Breakoutwatch Weekly Summary 05/22/21

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter. This newsletter summarizes the breakout events of the week

and provides additional guidance that does not fit into our daily

format. It is published each weekend.

Newsletter Archive: https://www.breakoutwatch.com/content/newsletters

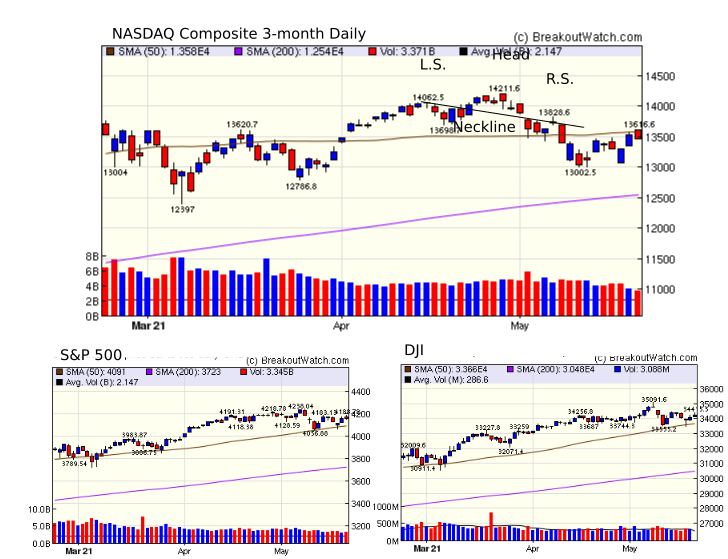

| NASDAQ Recovering from Bearish Head

and Shoulders Top Pattern. Trend Indicators are Negative The NASDAQ gained 0.3% this week while the S&P 500 dipped 0.4% and the DJI lost 0.5%. The NASDAQ Chart shows the index is recovering from a bearish Head and Shoulders Top pattern as traders buy beaten down tech stocks. On Friday, the index looked to continue its 3rd day of gains but failed to overcome resistance at the 50 day average level and faded for a loss of 0.5% for the day. Subscribers should be aware that our trend indicators for the three major indexes have been negative since May 10. I've added the S&P 500 and DJI charts to show that these indexes are moving sideways with a slight downward bias. In other words, there are no signs that the trends are likely to turn positive in the near future.  Inevitably, in a downward trending market, gains from breakouts will be marginal and we see this reflected in the average breakout gains this week. |

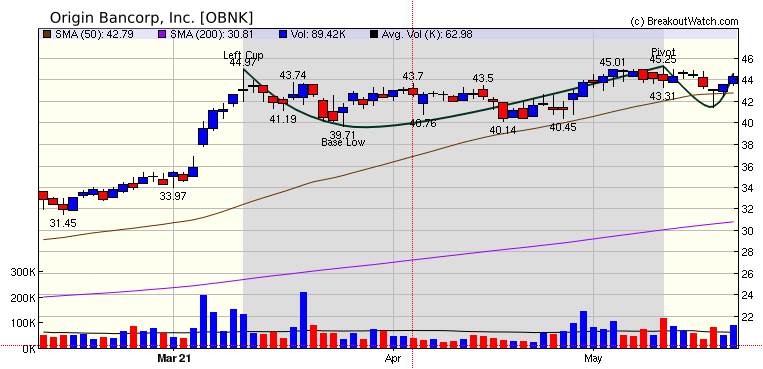

Bank stocks

are heavily represented in our list of stocks likely to close

above BoP at the next session. OBNK is in a cup and handle chart

pattern and appears to offer the best potential as volume has

risen sine the stock started to move up from the base in the

handle. It will need a 2% pop to reach the pivot so its breakout

may be delayed past Monday. |

| No new features this week |

| Symbol | Company | Industry | RS Rank | Last Close | BoP | % off BoP |

|---|---|---|---|---|---|---|

| CNOB | ConnectOne Bancorp, Inc. | Banks - Regional | 89 | 28.07 | 28.43 | 98.73 |

| OBNK | Origin Bancorp, Inc. | Banks - Regional | 92 | 44.31 | 45.25 | 97.92 |

| HSKA | Heska Corporation | Diagnostics & Research | 90 | 204.26 | 208.70 | 97.87 |

| MBIN | Merchants Bancorp | Banks - Regional | 93 | 43.92 | 45.67 | 96.17 |

| BWB | Bridgewater Bancshares, Inc. | Banks - Regional | 87 | 17.84 | 17.96 | 99.33 |

| UMBF | UMB Financial Corporation | Banks - Regional | 88 | 98.42 | 99.98 | 98.44 |

| CIVB | Civista Bancshares, Inc. | Banks - Regional | 84 | 23.69 | 23.97 | 98.83 |

| FCBC | First Community Bankshares, Inc. | Banks - Regional | 83 | 31.43 | 32.00 | 98.22 |

| PPBI | Pacific Premier Bancorp Inc | Banks - Regional | 91 | 45.8 | 47.43 | 96.56 |

| PNFP | Pinnacle Financial Partners, Inc. | Banks - Regional | 92 | 91.58 | 93.53 | 97.92 |

| TOWN | Towne Bank | Banks - Regional | 86 | 32.62 | 33.25 | 98.11 |

| GOGO | Gogo Inc. | Telecom Services | 97 | 12 | 12.51 | 95.92 |

| WASH | Washington Trust Bancorp, Inc. | Banks - Regional | 82 | 53.63 | 53.97 | 99.37 |

| BMTC | Bryn Mawr Bank Corporation | Banks - Regional | 88 | 47.62 | 48.32 | 98.55 |

| AUB | Atlantic Union Bankshares Corporation | Banks - Regional | 86 | 42.02 | 42.45 | 98.99 |

| WSFS | WSFS Financial Corporation | Banks - Regional | 85 | 52.95 | 53.92 | 98.2 |

| MGPI | MGP Ingredients, Inc. | Packaged Foods | 85 | 67.27 | 69.55 | 96.72 |

| OZK | Bank OZK | Banks - Regional | 87 | 42.98 | 44.13 | 97.39 |

| ZION | Zions Bancorporation N.A. | Banks - Regional | 86 | 58.1 | 60.65 | 95.8 |

| ORMP | Oramed Pharmaceuticals Inc. | Biotechnology | 98 | 11.31 | 11.79 | 95.93 |

| PBCT | People's United Financial, Inc. | Banks - Regional | 86 | 19.04 | 19.62 | 97.04 |

| FFWM | First Foundation Inc. | Banks - Regional | 82 | 25.02 | 25.76 | 97.13 |

| BIOX | Bioceres Crop Solutions Corp. | Agricultural Inputs | 97 | 15.7 | 16.00 | 98.13 |

| TBBK | The Bancorp, Inc. | Banks - Regional | 96 | 24.13 | 25.50 | 94.63 |

| HBAN | Huntington Bancshares Inco | Banks - Regional | 82 | 15.74 | 16.08 | 97.89 |

| OSBC | Old Second Bancorp, Inc. | Banks - Regional | 86 | 13.99 | 14.45 | 96.82 |

| HAFC | Hanmi Financial Corporation | Banks - Regional | 94 | 21.36 | 22.29 | 95.83 |

| FFIN | First Financial Bankshares, Inc. | Banks - Regional | 82 | 49.96 | 51.90 | 96.26 |

| TLND | Talend S.A. | Software - Infrastructure | 87 | 64.75 | 64.95 | 99.69 |

| APEN | Apollo Endosurgery, Inc. | Medical Devices | 98 | 7.03 | 7.20 | 97.64 |

| UBSI | United Bankshares, Inc. | Banks - Regional | 80 | 41.43 | 42.50 | 97.48 |

| SFNC | Simmons First National Corporation | Banks - Regional | 87 | 30.92 | 31.15 | 99.26 |

| ITI | Iteris, Inc. | Communication Equipment | 81 | 7.23 | 7.76 | 93.17 |

| UVSP | Univest Financial Corporation | Banks - Regional | 86 | 28.89 | 29.72 | 97.21 |

| STBA | S&T Bancorp, Inc. | Banks - Regional | 83 | 34.45 | 34.68 | 99.34 |

| RNST | Renasant Corporation | Banks - Regional | 86 | 45.04 | 45.59 | 98.79 |

| UCBI | United Community Banks, Inc. | Banks - Regional | 86 | 35.1 | 35.53 | 98.79 |

| VREX | Varex Imaging Corporation | Medical Devices | 85 | 25.41 | 26.14 | 97.21 |

| CZR | Caesars Entertainment, Inc. | Resorts & Casinos | 93 | 100.21 | 106.85 | 93.79 |

| VLY | Valley National Bancorp | Banks - Regional | 88 | 14.37 | 14.74 | 97.49 |

| EWBC | East West Bancorp, Inc. | Banks - Diversified | 91 | 76.56 | 80.47 | 95.14 |

| *These stocks were selected using our price breakout model. This model correctly selected CWH stocks that met or exceeded their breakout price with 80% probability over Jan. 2019 to Nov. 2020. This does not imply that on any one day, 80% or any of the stocks selected will meet or exceed their breakout price. | ||||||

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 30 | 0.91 |

| SQZ | 64 | 3.72 |

| HTF | 1 | -7.78 |

| HSB | 0 | |

| DB | 0 |

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2021-05-18 | INSE | SQZ | y | 8.45 | 8.76 | 95 | 11.11 | 31.48% | 32.9% |

| 2021-05-17 | CUTR | SQZ | y | 29.82 | 30.13 | 86 | 38.29 | 28.4% | 30.78% |

| 2021-05-18 | CUTR | SQZ | y | 30.14 | 31.05 | 86 | 38.29 | 27.04% | 29.4% |

| 2021-05-19 | INSE | SQZ | y | 8.77 | 9.09 | 94 | 11.11 | 26.68% | 28.05% |

| 2021-05-20 | INSE | SQZ | y | 9.10 | 9.92 | 95 | 11.11 | 22.09% | 23.41% |

| 2021-05-20 | CUTR | SQZ | y | 32.23 | 36.13 | 88 | 38.29 | 18.8% | 21.01% |

| 2021-05-21 | INSE | SQZ | y | 9.93 | 11.11 | 96 | 11.11 | 11.88% | 13.09% |

| 2021-05-18 | SLS | SQZ | y | 8.84 | 9.04 | 96 | 9.75 | 10.29% | 18.21% |

| 2021-05-17 | PLCE | CWH | n | 84.23 | 90.03 | 94 | 91.89 | 9.09% | 22.68% |

| 2021-05-18 | PTGX | CWH | n | 31.56 | 31.59 | 84 | 34.28 | 8.62% | 11.19% |

| 2021-05-19 | SLS | SQZ | y | 9.05 | 9.3 | 97 | 9.75 | 7.73% | 15.47% |

| 2021-05-20 | AVNW | SQZ | y | 33.25 | 34.75 | 98 | 35.67 | 7.28% | 8.27% |

| 2021-05-17 | NNBR | SQZ | y | 7.70 | 7.94 | 81 | 8.23 | 6.88% | 24.94% |

| 2021-05-21 | FARM | CWH | n | 11.46 | 12.24 | 93 | 12.24 | 6.81% | 7.94% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| ORMP | 11.79 | 1,031,132 | Oramed Pharmaceuticals Inc. | Biotechnology | 98 | 11.31 |

| GOGO | 12.51 | 2,673,099 | Gogo Inc. | Telecom Services | 97 | 12.00 |

| PTEN | 9.03 | 2,928,410 | Patterson-UTI Energy - Inc. | Oil & Gas Drilling | 93 | 8.40 |

| PVAC | 19.92 | 693,320 | Penn Virginia Corporation | Oil & Gas E&P | 92 | 18.23 |

| OXLC | 7.25 | 1,401,279 | Oxford Lane Capital Corp. | Asset Management | 89 | 6.79 |

| VLY | 14.74 | 3,917,202 | Valley National Bancorp | Banks - Regional | 88 | 14.37 |

| PBCT | 19.62 | 6,459,348 | People's United Financial - Inc. | Banks - Regional | 86 | 19.04 |

| FULT | 18.34 | 1,265,168 | Fulton Financial Corporation | Banks - Regional | 83 | 17.50 |

| HBAN | 16.08 | 18,401,074 | Huntington Bancshares Inco | Banks - Regional | 82 | 15.74 |

| UMPQ | 19.62 | 2,206,509 | Umpqua Holdings Corporation | Banks - Regional | 81 | 18.84 |

| These stocks meet our suggested screening factors

for our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 34207.8 |

-0.51% | 11.77% | Down |

| NASDAQ | 13471 |

0.31% | 4.52% | Down |

| S&P 500 | 4155.86 |

-0.43% | 10.64% | Down |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| NASDAQ Composite |

Dow Jones 8.62 |

Dow Jones 16.9 |

Dow Jones 11.77 |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Industrial Distribution |

Aluminum |

Aluminum |

Medical Distribution |

| Luxury Goods 53 |

Coking Coal 105 |

Confectioners 121 |

Oil & Gas Drilling 145 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 05/22/2021 NBIcharts, LLC dba BreakoutWatch.com. All

rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All

other marks are the property of their respective owners, and are used

for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.