and exceed their breakout price at the next session. I've reached the point now where the model can predict with 80% reliability which stocks at least close above their breakout price at the next session. The table below shows the model results for 2019-2020 (to date). If a stock on the CWH watchlist met its breakout price on the next day after appearing on the list, it was categorized as a Pass, if then a Fail. The results show that of those stocks that actually gained a Pass, the model predicted 80% of them.

Beginning next week, I'll publish each day the CWH stocks that the model predicts will meet the breakout price on the next trading day. This is the list as of Friday 11/4 for trading on Monday 11/07. The list is in highest probability order, but note that for any stock on the list there is a 20% chance that it will not meet its BoP at the next session. I'll say more about how to use this list in future.

|

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 25 | 1.28 |

| SQZ | 19 | 3.75 |

| HTF | 5 | 4.81 |

| HSB | 0 | |

| DB | 1 | 6.45 |

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2020-12-03 | MIK | CWH | n | 10.46 | 12.33 | 90 | 12.1 | 15.68% | 21.32% |

| 2020-12-03 | ESTC | CWH | n | 124.21 | 135 | 83 | 143.28 | 15.35% | 16% |

| 2020-11-30 | PSTI | SQZ | y | 9.59 | 10.11 | 91 | 10.83 | 12.93% | 13.45% |

| 2020-12-04 | ALTM | HTF | n | 44.00 | 49.66 | 95 | 49.66 | 12.86% | 15.77% |

| 2020-12-01 | CENX | CWH | n | 10.86 | 10.94 | 84 | 12.04 | 10.87% | 11.79% |

| 2020-11-30 | RCUS | CWH | n | 26.57 | 27.23 | 90 | 29.05 | 9.33% | 9.56% |

| 2020-12-01 | PRTK | CWH | n | 6.34 | 6.47 | 87 | 6.92 | 9.15% | 12.07% |

| 2020-12-04 | IDYA | SQZ | y | 14.30 | 15.6 | 88 | 15.6 | 9.09% | 12.94% |

| 2020-12-03 | CRWD | CWH | n | 155.00 | 161.19 | 92 | 167.26 | 7.91% | 8.99% |

| 2020-12-02 | EXAS | SQZ | y | 123.24 | 124.41 | 89 | 132.87 | 7.81% | 10.47% |

| 2020-12-02 | FOCS | SQZ | y | 39.60 | 39.98 | 85 | 42.42 | 7.12% | 11.77% |

| 2020-12-03 | EXAS | SQZ | y | 124.42 | 130.67 | 89 | 132.87 | 6.79% | 9.42% |

| 2020-12-01 | MEDP | DB | n | 129.07 | 131.08 | 79 | 137.39 | 6.45% | 7.46% |

| 2020-12-04 | MGNX | SQZ | y | 22.60 | 24 | 88 | 24 | 6.19% | 7.04% |

| 2020-12-03 | FOCS | SQZ | y | 39.99 | 43.41 | 85 | 42.42 | 6.08% | 10.68% |

| 2020-12-04 | WLL | CWH | n | 24.74 | 25.91 | 99 | 25.91 | 4.73% | 5.46% |

| 2020-12-03 | CULP | CWH | n | 14.97 | 15.25 | 82 | 15.66 | 4.61% | 8.8% |

| 2020-12-04 | LEU | CWH | n | 15.94 | 16.64 | 92 | 16.64 | 4.39% | 11.97% |

| 2020-12-04 | CDNA | HTF | n | 62.50 | 64.91 | 96 | 64.91 | 3.86% | 4.46% |

| 2020-12-04 | ARNC | HTF | n | 29.95 | 30.9 | 75 | 30.9 | 3.17% | 3.94% |

| 2020-12-03 | CPRI | HTF | n | 38.00 | 38.79 | 93 | 39.13 | 2.97% | 5.05% |

| 2020-12-04 | TFFP | SQZ | y | 15.40 | 15.8 | 96 | 15.8 | 2.6% | 3.31% |

| 2020-12-02 | RDHL | SQZ | y | 8.60 | 8.82 | 81 | 8.82 | 2.56% | 3.37% |

| 2020-12-03 | PJT | SQZ | y | 70.21 | 70.62 | 82 | 72 | 2.55% | 3.01% |

| 2020-12-04 | VRNS | SQZ | y | 123.06 | 126.11 | 80 | 126.11 | 2.48% | 2.83% |

| 2020-12-02 | SLM | CWH | n | 11.23 | 11.39 | 81 | 11.5 | 2.4% | 2.89% |

| 2020-12-02 | DB | CWH | n | 11.51 | 11.58 | 80 | 11.77 | 2.26% | 3.91% |

| 2020-12-03 | NWL | CWH | n | 21.60 | 21.77 | 80 | 22.03 | 1.99% | 2.27% |

| 2020-12-04 | PJT | SQZ | y | 70.63 | 72 | 81 | 72 | 1.94% | 2.39% |

| 2020-12-04 | XPER | CWH | n | 19.46 | 19.81 | 80 | 19.81 | 1.8% | 1.85% |

| 2020-12-03 | XLRN | SQZ | y | 116.78 | 118.53 | 87 | 118.85 | 1.77% | 3.29% |

| 2020-12-04 | AVNS | CWH | y | 44.85 | 45.61 | 82 | 45.61 | 1.69% | 2.92% |

| 2020-12-01 | VG | CWH | n | 13.37 | 13.4 | 81 | 13.59 | 1.65% | 6.13% |

| 2020-12-04 | LOVE | CWH | n | 33.48 | 33.99 | 94 | 33.99 | 1.52% | 1.76% |

| 2020-11-30 | LAZY | SQZ | y | 16.04 | 16.5 | 97 | 16.28 | 1.5% | 9.29% |

| 2020-12-04 | BILL | CWH | n | 124.50 | 126.23 | 88 | 126.23 | 1.39% | 4.35% |

| 2020-11-30 | OMI | SQZ | y | 24.92 | 25.76 | 97 | 25.22 | 1.2% | 7.22% |

| 2020-12-04 | MOD | HTF | n | 11.98 | 12.12 | 90 | 12.12 | 1.17% | 3.01% |

| 2020-12-04 | LBRT | CWH | n | 10.98 | 11.08 | 83 | 11.08 | 0.91% | 1.73% |

| 2020-12-04 | BHLB | CWH | n | 18.40 | 18.51 | 80 | 18.51 | 0.6% | 0.6% |

| 2020-12-04 | GE | CWH | n | 10.85 | 10.88 | 80 | 10.88 | 0.28% | 0.74% |

| 2020-12-04 | XLRN | SQZ | y | 118.54 | 118.85 | 87 | 118.85 | 0.26% | 1.76% |

| 2020-12-04 | ALDX | SQZ | y | 7.17 | 7.18 | 85 | 7.18 | 0.14% | 3.35% |

| 2020-12-02 | PFSI | SQZ | y | 58.99 | 60.49 | 86 | 58.67 | -0.54% | 3.31% |

| 2020-11-30 | ACH | CWH | n | 9.28 | 9.82 | 87 | 9.18 | -1.08% | 7.22% |

| 2020-11-30 | CARV | SQZ | y | 7.17 | 7.19 | 96 | 7.08 | -1.26% | 14.37% |

| 2020-11-30 | GMDA | CWH | n | 7.09 | 7.2 | 85 | 6.97 | -1.69% | 1.97% |

| 2020-11-30 | CRON | CWH | n | 8.81 | 8.85 | 84 | 8.63 | -2.04% | 3.86% |

| 2020-11-30 | PROF | CWH | n | 19.48 | 19.94 | 89 | 18.84 | -3.29% | 9.24% |

| 2020-11-30 | OVID | CWH | n | 6.43 | 6.84 | 84 | 2.68 | -58.32% | 8.55% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| GOGO | 11.95 | 4,088,950 | Gogo Inc. | Telecom Services | 94 | 10.12 |

| ATEC | 11.51 | 2,063,580 | Alphatec Holdings - Inc. | Medical Devices | 93 | 11.34 |

| GNMK | 14.45 | 1,379,937 | GenMark Diagnostics - Inc. | Medical Devices | 93 | 14.05 |

| MESO | 17.39 | 842,186 | Mesoblast Limited | Biotechnology | 89 | 16.10 |

| ISEE | 7.05 | 1,089,519 | IVERIC bio - Inc. | Biotechnology | 87 | 6.91 |

| UNFI | 18.45 | 2,132,206 | United Natural Foods - Inc. | Food Distribution | 87 | 18.33 |

| SSSS | 13.24 | 1,160,368 | SuRo Capital Corp. | Asset Management | 86 | 12.13 |

| CRON | 9.15 | 8,938,029 | Cronos Group Inc. | Drug Manufacturers - Specialty & Generic | 84 | 8.63 |

| CDXS | 19.30 | 515,026 | Codexis - Inc. | Biotechnology | 81 | 17.56 |

| These stocks meet our suggested screening factors

for our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 30218.3 |

1.03% | 5.89% | Up |

| NASDAQ | 12464.2 |

2.12% | 38.91% | Up |

| S&P 500 | 3699.12 |

1.67% | 14.5% | Up |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| NASDAQ Composite |

NASDAQ Composite 10.17 |

NASDAQ Composite 27 |

NASDAQ Composite 38.91 |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Solar |

Utilities - Renewable |

Grocery Stores |

| Agricultural Inputs 50 |

Aluminum 88 |

Luxury Goods 119 |

Luxury Goods 125 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 12/05/2020 NBIcharts, LLC dba BreakoutWatch.com. All

rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All

other marks are the property of their respective owners, and are used

for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.