Breakoutwatch Weekly Summary 01/30/21

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter. This newsletter summarizes the breakout events of the week

and provides additional guidance that does not fit into our daily

format. It is published each weekend.

Newsletter Archive: https://www.breakoutwatch.com/content/newsletters

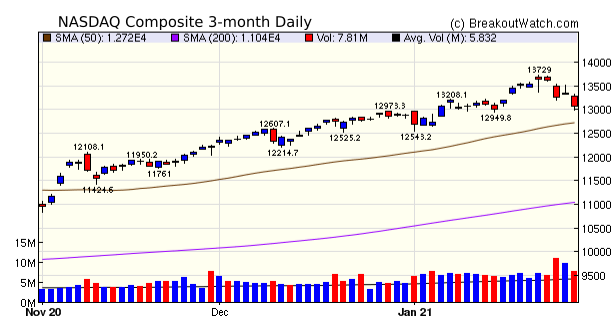

| Market Turmoil Hurts Investors

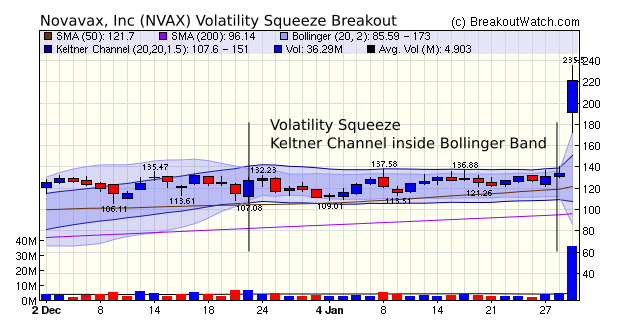

Despite Positive Earnings Reports Although the NASDAQ again set a new high on Monday, the squeeze on short sellers and market disruption by brokers caused the index to lose 3.5%. The market mood was not helped by the likely delay of the stimulus passage for some weeks. The fixation on the turmoil caused the market to overlook better than expected earnings reports from Apple (AAPL), Microsoft (MSFT), Facebook (FB), and Tesla (TSLA). There was also promising macro-economic news in that the economy improved at an annual rate of 4% in the 4th quarter. Hopefully, the volatility will diminish next week and the markets will resume the upward trend.  Volatility Squeeze stocks fared

best this week with 6 of 19 breakouts gaining more than 10%. The

outstanding performer was Novavax (NVAX) which gained 74% on

Friday after a long squeeze while investors waited for the

results of its vaccine trials. Their patience was rewarded when

Novavax said its vaccine candidate produced an 89.3% efficacy

rate in its Phase 3 trial in the UK. Watchers of this stock

could have been alerted a breakout was coming if they had

noticed the increase in volume on Wednesday and Thursday.

|

After looking over the Cup and Handle and Volatility Squeeze watchlists as of Friday's close, I don't see anything that I could suggest in this category this week. |

| No new features this week |

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 9 | 1.5 |

| SQZ | 19 | 10.37 |

| HTF | 5 | -4.98 |

| HSB | 0 | |

| DB | 0 |

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2021-01-25 | NVAX | SQZ | y | 126.99 | 131.46 | 98 | 220.94 | 73.98% | 85.45% |

| 2021-01-28 | NVAX | SQZ | y | 131.19 | 134.01 | 98 | 220.94 | 68.41% | 79.51% |

| 2021-01-25 | CLDX | SQZ | y | 17.81 | 18.82 | 97 | 21.62 | 21.39% | 24.82% |

| 2021-01-26 | RVP | SQZ | y | 13.59 | 15.69 | 96 | 16.09 | 18.4% | 28.7% |

| 2021-01-27 | SRNE | CWH | n | 10.78 | 15.23 | 90 | 12.66 | 17.44% | 57.88% |

| 2021-01-29 | ONCS | SQZ | y | 6.85 | 7.71 | 94 | 7.71 | 12.55% | 14.16% |

| 2021-01-27 | CLGN | HTF | n | 16.32 | 17 | 82 | 18.22 | 11.64% | 13.82% |

| 2021-01-27 | BIG | CWH | n | 54.59 | 65.05 | 80 | 59.68 | 9.32% | 22.73% |

| 2021-01-27 | FREQ | SQZ | y | 37.17 | 38.47 | 84 | 38.99 | 4.9% | 17.03% |

| 2021-01-28 | SRT | CWH | n | 8.36 | 8.54 | 81 | 8.74 | 4.55% | 6.7% |

| 2021-01-26 | HIMX | HTF | n | 9.07 | 9.76 | 93 | 9.48 | 4.52% | 13.34% |

| 2021-01-27 | AZUL | SQZ | y | 21.01 | 21.75 | 80 | 21.95 | 4.47% | 12.47% |

| 2021-01-29 | BNTX | CWH | n | 112.83 | 116.94 | 88 | 116.94 | 3.64% | 4.73% |

| 2021-01-29 | AHCO | SQZ | y | 37.26 | 38.27 | 88 | 38.27 | 2.71% | 4.05% |

| 2021-01-29 | AMRK | SQZ | y | 27.99 | 28.58 | 86 | 28.58 | 2.11% | 4.04% |

| 2021-01-26 | RBBN | SQZ | y | 7.20 | 7.31 | 89 | 7.31 | 1.53% | 9.44% |

| 2021-01-28 | FREQ | SQZ | y | 38.48 | 40.5 | 88 | 38.99 | 1.33% | 12.76% |

| 2021-01-25 | KODK | SQZ | y | 9.47 | 9.55 | 95 | 9.59 | 1.27% | 47.73% |

| 2021-01-29 | MGI | CWH | n | 7.59 | 7.67 | 94 | 7.67 | 1.05% | 14.62% |

| 2021-01-28 | AZUL | SQZ | y | 21.76 | 22.77 | 83 | 21.95 | 0.87% | 8.59% |

| 2021-01-29 | FTCH | SQZ | y | 60.73 | 61.24 | 96 | 61.24 | 0.84% | 1.37% |

| 2021-01-26 | QRTEA | CWH | n | 12.51 | 13.02 | 90 | 12.6 | 0.72% | 9.99% |

| 2021-01-28 | MEC | SQZ | y | 13.96 | 14.13 | 87 | 14 | 0.29% | 2.72% |

| 2021-01-25 | NSCO | SQZ | y | 7.67 | 7.81 | 89 | 7.62 | -0.65% | 10.95% |

| 2021-01-25 | SSSS | CWH | n | 14.79 | 14.96 | 88 | 14.67 | -0.81% | 7.37% |

| 2021-01-26 | FCEL | HTF | n | 20.94 | 21.64 | 99 | 20.76 | -0.86% | 19.39% |

| 2021-01-25 | MN | SQZ | y | 6.27 | 6.31 | 90 | 6.12 | -2.39% | 1.91% |

| 2021-01-25 | INSE | SQZ | y | 6.56 | 6.61 | 85 | 6.09 | -7.16% | 3.35% |

| 2021-01-25 | JD | CWH | n | 96.20 | 98.38 | 81 | 88.69 | -7.81% | 5.7% |

| 2021-01-27 | NSCO | SQZ | y | 8.27 | 8.29 | 91 | 7.62 | -7.86% | 2.9% |

| 2021-01-25 | LTBR | HTF | n | 7.08 | 8.41 | 90 | 6.35 | -10.31% | 31.5% |

| 2021-01-26 | WWR | CWH | n | 7.47 | 8.15 | 95 | 6.38 | -14.59% | 22.49% |

| 2021-01-28 | WBAI | HTF | n | 14.90 | 15.1 | 97 | 10.45 | -29.87% | 4.03% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| WYY | 14.99 | 773,314 | WidePoint Corporation | Information Technology Services | 99 | 12.60 |

| CYH | 11.45 | 3,370,640 | Community Health Systems - Inc. | Medical Care Facilities | 90 | 9.32 |

| CRMD | 9.21 | 686,668 | CorMedix Inc. | Biotechnology | 85 | 8.75 |

| ACB | 13.32 | 47,850,532 | Aurora Cannabis Inc. | Drug Manufacturers - Specialty & Generic | 83 | 11.15 |

| QFIN | 18.38 | 1,732,092 | 360 DigiTech - Inc. | Credit Services | 83 | 17.40 |

| SSL | 11.61 | 1,528,216 | Sasol Ltd. American Depos | Oil & Gas Integrated | 83 | 10.44 |

| SQNS | 8.39 | 1,034,343 | Sequans Communications S. | Semiconductors | 82 | 7.90 |

| These stocks meet our suggested screening factors

for our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 29982.6 |

-3.27% | -2.04% | Up |

| NASDAQ | 13070.7 |

-3.49% | 1.42% | Up |

| S&P 500 | 3714.24 |

-3.31% | -1.11% | Up |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| Dow Jones |

NASDAQ Composite 19.79 |

NASDAQ Composite 21.64 |

NASDAQ Composite 1.42 |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Solar |

Uranium |

Silver |

| Trucking 31 |

Electrical Equipment & Parts 64 |

Department Stores 130 |

Department Stores 133 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 01/30/2021 NBIcharts, LLC dba BreakoutWatch.com. All

rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All

other marks are the property of their respective owners, and are used

for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.