Breakoutwatch Weekly Summary 01/14/2023

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Market Summary

Stocks continue good start to 2023

Stocks recorded a second consecutive week of gains as investors weighed key inflation data and quarterly earnings reporting season kicked off in earnest on Friday. The Nasdaq Composite and growth-oriented sectors outperformed, helped by rebounds in some mega-cap technology-related names, including Amazon.com, Tesla, and Microsoft. Consumer staples shares lagged. JPMorgan Chase, Wells Fargo, and Bank of America beat consensus expectations when they released earnings Friday morning, but cautious outlooks from the banking giants caused shares to fall in early trading. [more...]

Major Index Performance

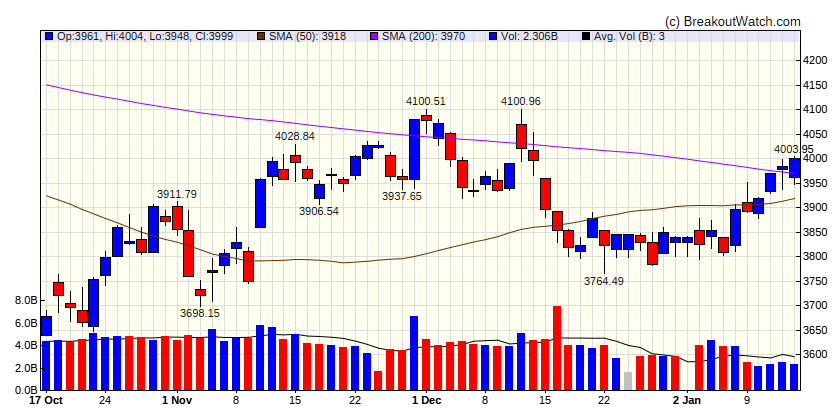

| Dow Jones | |

|---|---|

| Last Close | 34302.6 |

| Wk. Gain | 1.9 % |

| Yr. Gain | 3.57 % |

| Trend | Up |

|

|

| S&P 500 | |

|---|---|

| Last Close | 3999.09 |

| Wk. Gain | 2.26 % |

| Yr. Gain | 4.44 % |

| Trend | Up |

|

|

| NASDAQ Comp. | |

|---|---|

| Last Close | 11079.2 |

| Wk. Gain | 3.91 % |

| Yr. Gain | 6.86 % |

| Trend | Up |

|

|

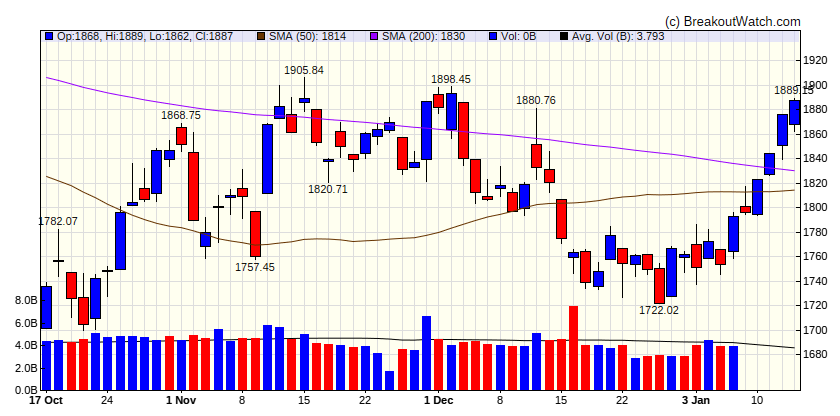

| Russell 2000 | |

|---|---|

| Last Close | 1887.03 |

| Wk. Gain | 4.77 % |

| Yr. Gain | 6.63 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | 5.16 | 9.55 | Up |

| REIT | 4.18 | 6.91 | Up |

| Technology | 3.79 | 6.14 | Up |

| Telecom | 3.53 | 10.49 | Up |

| Materials | 3.5 | 8.19 | Up |

| Finance | 2.1 | 6.35 | Up |

| Industrials | 1.83 | 5.37 | Up |

| Energy | 1.47 | 4.01 | Up |

| Utilities | 0.58 | 0.36 | Up |

| Health Care | 0.3 | 0.57 | Up |

| Consumer Staples | -0.93 | 0.54 | Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| CWH | ARCO | Arcos Dorados Holdings Inc. | Restaurants | 87.3 % | 3.7 % |

| SQZ | TGLS | Tecnoglass Inc. | Building Products & Equipment | 86.8 % | 2.6 % |

| CWH | MOD | Modine Manufacturing Company | Auto Parts | 86.1 % | 1.7 % |

| SQZ | RIO | Rio Tinto Plc | Other Industrial Metals & Mining | 85.9 % | 4.7 % |

| SQZ | MEDP | Medpace Holdings, Inc. | Diagnostics & Research | 85.7 % | 2.4 % |

| CWH | SXC | SunCoke Energy, Inc. | Coking Coal | 85.3 % | 0.6 % |

| SQZ | TITN | Titan Machinery Inc. | Industrial Distribution | 85.1 % | 4.4 % |

| SQZ | FCFS | FirstCash Holdings, Inc. | Credit Services | 83.9 % | 0.2 % |

| SQZ | FIX | Comfort Systems USA, Inc. | Engineering & Construction | 83.3 % | 2.8 % |

| SQZ | XOM | Exxon Mobil Corporation | Oil & Gas Integrated | 82.2 % | 4.3 % |

| CWH | CRH | CRH PLC American Deposita | Building Materials | 81.7 % | 2.5 % |

| CWH | IBKR | Interactive Brokers Group, Inc. | Capital Markets | 81.3 % | 0.2 % |

| SQZ | WSC | WillScot Mobile Mini Holdings Corp. | Rental & Leasing Services | 81.2 % | 0.4 % |

| SQZ | TNP | Tsakos Energy Navigation Ltd | Oil & Gas Midstream | 81 % | 2.1 % |

| SQZ | UFPT | UFP Technologies, Inc. | Packaging & Containers | 80.7 % | 0.9 % |

| SQZ | AVGO | Broadcom Inc. | Semiconductors | 80.4 % | 0.1 % |

| CWH | CAAP | Corporacion America Airports SA | Airports & Air Services | 80.2 % | 2.8 % |

| CWH | URI | United Rentals, Inc. | Rental & Leasing Services | 80.2 % | 0.9 % |

| SQZ | CMI | Cummins Inc. | Specialty Industrial Machinery | 80.1 % | 3.6 % |

| SQZ | KNSL | Kinsale Capital Group, Inc. | Insurance - Property & Casualty | 80.1 % | 3.5 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | SFL | SFL Corporation Ltd | Marine Shipping | 72.8 % | -0.2 % |

| SS | AN | AutoNation, Inc. | Auto & Truck Dealerships | 65 % | -2.9 % |

| SS | WMT | Walmart Inc. | Discount Stores | 64.9 % | -0.4 % |

| SS | ISTR | Investar Holding Corporation | Banks - Regional | 64.5 % | -0.9 % |

| SS | SFBC | Sound Financial Bancorp, Inc. | Banks - Regional | 60.2 % | -0.5 % |

| SS | EXR | Extra Space Storage Inc | REIT - Industrial | 59.1 % | -0.4 % |

| SS | SWX | Southwest Gas Holdings, Inc. | Utilities - Regulated Gas | 52.2 % | -0.3 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout at Next Session

| Symbol | BoP | Company | Industry | Within x% of BoP | C Score* | Chart Link |

|---|---|---|---|---|---|---|

| There were no CWH stocks meeting our breakout model criteria | ||||||

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | ||||||

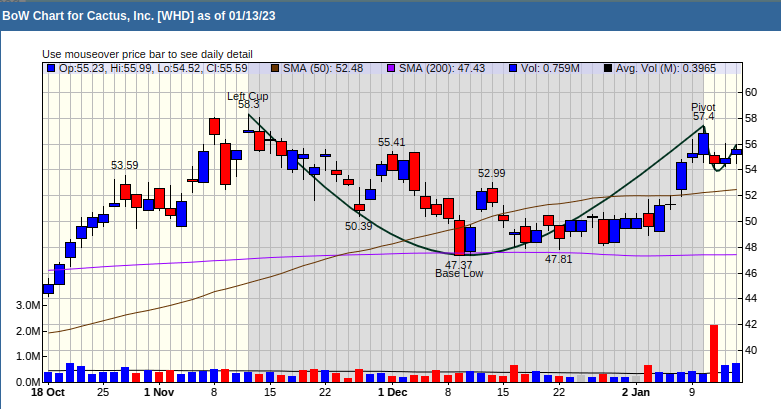

Cup and Handle Chart of the Week