Breakoutwatch Weekly Summary 03/19/22

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter. This newsletter summarizes the breakout events of the week

and provides additional guidance that does not fit into our daily

format. It is published each weekend.

Newsletter Archive: https://www.breakoutwatch.com/content/newsletters

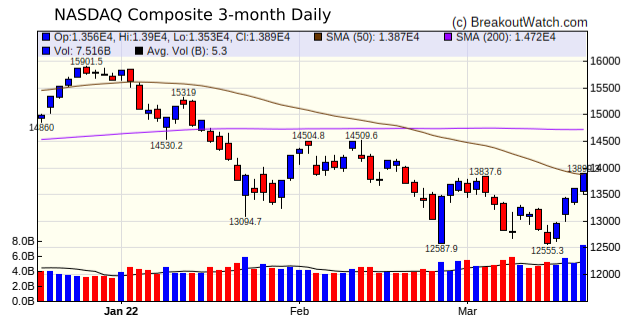

| NASDAQ Follow Through Day; 80

Breakouts Exceed 5% Gain Friday's 2% gain by the NASDAQ on well above average volume qualifies as a 'follow through day' following the low set on March 14. Friday was the 4th day after the March 14 bottom, it closed higher than the previous day and did so on higher volume, meeting the O'Neil criteria. This was not enough to change our market trend algorithm, which is still negative for all three major indexes, although another positive day could swing the trend(s) into a positive direction. For the week, the NASDAQ gained 8.2%.  This was also a very strong week

for breakouts with 80 watchlist stocks exceeding a 5% gain.

|

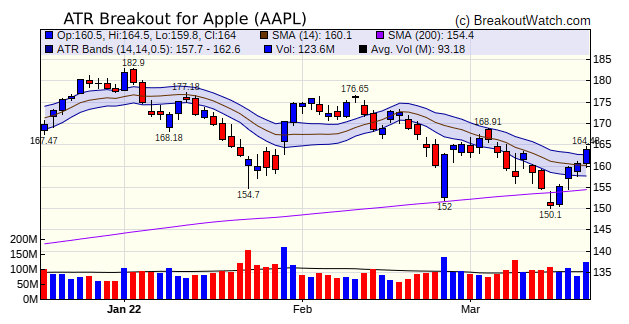

Apple (AAPL)

met our criteria for an Average True Range Breakout on Friday.

AAPL was the best performing mega cap tech stock on Friday, and

played a major role in moving the NASDAQ higher. If the tech

stock rally continues, AAPL will likely continue to be the mega

cap leader. |

| No new features this week |

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 13 | 2.33 |

| SQZ | 67 | 2.28 |

| HTF | 0 | |

| HSB | 0 | |

| DB | 0 |

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2022-03-17 | LMST | SQZ | y | 19.23 | 20.67 | 86 | 21.49 | 11.75% | 12.09% |

| 2022-03-14 | MKL | SQZ | y | 1301.67 | 1355.51 | 86 | 1429 | 9.78% | 9.87% |

| 2022-03-16 | FGBI | CWH | y | 22.31 | 22.51 | 88 | 24.35 | 9.14% | 12.28% |

| 2022-03-17 | CIX | SQZ | y | 22.17 | 22.99 | 86 | 24 | 8.25% | 8.25% |

| 2022-03-17 | FGBI | SQZ | y | 22.52 | 23.43 | 88 | 24.35 | 8.13% | 11.23% |

| 2022-03-14 | REGN | SQZ | y | 642.59 | 656.41 | 88 | 685.94 | 6.75% | 7.38% |

| 2022-03-16 | BSAC | CWH | n | 21.08 | 21.71 | 85 | 22.24 | 5.5% | 6.26% |

| 2022-03-14 | SLGN | SQZ | y | 42.82 | 44.08 | 81 | 44.99 | 5.07% | 6.19% |

| 2022-03-16 | MGPI | SQZ | y | 79.37 | 83.71 | 88 | 83.37 | 5.04% | 6.87% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | Company | Industry | RS Rank | Last Close | BoP | % off BoP |

|---|---|---|---|---|---|---|

| RCMT | RCM Technologies, Inc. | Engineering & Construction | 97 | 7.72 | 7.75 | 99.61 |

| FLMN | Falcon Minerals Corporation | Oil & Gas E&P | 95 | 6.29 | 6.48 | 97.07 |

| MAXR | Maxar Technologies Inc. | Communication Equipment | 86 | 35.84 | 36.17 | 99.09 |

| STNG | Scorpio Tankers Inc. | Oil & Gas Midstream | 92 | 19.23 | 19.64 | 97.91 |

| TCFC | The Community Financial Corporation | Banks - Regional | 86 | 40.38 | 41.00 | 98.49 |

| *These stocks were selected using our CWH price breakout model. This model selects stocks likely to close above the breakout price at the next session. When backtested over the three years beginning January 2019 until October 28, 2021, 80% of the stocks selected closed above their breakout price. This does not mean that on any day, 80% of the stocks selected will breakout, but it is the expectation over an extended period of time. | ||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 34754.9 |

5.5% | -4.36% | Down |

| NASDAQ | 13893.8 |

8.18% | -11.19% | Down |

| S&P 500 | 4463.12 |

6.16% | -6.36% | Down |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| NASDAQ Composite |

Dow Jones -3.41 |

S&P 500 0.68 |

Dow Jones -4.36 |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Oil & Gas Drilling |

Oil & Gas Integrated |

Airports & Air Services |

Utilities - Renewable |

| Aerospace & Defense 0 |

Aerospace & Defense 0 |

Aerospace & Defense 0 |

Aerospace & Defense 0 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 03/19/2022 Proactive Technologies, LLC dba

BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of Proactive Technologies

LLC. All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.