Breakoutwatch Weekly Summary 07/30/22

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter. This newsletter summarizes the breakout events of the week

and provides additional guidance that does not fit into our daily

format. It is published each weekend.

Newsletter Archive: https://www.breakoutwatch.com/content/newsletters

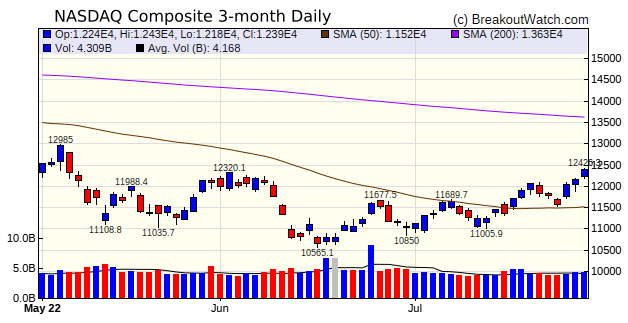

| NASDAQ Gains 4.7%; 81 Breakouts

Rise at Least 5% This was an exceptionally strong week for the markets with the NASDAQ outpacing the other major indexes with a 4.7% gain and over 12% for the month of July. Wednesday's 0.75% increase in the Fed funds rate sparked a rally as it indicated the Fed's determination to curb inflation. The markets shrugged off the second monthly decrease in GDP and preferred to focus on growth stocks following better than expected earnings reports from Amazon, Tesla and positive guidance from Microsoft, Alphabet and Apple.,  Of the 81 breakouts gaining more

than 5%, 5 were cup and handle pattern breakouts and the rest

from the Volatility Squeeze pattern with one High Tight Flag

breakout.

|

|

TECK Resources Ltd (TECK) TECK broke out from its average true range on Friday on above average volume. TECK has suffered in the recent downturn but appears to be on the upswing now. TECK's fundamentals are strong, scoring 8 out of 11 points in our Fundamentals scoring system.  |

| No new features this week |

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 30 | 2.27 |

| SQZ | 296 | 3.61 |

| HTF | 1 | 8.94 |

| HSB | 0 | |

| DB | 0 |

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2022-07-25 | CRK | SQZ | y | 13.59 | 14.91 | 98 | 15.93 | 17.22% | 21.57% |

| 2022-07-25 | PAM | SQZ | y | 20.44 | 21.28 | 88 | 23.95 | 17.17% | 20.5% |

| 2022-07-25 | PBFX | SQZ | y | 16.06 | 16.38 | 93 | 18.63 | 16% | 16.87% |

| 2022-07-26 | PBR | SQZ | y | 12.40 | 12.61 | 86 | 14.28 | 15.16% | 16.45% |

| 2022-07-25 | CSIQ | SQZ | y | 32.21 | 33.55 | 87 | 36.89 | 14.53% | 18.53% |

| 2022-07-25 | VNOM | SQZ | y | 26.85 | 28.36 | 92 | 30.74 | 14.49% | 15.34% |

| 2022-07-25 | NFE | SQZ | y | 42.99 | 45.08 | 97 | 48.97 | 13.91% | 15.38% |

| 2022-07-25 | CVX | SQZ | y | 144.20 | 148.48 | 93 | 163.78 | 13.58% | 14.19% |

| 2022-07-25 | MFA | SQZ | y | 11.43 | 11.48 | 99 | 12.96 | 13.39% | 15.44% |

| 2022-07-25 | EQNR | SQZ | y | 34.21 | 35.54 | 95 | 38.41 | 12.28% | 12.42% |

| 2022-07-28 | VTNR | SQZ | y | 12.11 | 13.48 | 99 | 13.58 | 12.14% | 16.27% |

| 2022-07-25 | TRGP | SQZ | y | 61.72 | 64.15 | 90 | 69.11 | 11.97% | 12.33% |

| 2022-07-27 | PAM | SQZ | y | 21.47 | 22.34 | 91 | 23.95 | 11.55% | 14.72% |

| 2022-07-27 | CCJ | SQZ | y | 23.13 | 25.14 | 86 | 25.77 | 11.41% | 11.89% |

| 2022-07-25 | XOM | SQZ | y | 87.09 | 89.98 | 96 | 96.93 | 11.3% | 11.97% |

| 2022-07-25 | SHLX | SQZ | y | 14.47 | 14.55 | 91 | 16.05 | 10.92% | 11.13% |

| 2022-07-27 | STLD | SQZ | y | 70.49 | 72.83 | 86 | 77.88 | 10.48% | 10.75% |

| 2022-07-25 | SBR | SQZ | y | 64.06 | 66.78 | 96 | 70.39 | 9.88% | 10.68% |

| 2022-07-27 | CSL | CWH | n | 269.61 | 271.55 | 94 | 296.1 | 9.83% | 10.24% |

| 2022-07-25 | KRP | SQZ | y | 16.26 | 16.93 | 92 | 17.82 | 9.59% | 10.39% |

| 2022-07-25 | BSM | SQZ | y | 14.22 | 14.66 | 94 | 15.58 | 9.56% | 12.04% |

| 2022-07-28 | CHRW | SQZ | y | 101.14 | 108.07 | 82 | 110.7 | 9.45% | 9.54% |

| 2022-07-25 | AVD | SQZ | y | 21.45 | 21.82 | 95 | 23.41 | 9.14% | 12.07% |

| 2022-07-25 | DXPE | SQZ | y | 31.18 | 31.53 | 95 | 34 | 9.04% | 9.4% |

| 2022-07-27 | EDU | HTF | n | 25.16 | 25.74 | 99 | 27.41 | 8.94% | 18.16% |

| 2022-07-27 | GMS | SQZ | y | 48.74 | 50.14 | 84 | 53.07 | 8.88% | 9.87% |

| 2022-07-27 | DKL | SQZ | y | 50.73 | 52.67 | 90 | 55.14 | 8.69% | 9.68% |

| 2022-07-25 | NML | SQZ | y | 6.34 | 6.57 | 93 | 6.89 | 8.68% | 9.94% |

| 2022-07-27 | PBFX | SQZ | y | 17.17 | 18.27 | 95 | 18.63 | 8.5% | 9.32% |

| 2022-07-27 | CPG | SQZ | y | 7.31 | 7.47 | 97 | 7.92 | 8.34% | 9.58% |

| 2022-07-25 | HESM | SQZ | y | 28.12 | 29.59 | 80 | 30.42 | 8.18% | 9.71% |

| 2022-07-26 | EQNR | SQZ | y | 35.55 | 36.27 | 96 | 38.41 | 8.05% | 8.19% |

| 2022-07-25 | PEO | SQZ | y | 19.61 | 20.12 | 90 | 21.18 | 8.01% | 8.52% |

| 2022-07-25 | ATI | SQZ | y | 23.12 | 23.64 | 91 | 24.89 | 7.66% | 8.91% |

| 2022-07-25 | EZPW | SQZ | y | 7.48 | 7.49 | 93 | 8.04 | 7.49% | 8.16% |

| 2022-07-25 | SRE | SQZ | y | 154.25 | 158.27 | 90 | 165.8 | 7.49% | 7.81% |

| 2022-07-27 | MMYT | CWH | n | 29.79 | 30.22 | 91 | 32 | 7.42% | 7.49% |

| 2022-07-28 | PAM | SQZ | y | 22.35 | 23.65 | 92 | 23.95 | 7.16% | 10.21% |

| 2022-07-25 | NEP | SQZ | y | 77.23 | 80.72 | 89 | 82.74 | 7.13% | 9.76% |

| 2022-07-28 | PBF | SQZ | y | 31.15 | 31.38 | 99 | 33.35 | 7.06% | 8.15% |

| 2022-07-25 | MPC | SQZ | y | 85.66 | 88.8 | 95 | 91.66 | 7% | 7.35% |

| 2022-07-28 | STLD | SQZ | y | 72.84 | 74.17 | 87 | 77.88 | 6.92% | 7.18% |

| 2022-07-25 | SO | SQZ | y | 71.95 | 72.69 | 89 | 76.89 | 6.87% | 7.87% |

| 2022-07-25 | MYE | SQZ | y | 22.77 | 23.12 | 93 | 24.33 | 6.85% | 7.64% |

| 2022-07-25 | ORA | CWH | n | 81.13 | 81.73 | 91 | 86.54 | 6.67% | 7.33% |

| 2022-07-25 | CNP | SQZ | y | 29.71 | 30.1 | 89 | 31.69 | 6.66% | 7.19% |

| 2022-07-27 | TMST | SQZ | y | 19.04 | 19.7 | 94 | 20.29 | 6.57% | 7.41% |

| 2022-07-25 | CTVA | SQZ | y | 54.02 | 55.47 | 93 | 57.55 | 6.53% | 7.44% |

| 2022-07-27 | PLAB | CWH | n | 22.36 | 23.21 | 98 | 23.81 | 6.48% | 6.71% |

| 2022-07-27 | MXC | SQZ | y | 17.48 | 17.97 | 98 | 18.6 | 6.41% | 10.98% |

| 2022-07-29 | PBF | SQZ | y | 31.39 | 33.35 | 99 | 33.35 | 6.24% | 7.33% |

| 2022-07-28 | MFA | SQZ | y | 12.20 | 12.85 | 99 | 12.96 | 6.23% | 8.16% |

| 2022-07-26 | NFG | SQZ | y | 68.24 | 70.12 | 92 | 72.34 | 6.01% | 7% |

| 2022-07-25 | NVGS | SQZ | y | 11.00 | 11.37 | 92 | 11.65 | 5.91% | 7.18% |

| 2022-07-25 | FBIZ | SQZ | y | 31.59 | 31.95 | 87 | 33.45 | 5.89% | 12.12% |

| 2022-07-28 | CPG | SQZ | y | 7.48 | 7.73 | 97 | 7.92 | 5.88% | 7.09% |

| 2022-07-26 | CTRA | SQZ | y | 28.90 | 29.45 | 94 | 30.59 | 5.85% | 6.44% |

| 2022-07-28 | XOM | SQZ | y | 91.58 | 92.64 | 95 | 96.93 | 5.84% | 6.48% |

| 2022-07-28 | ORA | SQZ | y | 81.77 | 84.91 | 91 | 86.54 | 5.83% | 6.49% |

| 2022-07-28 | EZPW | SQZ | y | 7.60 | 7.87 | 93 | 8.04 | 5.79% | 6.45% |

| 2022-07-26 | ATO | SQZ | y | 114.78 | 116.25 | 91 | 121.39 | 5.76% | 6.22% |

| 2022-07-26 | CF | SQZ | y | 90.29 | 90.4 | 97 | 95.49 | 5.76% | 7.75% |

| 2022-07-26 | SO | SQZ | y | 72.70 | 73.51 | 90 | 76.89 | 5.76% | 6.75% |

| 2022-07-29 | SOI | SQZ | y | 10.50 | 11.09 | 93 | 11.09 | 5.62% | 5.62% |

| 2022-07-28 | APA | SQZ | y | 35.20 | 35.62 | 94 | 37.17 | 5.6% | 6.36% |

| 2022-07-27 | FIZZ | SQZ | y | 51.32 | 51.45 | 92 | 54.18 | 5.57% | 5.98% |

| 2022-07-26 | ED | SQZ | y | 94.10 | 95.36 | 93 | 99.27 | 5.49% | 6.01% |

| 2022-07-26 | OGE | SQZ | y | 38.95 | 39.42 | 89 | 41.08 | 5.47% | 5.98% |

| 2022-07-28 | DVN | SQZ | y | 59.59 | 60.37 | 97 | 62.85 | 5.47% | 5.94% |

| 2022-07-26 | AJG | SQZ | y | 169.72 | 169.99 | 88 | 178.99 | 5.46% | 8.93% |

| 2022-07-27 | VMI | CWH | n | 257.53 | 257.87 | 91 | 271.48 | 5.42% | 6.96% |

| 2022-07-25 | WMB | SQZ | y | 32.35 | 33.45 | 91 | 34.09 | 5.38% | 6.15% |

| 2022-07-25 | KBR | SQZ | y | 50.52 | 51.03 | 92 | 53.23 | 5.36% | 5.84% |

| 2022-07-28 | FIZZ | SQZ | y | 51.46 | 52.68 | 91 | 54.18 | 5.29% | 5.69% |

| 2022-07-25 | PSX | SQZ | y | 84.54 | 87.24 | 89 | 89 | 5.28% | 6.55% |

| 2022-07-25 | NEE | SQZ | y | 80.26 | 80.98 | 88 | 84.49 | 5.27% | 7.49% |

| 2022-07-26 | CNP | SQZ | y | 30.11 | 30.5 | 90 | 31.69 | 5.25% | 5.76% |

| 2022-07-26 | MYE | SQZ | y | 23.13 | 23.31 | 93 | 24.33 | 5.19% | 5.97% |

| 2022-07-27 | HUBG | SQZ | y | 72.66 | 73.87 | 88 | 76.4 | 5.15% | 5.97% |

| 2022-07-26 | TWNK | SQZ | y | 21.52 | 21.58 | 91 | 22.62 | 5.11% | 6.55% |

| 2022-07-25 | IBOC | SQZ | y | 41.74 | 42.53 | 87 | 43.86 | 5.08% | 5.32% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | Company | Industry | RS Rank | Last Close | BoP | % off BoP |

|---|---|---|---|---|---|---|

| NOVT | Novanta Inc. | Scientific & Technical Instruments | 89 | 154.2 | 156.06 | 98.81 |

| SEED | Origin Agritech Limited | Agricultural Inputs | 97 | 11.19 | 11.40 | 98.16 |

| BATRA | Liberty Media Corporation | Entertainment | 85 | 28.86 | 29.23 | 98.73 |

| *These stocks were selected using our CWH price breakout model. This model selects stocks likely to close above the breakout price at the next session. When backtested over the three years beginning January 2019 until October 28, 2021, 80% of the stocks selected closed above their breakout price. This does not mean that on any day, 80% of the stocks selected will breakout, but it is the expectation over an extended period of time. | ||||||

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| EOLS | 14.29 | 665,313 | Evolus - Inc. | Drug Manufacturers - Specialty & Generic | 96 | 12.33 |

| LPG | 16.91 | 885,989 | Dorian LPG Ltd. | Oil & Gas Midstream | 94 | 16.12 |

| MERC | 16.82 | 501,863 | Mercer International Inc. | Paper & Paper Products | 94 | 15.96 |

| FOLD | 11.55 | 4,920,064 | Amicus Therapeutics - Inc. | Biotechnology | 93 | 9.96 |

| ACRS | 16.86 | 533,711 | Aclaris Therapeutics - Inc. | Biotechnology | 92 | 15.41 |

| MGI | 10.29 | 1,089,967 | Moneygram International - Inc. | Credit Services | 91 | 10.16 |

| TAC | 11.85 | 526,867 | TransAlta Corporation Ord | Utilities - Independent Power Producers | 86 | 11.42 |

| These stocks meet our suggested screening factors

for our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 32845.1 |

2.96% | -9.61% | Up |

| NASDAQ | 12390.7 |

4.7% | -20.8% | Up |

| S&P 500 | 4130.29 |

4.26% | -13.34% | Up |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| NASDAQ Composite |

NASDAQ Composite -0.4 |

Dow Jones -5.42 |

Dow Jones -9.61 |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Thermal Coal |

Grocery Stores |

Oil & Gas Integrated |

Luxury Goods |

| Aerospace & Defense 0 |

Aerospace & Defense 0 |

Aerospace & Defense 0 |

Aerospace & Defense 0 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 07/30/2022 Proactive Technologies, LLC dba

BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of Proactive Technologies

LLC. All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.