Breakoutwatch Weekly Summary 10/09/21

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter. This newsletter summarizes the breakout events of the week

and provides additional guidance that does not fit into our daily

format. It is published each weekend.

Newsletter Archive: https://www.breakoutwatch.com/content/newsletters

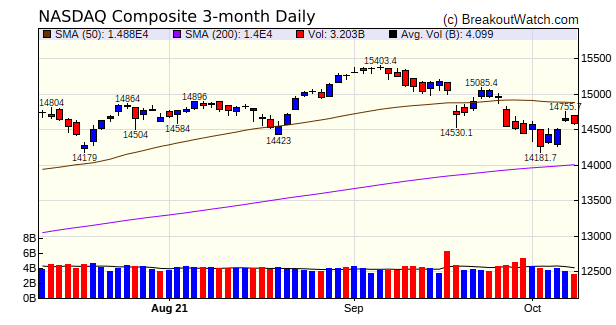

| New Feature: Chart of the Day The NASDAQ recovered from a stressful start to the week to gain just 0.1%. Thursday's gap up in response to optimism that the debt ceiling crisis was averted, at least for now, was countered by the disappointing Jobs report on Friday and underlying evidence of inflation concerns, as average hourly earnings increased by 0.6%. Supply chain issues, which include labor shortages, also contribute to rising prices. Our trend indicators continue to be negative and while Congress remains deadlocked, supply chain shortages persist and inflation threatens to erode earnings, they are likely to remain so.  |

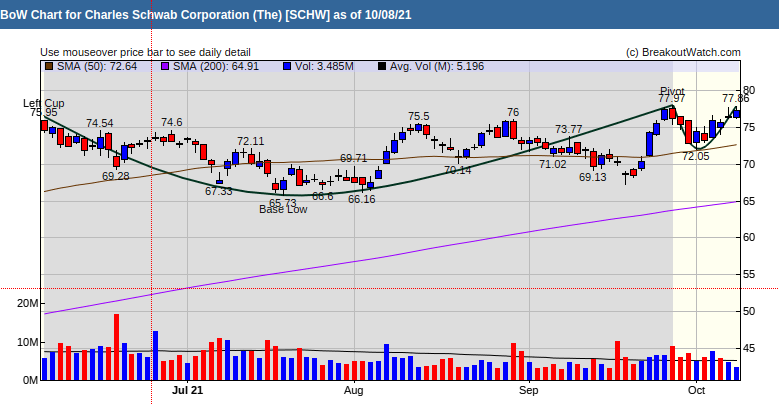

On Friday, there

were just 28 stocks on our cup and handle watchlist indicating

that there are few candidates for a breakout in the near term.

Of those on the list, Charles Schwab topped the list of possible

breakouts as determined by our breakout price model. The stock

did close higher on Friday although volume was lower than

average. |

| Chart of the Day We are now selecting the top stock on our Cup and Handle watchlist with the highest probability of breakout and identifying it as our "Chart of the Day'. This will be emailed to subscribers each day in addition to the regular daily report. The "Chart of the Day" is also accessible from the Reports menu. Include in each mailing is the corresponding analysis of the stock using technical and fundamental criteria. Readers can see Friday's chart by following this link |

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 14 | 1.41 |

| SQZ | 49 | 1.44 |

| HTF | 1 | 16.06 |

| HSB | 0 | |

| DB | 0 |

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2021-10-08 | AEHR | HTF | n | 16.75 | 19.44 | 99 | 19.44 | 16.06% | 19.04% |

| 2021-10-06 | MSTR | SQZ | y | 651.02 | 673.81 | 96 | 708.82 | 8.88% | 9.49% |

| 2021-10-06 | SLCT | CWH | n | 17.96 | 18.35 | 94 | 19.49 | 8.52% | 8.74% |

| 2021-10-04 | DCP | SQZ | y | 29.14 | 30.26 | 93 | 31.38 | 7.69% | 10.12% |

| 2021-10-06 | FBNC | CWH | n | 44.50 | 45.21 | 85 | 47.85 | 7.53% | 7.73% |

| 2021-10-04 | AGO | SQZ | y | 47.54 | 47.65 | 88 | 50.34 | 5.89% | 6.98% |

| 2021-10-05 | AGO | SQZ | y | 47.66 | 48.39 | 87 | 50.34 | 5.62% | 6.71% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | Company | Industry | RS Rank | Last Close | BoP | % off BoP |

|---|---|---|---|---|---|---|

| SCHW | Charles Schwab Corporation (The) | Capital Markets | 89 | 77.34 | 77.96 | 99.2 |

| PUMP | ProPetro Holding Corp. | Oil & Gas Equipment & Services | 88 | 9.96 | 10.32 | 96.51 |

| WBS | Webster Financial Corporation | Banks - Regional | 85 | 56.5 | 57.08 | 98.98 |

| PBCT | People's United Financial, Inc. | Banks - Regional | 82 | 17.99 | 18.26 | 98.52 |

| HAYN | Haynes International, Inc. | Metal Fabrication | 92 | 38.3 | 39.16 | 97.8 |

| FITB | Fifth Third Bancorp | Banks - Regional | 89 | 43.95 | 44.39 | 99.01 |

| STXB | Spirit of Texas Bancshares, Inc. | Banks - Regional | 86 | 24.35 | 24.94 | 97.63 |

| WAFD | Washington Federal, Inc. | Banks - Regional | 83 | 35.12 | 35.44 | 99.1 |

| OBNK | Origin Bancorp, Inc. | Banks - Regional | 84 | 43.47 | 43.96 | 98.89 |

| OZK | Bank OZK | Banks - Regional | 87 | 44.09 | 44.83 | 98.35 |

| MYO | Myomo Inc. | Medical Devices | 92 | 11.78 | 12.76 | 92.32 |

| PDLB | PDL Community Bancorp | Banks - Regional | 87 | 14.74 | 14.80 | 99.59 |

| SNV | Synovus Financial Corp. | Banks - Regional | 83 | 45.6 | 46.02 | 99.09 |

| CSTR | CapStar Financial Holdings, Inc. | Banks - Regional | 89 | 21.75 | 22.00 | 98.86 |

| *These stocks were selected using our price breakout model. This model correctly selected CWH stocks that met or exceeded their breakout price with 80% probability over Jan. 2019 to Nov. 2020. This does not imply that on any one day, 80% or any of the stocks selected will meet or exceed their breakout price. | ||||||

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| CNSL | 9.70 | 543,815 | Consolidated Communications Holdings - Inc. | Telecom Services | 91 | 9.37 |

| GOSS | 14.09 | 806,601 | Gossamer Bio - Inc. | Biotechnology | 88 | 12.57 |

| PUMP | 10.32 | 1,324,285 | ProPetro Holding Corp. | Oil & Gas Equipment & Services | 88 | 9.96 |

| WSR | 10.26 | 818,852 | Whitestone REIT | REIT - Retail | 84 | 9.84 |

| INN | 10.20 | 1,426,911 | Summit Hotel Properties - Inc. | REIT - Hotel & Motel | 82 | 9.95 |

| PBCT | 18.26 | 4,936,920 | People's United Financial - Inc. | Banks - Regional | 82 | 17.99 |

| UE | 19.44 | 1,006,377 | Urban Edge Properties | REIT - Diversified | 81 | 18.52 |

| These stocks meet our suggested screening factors

for our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 34746.2 |

1.22% | 13.53% | Down |

| NASDAQ | 14579.5 |

0.09% | 13.12% | Down |

| S&P 500 | 4391.34 |

0.79% | 16.92% | Down |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| Dow Jones |

S&P 500 0.49 |

S&P 500 6.35 |

S&P 500 16.92 |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Thermal Coal |

REIT - Residential |

Uranium |

Shell Companies |

| Aerospace & Defense 0 |

Aerospace & Defense 0 |

Aerospace & Defense 0 |

Aerospace & Defense 0 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 10/09/2021 Proactive Technologies, LLC dba

BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of Proactive Technologies

LLC. All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.