Breakoutwatch Weekly Summary 12/12/20

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter. This newsletter summarizes the breakout events of the week

and provides additional guidance that does not fit into our daily

format. It is published each weekend.

Newsletter Archive: https://www.breakoutwatch.com/content/newsletters

| Cup and Handle Breakouts Average 8%

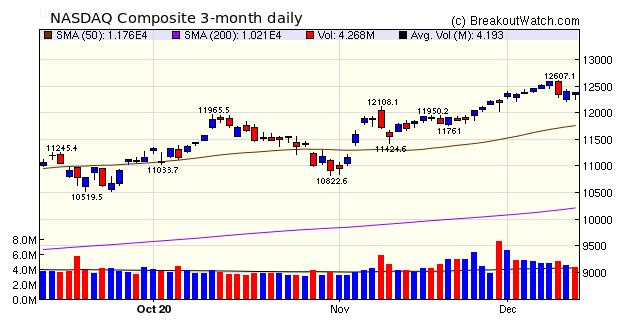

Gain as Major Indexes Stall The three major indexes closed the week with mild losses after setting new highs earlier in the week. Only the Russell 2000 closed higher with a 1% gain. Some of the selling could be attributed to rotation out of existing positions to invest in IPO's such as Airbnb (ABNB) which more than doubled in its IPO, and DoorDash (DASH) which surged 85%. There was also an offering of stock from Tesla (TSLA) which sold $5 billion of common stock. The markets were also disappointed by a continued stalemate over the Covid relief bill.  The cup and handle pattern watchlist again delivered the best return with 8 breakouts averaging an 8% gain. |

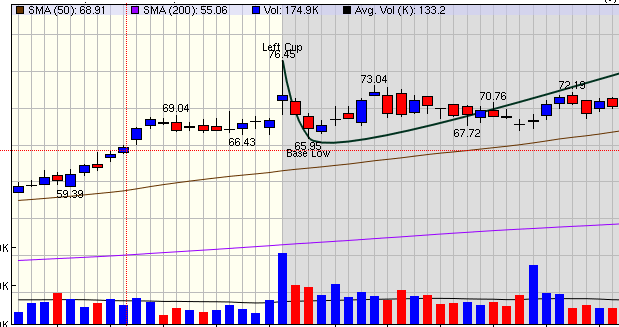

| PJT Partners Inc

(PJT) PJT partners is an investment bank. The chart shows 5 days of above average volumein the last 6 and even at its low point in the handle volume was still equal to the 50 day average.  |

| No new features this week |

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 16 | 8 |

| SQZ | 29 | 2.6 |

| HTF | 3 | -3.44 |

| HSB | 0 | |

| DB | 2 | -2.72 |

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2020-12-07 | GMDA | CWH | n | 7.23 | 10.89 | 87 | 9.92 | 37.21% | 54.91% |

| 2020-12-10 | TGTX | CWH | n | 31.65 | 41.72 | 93 | 42.27 | 33.55% | 40.54% |

| 2020-12-10 | ALPN | CWH | n | 10.97 | 11.07 | 96 | 13 | 18.51% | 32.91% |

| 2020-12-07 | ADPT | SQZ | y | 47.79 | 53.34 | 84 | 56.05 | 17.28% | 19.96% |

| 2020-12-07 | FREQ | CWH | n | 29.66 | 29.87 | 88 | 34.09 | 14.94% | 16.69% |

| 2020-12-08 | SURF | SQZ | y | 8.33 | 8.92 | 95 | 9.47 | 13.69% | 25.08% |

| 2020-12-07 | FOSL | HTF | n | 12.20 | 12.4 | 95 | 13.29 | 8.93% | 10.08% |

| 2020-12-08 | CHWY | CWH | n | 78.50 | 79.15 | 93 | 85.11 | 8.42% | 8.74% |

| 2020-12-07 | VRNS | SQZ | y | 126.12 | 127.73 | 81 | 135.12 | 7.14% | 7.33% |

| 2020-12-08 | VRNS | SQZ | y | 127.74 | 132.75 | 82 | 135.12 | 5.78% | 5.97% |

| 2020-12-07 | NVTA | CWH | y | 53.57 | 54.19 | 96 | 56.6 | 5.66% | 11.52% |

| 2020-12-07 | PJT | SQZ | y | 72.01 | 74.24 | 82 | 75.99 | 5.53% | 6.92% |

| 2020-12-07 | XLRN | SQZ | y | 118.86 | 119.4 | 86 | 124.28 | 4.56% | 5.49% |

| 2020-12-08 | CORT | CWH | n | 24.22 | 24.32 | 87 | 25.32 | 4.54% | 5% |

| 2020-12-08 | QDEL | SQZ | y | 193.93 | 195.37 | 91 | 202.56 | 4.45% | 5.18% |

| 2020-12-10 | CSSE | CWH | n | 17.50 | 18.6 | 90 | 18.25 | 4.29% | 9.89% |

| 2020-12-08 | XLRN | SQZ | y | 119.41 | 121.36 | 86 | 124.28 | 4.08% | 5% |

| 2020-12-11 | TBIO | CWH | n | 24.24 | 25.09 | 93 | 25.09 | 3.51% | 5.9% |

| 2020-12-11 | LPSN | SQZ | y | 56.04 | 57.99 | 86 | 57.99 | 3.48% | 3.53% |

| 2020-12-08 | INMB | SQZ | y | 8.93 | 8.98 | 86 | 9.23 | 3.36% | 6.38% |

| 2020-12-10 | AVYA | CWH | n | 20.32 | 20.59 | 86 | 20.95 | 3.1% | 3.59% |

| 2020-12-10 | SGEN | DB | n | 185.80 | 186.55 | 79 | 191.175 | 2.89% | 3.36% |

| 2020-12-08 | VCRA | SQZ | y | 34.84 | 35.51 | 82 | 35.84 | 2.87% | 5.17% |

| 2020-12-11 | QDEL | SQZ | y | 197.10 | 202.56 | 90 | 202.56 | 2.77% | 3.49% |

| 2020-12-11 | HZNP | SQZ | y | 73.56 | 75.57 | 87 | 75.57 | 2.73% | 3% |

| 2020-12-10 | TWLO | CWH | n | 333.62 | 334.51 | 94 | 342.41 | 2.63% | 3.71% |

| 2020-12-09 | XLRN | SQZ | y | 121.37 | 121.48 | 86 | 124.28 | 2.4% | 3.3% |

| 2020-12-08 | PJT | SQZ | y | 74.25 | 74.62 | 84 | 75.99 | 2.34% | 3.69% |

| 2020-12-10 | OCN | SQZ | y | 26.06 | 26.37 | 99 | 26.55 | 1.88% | 4.22% |

| 2020-12-08 | GDOT | SQZ | y | 55.74 | 56.81 | 86 | 56.18 | 0.79% | 5.85% |

| 2020-12-11 | EDUC | SQZ | y | 16.02 | 16.14 | 93 | 16.14 | 0.75% | 0.75% |

| 2020-12-07 | ATEC | CWH | y | 11.51 | 11.89 | 93 | 11.59 | 0.7% | 6.86% |

| 2020-12-11 | ARGX | CWH | n | 292.58 | 294.51 | 84 | 294.51 | 0.66% | 1.63% |

| 2020-12-11 | OCN | SQZ | y | 26.38 | 26.55 | 99 | 26.55 | 0.64% | 1.06% |

| 2020-12-08 | OSUR | SQZ | y | 12.76 | 13.5 | 85 | 12.84 | 0.63% | 6.82% |

| 2020-12-08 | EDUC | SQZ | y | 16.04 | 16.06 | 94 | 16.14 | 0.62% | 4.99% |

| 2020-12-09 | AAWW | SQZ | y | 54.97 | 55.76 | 87 | 55.23 | 0.47% | 3.17% |

| 2020-12-10 | NUS | SQZ | y | 51.75 | 52.68 | 80 | 51.73 | -0.04% | 2.42% |

| 2020-12-08 | WTRE | SQZ | y | 34.68 | 34.7 | 91 | 34.65 | -0.09% | 0.17% |

| 2020-12-09 | PACK | CWH | y | 12.07 | 12.1 | 85 | 11.98 | -0.75% | 3.56% |

| 2020-12-08 | NLTX | SQZ | y | 12.51 | 12.7 | 85 | 12.39 | -0.96% | 5.6% |

| 2020-12-10 | AAWW | SQZ | y | 55.77 | 56.06 | 88 | 55.23 | -0.97% | 0.77% |

| 2020-12-10 | STMP | SQZ | y | 201.48 | 203.02 | 80 | 196.61 | -2.42% | 2% |

| 2020-12-09 | ASTE | CWH | n | 62.78 | 63.33 | 81 | 60.91 | -2.98% | 1.86% |

| 2020-12-07 | NVDA | SQZ | y | 542.34 | 544.27 | 89 | 520.53 | -4.02% | 1.27% |

| 2020-12-08 | CSIQ | SQZ | y | 39.72 | 39.96 | 91 | 37.95 | -4.46% | 2.22% |

| 2020-12-09 | GEF | CWH | n | 51.27 | 51.76 | 80 | 48.17 | -6.05% | 2.11% |

| 2020-12-07 | AOSL | HTF | n | 26.66 | 28.36 | 94 | 24.9 | -6.6% | 9.53% |

| 2020-12-07 | SWKS | DB | n | 151.89 | 153.42 | 73 | 139.24 | -8.33% | 2.71% |

| 2020-12-08 | AXTI | HTF | n | 10.44 | 10.82 | 96 | 9.12 | -12.64% | 11.59% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| MESO | 17.39 | 795,962 | Mesoblast Limited | Biotechnology | 91 | 16.96 |

| ENLV | 13.77 | 995,169 | Enlivex Therapeutics Ltd. | Biotechnology | 90 | 10.15 |

| GNMK | 14.61 | 1,385,517 | GenMark Diagnostics - Inc. | Medical Devices | 87 | 12.96 |

| WPX | 8.62 | 12,458,968 | WPX Energy - Inc. | Oil & Gas E&P | 86 | 8.32 |

| SSSS | 13.24 | 847,419 | SuRo Capital Corp. | Asset Management | 85 | 12.65 |

| GE | 11.49 | 165,203,788 | General Electric Company | Specialty Industrial Machinery | 84 | 11.16 |

| CDXS | 19.30 | 531,339 | Codexis - Inc. | Biotechnology | 83 | 17.55 |

| TAST | 7.48 | 662,373 | Carrols Restaurant Group - Inc. | Restaurants | 83 | 6.83 |

| INFY | 16.09 | 14,426,948 | Infosys Limited American | Information Technology Services | 83 | 15.74 |

| XPER | 19.91 | 1,237,210 | Xperi Holding Corporation | Semiconductor Equipment & Materials | 81 | 19.53 |

| These stocks meet our suggested screening factors

for our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 30046.4 |

-0.57% | 5.28% | Up |

| NASDAQ | 12377.9 |

-0.69% | 37.95% | Up |

| S&P 500 | 3663.46 |

-0.96% | 13.39% | Up |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| Dow Jones |

NASDAQ Composite 14.05 |

NASDAQ Composite 29.09 |

NASDAQ Composite 37.95 |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Aluminum |

Home Improvement Retail |

Silver |

| Uranium 68 |

Uranium 83 |

Textile Manufacturing 118 |

Textile Manufacturing 129 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 12/12/2020 NBIcharts, LLC dba BreakoutWatch.com. All

rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All

other marks are the property of their respective owners, and are used

for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.