Breakoutwatch Weekly Summary 01/07/22

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter. This newsletter summarizes the breakout events of the week

and provides additional guidance that does not fit into our daily

format. It is published each weekend.

Newsletter Archive: https://www.breakoutwatch.com/content/newsletters

I wish all my readers a safe and prosperous 2022

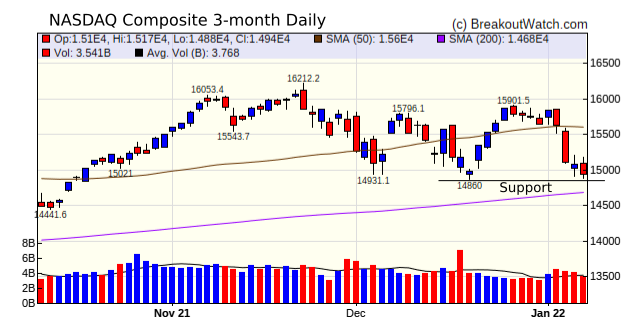

| NASDAQ Testing Support Levels. Beta

Android App Released The NASDAQ tested support levels on Friday and closed the week with a 4.5% loss. The mega cap tech stocks are now 7% below their high, as measured by the MGK etf. Briefing.com explains the downturn as follows: The growth-stock weakness was linked to the rise in the 10-yr yield, which hit 1.80% on Friday after starting the week at 1.51%. The first 12-basis-point increase didn't deter risk sentiment, though, evident in the S&P 500 setting record highs to start the week and Apple (AAPL) reaching the $3.0 trillion market capitalization.The implication being that there may be more pain ahead. Our trend indicators are negative across all three major indexes.  Better Prospects for Breakouts

The rotation into value stocks,

which are mostly not near their all time highs, could provide

more profitable breakout opportunities as there is more upside

potential. There were 17 breakouts this week that gained more

than 5%. See the table below.

|

Prime Energy

Resources was a possible breakout pick on December 31 and broke

out on January 3. A new pivot was set on Jan. 4 and profit

taking followed. It has now formed a new handle and closed on

Friday just 0.7% below the new pivot. Buy volume was above

average on Jan. 6 but Friday's hanging man doji on low volume

indicates an imminent breakout is doubtful. For alternative

possible breakouts, see "CwH Stocks Likely to Close above BoP at

Next Session* " below. |

| Beta Android App Released. You can now download a Breakoutwatch App to your Android smart phone. The App is still under development and not yet ready for the Google Play Store but you can try it out now. Instructions for the installation are here. An iPhone version will follow soon. |

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 6 | 1.89 |

| SQZ | 38 | 3.59 |

| HTF | 0 | |

| HSB | 0 | |

| DB | 0 |

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2022-01-03 | VNOM | SQZ | y | 21.32 | 22.44 | 89 | 25.26 | 18.48% | 21.39% |

| 2022-01-03 | KRP | SQZ | y | 13.64 | 14.95 | 86 | 15.38 | 12.76% | 15.82% |

| 2022-01-04 | VNOM | SQZ | y | 22.45 | 23.99 | 92 | 25.26 | 12.52% | 15.28% |

| 2022-01-04 | KEY | SQZ | y | 23.59 | 24.82 | 83 | 26.35 | 11.7% | 12.12% |

| 2022-01-04 | ESTE | CWH | n | 11.93 | 12.36 | 93 | 13.15 | 10.23% | 14.5% |

| 2022-01-04 | FITB | SQZ | y | 44.68 | 46.57 | 86 | 48.8 | 9.22% | 9.56% |

| 2022-01-04 | TX | SQZ | y | 44.58 | 45.71 | 84 | 48.28 | 8.3% | 9.83% |

| 2022-01-04 | PACW | SQZ | y | 46.25 | 47.55 | 87 | 49.9 | 7.89% | 8.98% |

| 2022-01-04 | MVO | CWH | n | 8.89 | 8.91 | 97 | 9.48 | 6.64% | 6.86% |

| 2022-01-04 | BAC | SQZ | y | 46.19 | 47.99 | 85 | 49.18 | 6.47% | 6.75% |

| 2022-01-05 | MVO | SQZ | y | 8.92 | 9.28 | 97 | 9.48 | 6.28% | 6.5% |

| 2022-01-05 | EPC | SQZ | y | 46.09 | 47.69 | 87 | 48.86 | 6.01% | 6.95% |

| 2022-01-03 | TRST | SQZ | y | 33.32 | 33.95 | 99 | 35.29 | 5.91% | 6.09% |

| 2022-01-03 | WTTR | SQZ | y | 6.24 | 6.7 | 86 | 6.6 | 5.77% | 12.18% |

| 2022-01-03 | QCRH | SQZ | y | 56.01 | 56.23 | 84 | 59.2 | 5.7% | 5.71% |

| 2022-01-05 | TX | SQZ | y | 45.72 | 48.03 | 86 | 48.28 | 5.6% | 7.09% |

| 2022-01-04 | LPI | SQZ | y | 68.05 | 75.98 | 97 | 71.45 | 5% | 14.94% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | Company | Industry | RS Rank | Last Close | BoP | % off BoP |

|---|---|---|---|---|---|---|

| PNRG | PrimeEnergy Resources Corporation | Oil & Gas E&P | 96 | 74.51 | 75.04 | 99.29 |

| TECK | Teck Resources Ltd Ordina | Other Industrial Metals & Mining | 93 | 30.41 | 30.44 | 99.9 |

| EQT | EQT Corporation | Oil & Gas E&P | 88 | 22.81 | 23.37 | 97.6 |

| HWBK | Hawthorn Bancshares, Inc. | Banks - Regional | 85 | 25.9 | 26.12 | 99.16 |

| SMM | Salient Midstream | Asset Management | 85 | 6.93 | 6.96 | 99.57 |

| PRPH | ProPhase Labs, Inc. | Drug Manufacturers - Specialty & Generic | 85 | 7.56 | 8.07 | 93.68 |

| PARR | Par Pacific Holdings, Inc. | Oil & Gas Refining & Marketing | 85 | 17.68 | 17.81 | 99.27 |

| *These stocks were selected using our CWH price breakout model. This model selects stocks likely to close above the breakout price at the next session. When backtested over the three years beginning January 2019 until October 28, 2021, 80% of the stocks selected closed above their breakout price. This does not mean that on any day, 80% of the stocks selected will breakout, but it is the expectation over an extended period of time. | ||||||

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| KRP | 15.80 | 552,286 | Kimbell Royalty Partners | Oil & Gas E&P | 92 | 15.38 |

| LPL | 10.78 | 858,992 | LG Display Co - Ltd AMERIC | Consumer Electronics | 87 | 10.16 |

| WTTR | 7.00 | 605,057 | Select Energy Services - Inc. | Oil & Gas Equipment & Services | 87 | 6.60 |

| CNR | 19.08 | 863,020 | Cornerstone Building Brands - Inc. | Building Products & Equipment | 86 | 16.58 |

| PARR | 17.81 | 530,238 | Par Pacific Holdings - Inc. | Oil & Gas Refining & Marketing | 85 | 17.68 |

| UE | 19.83 | 1,030,646 | Urban Edge Properties | REIT - Diversified | 81 | 19.52 |

| These stocks meet our suggested screening factors

for our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 36231.7 |

-0.29% | -0.29% | Down |

| NASDAQ | 14935.9 |

-4.53% | -4.53% | Down |

| S&P 500 | 4677.03 |

-1.87% | -1.87% | Down |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| Dow Jones |

S&P 500 6.51 |

S&P 500 7.03 |

Dow Jones -0.29 |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| REIT - Residential |

REIT - Residential |

Industrial Distribution |

Silver |

| Aerospace & Defense 0 |

Aerospace & Defense 0 |

Aerospace & Defense 0 |

Aerospace & Defense 0 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 01/07/2022 Proactive Technologies, LLC dba

BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of Proactive Technologies

LLC. All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.