Breakoutwatch Weekly Summary 04/23/22

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter. This newsletter summarizes the breakout events of the week

and provides additional guidance that does not fit into our daily

format. It is published each weekend.

Newsletter Archive: https://www.breakoutwatch.com/content/newsletters

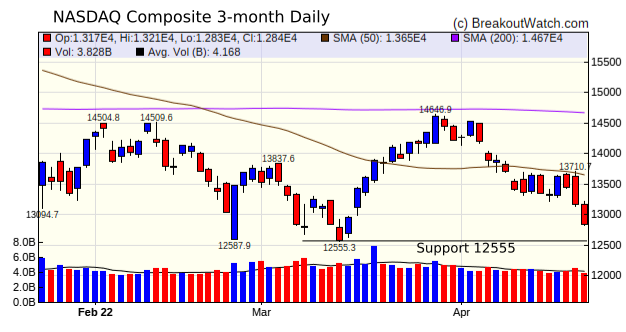

| Fed Tightening Slams NASDAQ The NASDAQ gave up 3.8% this week in response to Fed Chairman Powell saying "50 basis points will be on the table for the May meeting," at the IMF Debate on the Global Economy on Thursday. The NASDAQ looks likely to test support at 12555 which would be 20.8% below the November 22 high. A fall of 20% is considered to confirm a bear market. A 50 basis point (0.5%) rise is unlikely to be the end of tightening, with St. Louis Fed President Bullard predicting a 3.5% rate by year's end.  Reminder: Our rates will rise 5% on

May 1

|

||||||||||||||||||||

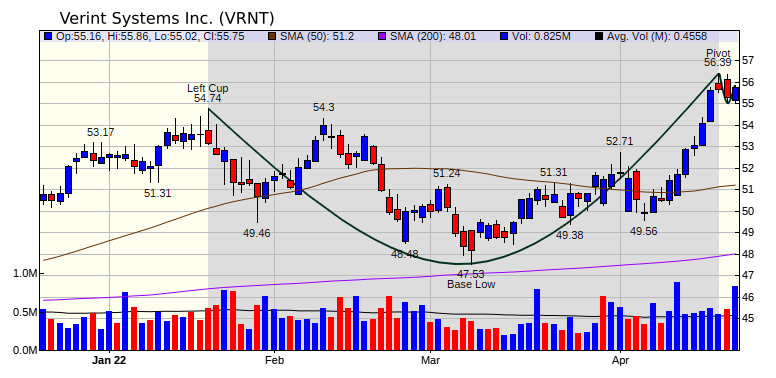

| Verint Systems

Inc. Verint was the only cup and handle stock that met my Friday screen for stocks likely to breakout. VRNT stock closed 6% higher than the previous day's close on Friday on double the average 50 day volume.  |