Breakoutwatch Weekly Summary 02/06/21

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter. This newsletter summarizes the breakout events of the week

and provides additional guidance that does not fit into our daily

format. It is published each weekend.

Newsletter Archive: https://www.breakoutwatch.com/content/newsletters

| Breakouts gain 7.8% on Average;

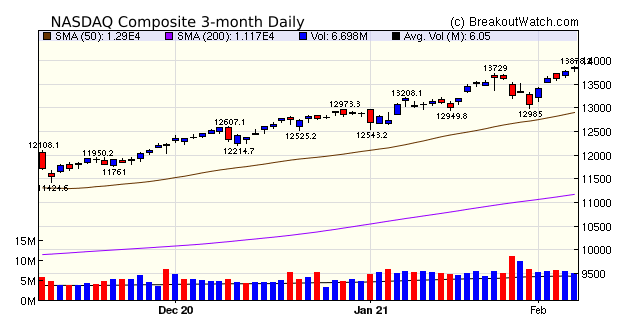

Stocks Likely to Breakout Tutorial Traders bought last week's dip and the markets again set new highs. The NASDAQ closed higher in each session delivering a 6% gain for the week. It is clear now that the Biden Covid rescue and stimulus plan will be passed using 'reconciliation', which will ensure that the majority of the 1.9T package will pass and the bull market will continue, barring any external shocks. Fourth quarter earnings were strong, exceeding analysts estimates in aggregate by 15%, so with further stimulus, and vaccination allowing economic activity to improve, the markets are expecting earnings strength to continue.  Cup and Handle breakouts (10)

averaged an 8.8% gain and Volatility Squeeze breakouts (58) did

almost as well with an average 0f 7% gain. There were a

surprising number of HTF breakouts (7) with a stellar 14%

average gain. Readers of How to Make Money in Stocks will recall

that this pattern is considered rare, but capable of giving

strong gains.

|

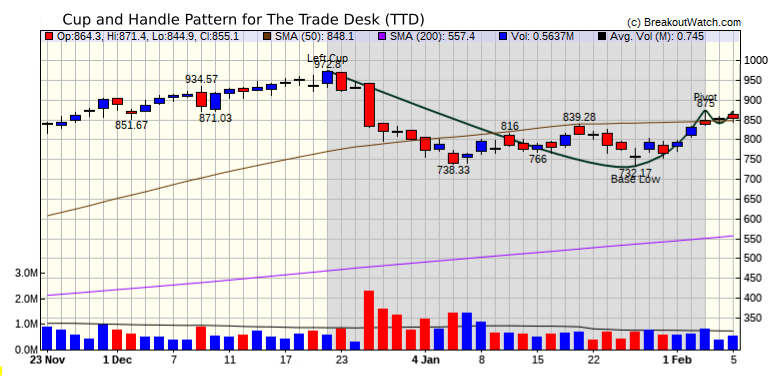

The Trade Desk

(TTD) is on our list of stocks most likely to breakout out on

Monday. I like it because it has 9% to improve before hitting

resistance at the left cup level, although I would prefer a

longer, deeper handle and above average volume in Friday's

trading. Read how I would play this, and other stocks on our

"Likely to Close above BoP at Next Session" list below. |

| No new features this week |

|

Our latest strategy

suggestions are here.

How to Trade Stocks "Likely to

Close above BoP at Next Session"

Here is the list for Friday 2/05

for trading on 2/07

Every day we use our price model

to select stocks likely to close above their breakout price at

the next session. See our 12/19/20

newsletter for a brief tutorial. I don't monitor the

market in real time waiting for alerts, so here's how I play

stocks on the list.

1. Go to the

Daily Report on the website

https://www.breakoutwatch.com/content/daily-reports

2. Click

through the symbols to see the cup and handle pattern for each

stock

3. Pick one or

more stocks on the list to trade at the next session

4. Place a

market stop order at the breakout price. If the price rises to

the breakout price, the stock will be bought and if not you

are not out of pocket.

5. If you

bought the stock, but it closes below BoP, sell at the next

open.

6. If the

stock closes above BoP, set a trailing stop using the Trailing

Stop Calculator and adjust it each day.

|

||||||||||||||||||||||||||||||||||||||||||

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 10 | 8.84 |

| SQZ | 58 | 7.03 |

| HTF | 7 | 13.78 |

| HSB | 0 | |

| DB | 2 | 5.39 |

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2021-02-01 | AVNW | CWH | n | 39.50 | 41.97 | 93 | 54.75 | 38.61% | 46.81% |

| 2021-02-02 | PERI | SQZ | y | 15.08 | 15.23 | 93 | 20.43 | 35.48% | 36.67% |

| 2021-02-03 | PERI | SQZ | y | 15.24 | 15.55 | 93 | 20.43 | 34.06% | 35.24% |

| 2021-02-04 | PERI | SQZ | y | 15.56 | 16.74 | 92 | 20.43 | 31.3% | 32.46% |

| 2021-02-03 | PLSE | HTF | n | 35.99 | 36.62 | 95 | 44.15 | 22.67% | 23.34% |

| 2021-02-05 | PERI | SQZ | y | 16.75 | 20.43 | 93 | 20.43 | 21.97% | 23.04% |

| 2021-02-01 | FVE | SQZ | y | 7.24 | 7.73 | 84 | 8.66 | 19.61% | 20.17% |

| 2021-02-02 | APHA | HTF | n | 14.01 | 14.74 | 95 | 16.67 | 18.99% | 24.88% |

| 2021-02-04 | VJET | HTF | n | 18.90 | 19.3 | 93 | 22.43 | 18.68% | 21.16% |

| 2021-02-02 | IDT | CWH | n | 14.90 | 15.28 | 88 | 17.62 | 18.26% | 21.99% |

| 2021-02-03 | REKR | HTF | n | 13.70 | 14.77 | 95 | 16.04 | 17.08% | 25.33% |

| 2021-02-01 | FPRX | SQZ | y | 16.73 | 16.75 | 97 | 19.41 | 16.02% | 16.86% |

| 2021-02-02 | FPRX | SQZ | y | 16.76 | 17.77 | 97 | 19.41 | 15.81% | 16.65% |

| 2021-02-03 | SSL | CWH | n | 11.61 | 12.93 | 83 | 13.39 | 15.33% | 15.76% |

| 2021-02-04 | DMTK | HTF | n | 47.13 | 49.24 | 96 | 54.17 | 14.94% | 18.25% |

| 2021-02-04 | PRTK | SQZ | y | 6.96 | 7.57 | 81 | 7.86 | 12.93% | 15.42% |

| 2021-02-02 | FREQ | SQZ | y | 44.72 | 47.46 | 91 | 50.46 | 12.84% | 13.8% |

| 2021-02-04 | FAT | SQZ | y | 7.46 | 7.82 | 83 | 8.35 | 11.93% | 15.73% |

| 2021-02-02 | FVE | SQZ | y | 7.74 | 7.83 | 85 | 8.66 | 11.89% | 12.4% |

| 2021-02-02 | RARE | SQZ | y | 145.64 | 153.15 | 88 | 162.22 | 11.38% | 12.01% |

| 2021-02-02 | BL | SQZ | y | 133.73 | 138.79 | 83 | 148.51 | 11.05% | 11.16% |

| 2021-02-03 | DLTH | SQZ | y | 13.22 | 14.05 | 81 | 14.63 | 10.67% | 12.44% |

| 2021-02-02 | RYAM | SQZ | y | 7.44 | 7.98 | 95 | 8.2 | 10.22% | 20.3% |

| 2021-02-04 | VERU | SQZ | y | 9.90 | 14.28 | 96 | 10.895 | 10.05% | 47.37% |

| 2021-02-04 | AEYE | DB | y | 26.98 | 29.65 | 93 | 29.6 | 9.71% | 13.23% |

| 2021-02-02 | ATLC | SQZ | y | 27.29 | 28.5 | 92 | 29.88 | 9.49% | 10.3% |

| 2021-02-03 | SOLO | SQZ | y | 8.02 | 8.13 | 97 | 8.69 | 8.35% | 21.45% |

| 2021-02-01 | QFIN | CWH | n | 18.38 | 18.51 | 83 | 19.91 | 8.32% | 10.99% |

| 2021-02-04 | BL | SQZ | y | 137.26 | 142.89 | 83 | 148.51 | 8.2% | 8.3% |

| 2021-02-03 | JOE | SQZ | y | 49.51 | 50.32 | 91 | 53.41 | 7.88% | 8.02% |

| 2021-02-05 | ARWR | SQZ | y | 83.93 | 90.47 | 83 | 90.47 | 7.79% | 9.25% |

| 2021-02-04 | SOLO | SQZ | y | 8.14 | 9.48 | 97 | 8.69 | 6.76% | 19.66% |

| 2021-02-04 | HZN | SQZ | y | 9.34 | 9.57 | 93 | 9.96 | 6.64% | 7.39% |

| 2021-02-04 | CLDX | CWH | n | 22.43 | 23.09 | 98 | 23.8 | 6.11% | 13.95% |

| 2021-02-05 | FVE | CWH | y | 8.17 | 8.66 | 86 | 8.66 | 6% | 6.49% |

| 2021-02-02 | ALTM | SQZ | y | 51.67 | 51.74 | 97 | 54.76 | 5.98% | 7.41% |

| 2021-02-03 | FTCH | SQZ | y | 62.94 | 67 | 96 | 66.51 | 5.67% | 10.35% |

| 2021-02-04 | EVRI | SQZ | y | 14.42 | 14.83 | 87 | 15.21 | 5.48% | 6.66% |

| 2021-02-02 | AZUL | SQZ | y | 22.89 | 23.5 | 85 | 24.14 | 5.46% | 6.86% |

| 2021-02-04 | MCRB | SQZ | y | 25.76 | 26.34 | 97 | 27.04 | 4.97% | 7.73% |

| 2021-02-03 | ATLC | SQZ | y | 28.51 | 29.53 | 92 | 29.88 | 4.81% | 5.58% |

| 2021-02-05 | AIRT | SQZ | y | 22.61 | 23.61 | 84 | 23.61 | 4.42% | 6.02% |

| 2021-02-02 | VLRS | SQZ | y | 12.07 | 12.18 | 83 | 12.6 | 4.39% | 5.97% |

| 2021-02-05 | LPI | HTF | n | 28.66 | 29.9 | 88 | 29.9 | 4.33% | 5.37% |

| 2021-02-04 | ALLK | SQZ | y | 138.29 | 141.6 | 83 | 144.14 | 4.23% | 4.23% |

| 2021-02-04 | DLTH | SQZ | y | 14.06 | 14.1 | 84 | 14.63 | 4.05% | 5.73% |

| 2021-02-05 | HZN | SQZ | y | 9.58 | 9.96 | 94 | 9.96 | 3.97% | 4.7% |

| 2021-02-03 | MN | SQZ | y | 6.29 | 6.45 | 88 | 6.51 | 3.5% | 5.72% |

| 2021-02-02 | SAIL | SQZ | y | 57.21 | 58.99 | 88 | 59.13 | 3.36% | 6.61% |

| 2021-02-04 | MESA | SQZ | y | 6.93 | 7.21 | 83 | 7.13 | 2.89% | 6.2% |

| 2021-02-05 | MCRB | SQZ | y | 26.35 | 27.04 | 97 | 27.04 | 2.62% | 5.31% |

| 2021-02-04 | VLRS | SQZ | y | 12.28 | 12.5 | 83 | 12.6 | 2.61% | 4.15% |

| 2021-02-01 | WORK | SQZ | y | 42.18 | 42.51 | 83 | 43.24 | 2.51% | 2.73% |

| 2021-02-05 | NSYS | SQZ | y | 8.09 | 8.27 | 85 | 8.27 | 2.22% | 3.08% |

| 2021-02-05 | RHP | SQZ | y | 69.01 | 70.38 | 80 | 70.38 | 1.99% | 2.95% |

| 2021-02-05 | ALLK | SQZ | y | 141.61 | 144.14 | 83 | 144.14 | 1.79% | 1.79% |

| 2021-02-02 | WORK | SQZ | y | 42.52 | 42.73 | 82 | 43.24 | 1.69% | 1.9% |

| 2021-02-03 | MGNX | SQZ | y | 22.51 | 23.13 | 84 | 22.86 | 1.55% | 6.18% |

| 2021-02-05 | NBR | CWH | n | 77.21 | 78.12 | 93 | 78.12 | 1.18% | 2.32% |

| 2021-02-03 | WORK | SQZ | y | 42.74 | 43.04 | 82 | 43.24 | 1.17% | 1.38% |

| 2021-02-02 | HCAP | SQZ | y | 7.83 | 7.91 | 88 | 7.92 | 1.15% | 2.17% |

| 2021-02-05 | XOMA | SQZ | y | 43.34 | 43.83 | 85 | 43.83 | 1.13% | 1.45% |

| 2021-02-04 | VER | DB | y | 36.89 | 37.16 | 98 | 37.28 | 1.06% | 1.57% |

| 2021-02-04 | MN | SQZ | y | 6.46 | 6.48 | 90 | 6.51 | 0.77% | 2.94% |

| 2021-02-05 | VLRS | SQZ | y | 12.51 | 12.6 | 83 | 12.6 | 0.72% | 1.28% |

| 2021-02-04 | PK | SQZ | y | 18.08 | 18.11 | 82 | 18.15 | 0.39% | 3.54% |

| 2021-02-05 | VER | SQZ | y | 37.17 | 37.28 | 98 | 37.28 | 0.3% | 0.81% |

| 2021-02-05 | PK | SQZ | y | 18.12 | 18.15 | 81 | 18.15 | 0.17% | 2.98% |

| 2021-02-04 | HCAP | CWH | n | 7.92 | 7.93 | 89 | 7.92 | 0% | 1.01% |

| 2021-02-03 | AI | SQZ | y | 146.89 | 147.05 | 99 | 146.6 | -0.2% | 7.75% |

| 2021-02-03 | HEXO | HTF | n | 7.82 | 7.93 | 94 | 7.8 | -0.26% | 4.48% |

| 2021-02-04 | AI | SQZ | y | 147.06 | 154.37 | 99 | 146.6 | -0.31% | 7.62% |

| 2021-02-04 | FTCH | SQZ | y | 67.01 | 67.13 | 96 | 66.51 | -0.75% | 3.64% |

| 2021-02-01 | NLS | CWH | n | 25.18 | 26.58 | 96 | 24.79 | -1.55% | 9.41% |

| 2021-02-04 | CPA | SQZ | y | 81.94 | 82.93 | 80 | 79.7 | -2.73% | 4.47% |

| 2021-02-03 | ACB | CWH | n | 13.32 | 13.75 | 83 | 12.8 | -3.9% | 6.23% |

| 2021-02-01 | AHCO | SQZ | y | 38.28 | 40.15 | 90 | 35.74 | -6.64% | 8.62% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| WYY | 14.99 | 778,110 | WidePoint Corporation | Information Technology Services | 99 | 13.10 |

| CYH | 11.45 | 3,093,798 | Community Health Systems - Inc. | Medical Care Facilities | 83 | 9.22 |

| These stocks meet our suggested screening factors

for our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 31148.2 |

3.89% | 1.77% | Up |

| NASDAQ | 13856.3 |

6.01% | 7.51% | Up |

| S&P 500 | 3886.83 |

4.65% | 3.48% | Up |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| NASDAQ Composite |

NASDAQ Composite 16.49 |

NASDAQ Composite 25.84 |

NASDAQ Composite 7.51 |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Luxury Goods |

Uranium |

Silver |

| Silver 50 |

Internet Retail 46 |

Department Stores 130 |

Department Stores 136 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 02/06/2021 NBIcharts, LLC dba BreakoutWatch.com. All

rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All

other marks are the property of their respective owners, and are used

for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.