Breakoutwatch Weekly Summary 02/11/2023

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

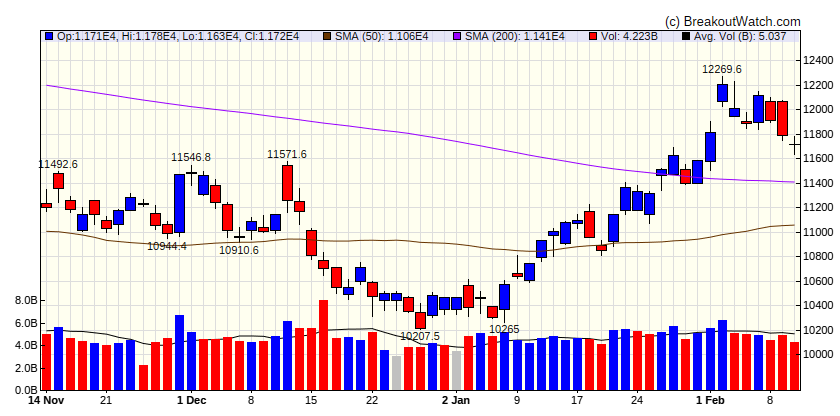

Benchmarks give back a part of the previous week’s gains

The major benchmarks ended lower in a week with relatively few important economic releases or other concrete drivers of sentiment, according to T. Rowe Price traders. Sector performance was relatively uniform within the S&P 500 Index, with energy stocks being the notable upside outlier and communication services shares the prominent laggard. Our traders also observed that a recent pattern of short covering—or the buying of certain stocks by hedge funds and others to cover previous bets that the shares would fall—was perceived by many to be coming to an end. [more...]

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | 33869.3 |

| Wk. Gain | -0.02 % |

| Yr. Gain | 2.26 % |

| Trend | Up |

|

|

| S&P 500 | |

|---|---|

| Last Close | 4090.46 |

| Wk. Gain | -0.71 % |

| Yr. Gain | 6.83 % |

| Trend | Up |

|

|

| NASDAQ Comp. | |

|---|---|

| Last Close | 11718.1 |

| Wk. Gain | -1.56 % |

| Yr. Gain | 13.02 % |

| Trend | Up |

|

|

| Russell 2000 | |

|---|---|

| Last Close | 1918.81 |

| Wk. Gain | -2.9 % |

| Yr. Gain | 8.42 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | -2.33 | 15.25 | Up |

| Consumer Staples | -0.49 | -1.41 | Down |

| Energy | 4.69 | 4.47 | Down |

| Finance | -0.15 | 8.13 | Up |

| Health Care | -0.49 | -1.45 | Down |

| Industrials | -0.52 | 6.28 | Up |

| Technology | -0.24 | 14.18 | Up |

| Materials | -1.46 | 6.53 | Down |

| REIT | -0.93 | 9.07 | Up |

| Telecom | -4.82 | 15.06 | Up |

| Utilities | -0.23 | -4.47 | Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| SQZ | SXC | SunCoke Energy, Inc. | Coking Coal | 82.9 % | 2.5 % |

| SQZ | SHEL | Royal Dutch Shell PLC Ame | Oil & Gas Integrated | 80.6 % | 3.3 % |

| CWH | MPWR | Monolithic Power Systems, Inc. | Semiconductors | 78.7 % | 2.6 % |

| CWH | TEX | Terex Corporation | Farm & Heavy Construction Machinery | 77.3 % | 1.8 % |

| CWH | TIPT | Tiptree Inc. | Insurance - Specialty | 77.3 % | 4.4 % |

| SQZ | RFP | Resolute Forest Products Inc. | Paper & Paper Products | 75.4 % | 0.1 % |

| SQZ | MNST | Monster Beverage Corporation | Beverages - Non-Alcoholic | 74.9 % | 1 % |

| CWH | MGM | MGM Resorts International | Resorts & Casinos | 73.9 % | 3.5 % |

| SQZ | TW | Tradeweb Markets Inc. | Capital Markets | 73.3 % | 0.9 % |

| SQZ | STVN | Stevanato Group S.p.A. Or | Medical Instruments & Supplies | 72.8 % | 2.2 % |

| SQZ | SFM | Sprouts Farmers Market, Inc. | Grocery Stores | 72.6 % | 0.5 % |

| SQZ | EVH | Evolent Health, Inc | Health Information Services | 72.2 % | 0.5 % |

| CWH | OPRA | Opera Limited | Internet Content & Information | 71.6 % | 0.9 % |

| CWH | BRBR | BellRing Brands, Inc. | Packaged Foods | 71.3 % | 3.4 % |

| SQZ | UNM | Unum Group | Insurance - Life | 70.9 % | 2.2 % |

| SQZ | ORLY | O'Reilly Automotive, Inc. | Specialty Retail | 68 % | 1 % |

| SQZ | BEKE | KE Holdings Inc | Real Estate Services | 67.6 % | 1.6 % |

| SQZ | GEO | Geo Group Inc | REIT - Healthcare Facilities | 67 % | 1.9 % |

| SQZ | BIIB | Biogen Inc. | Drug Manufacturers - General | 66.9 % | 0.9 % |

| SQZ | TFPM | Triple Flag Precious Metals Corp. | Other Precious Metals & Mining | 66.9 % | 0.9 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | HDSN | Hudson Technologies, Inc. | Specialty Chemicals | 78.6 % | -2.6 % |

| SS | CCB | Coastal Financial Corporation | Banks - Regional | 76.3 % | -1.9 % |

| SS | MCRI | Monarch Casino & Resort, Inc. | Resorts & Casinos | 71 % | -0.7 % |

| SS | CLW | Clearwater Paper Corporation | Paper & Paper Products | 70.5 % | -2.1 % |

| SS | SEDG | SolarEdge Technologies, Inc. | Solar | 70.4 % | -1.3 % |

| SS | MCBC | Macatawa Bank Corporation | Banks - Regional | 69.6 % | -0.9 % |

| SS | FCNCA | First Citizens BancShares, Inc. | Banks - Regional | 66.1 % | -1.7 % |

| SS | PFIS | Peoples Financial Services Corp. | Banks - Regional | 65.2 % | -0.3 % |

| SS | VRAY | ViewRay, Inc. | Medical Devices | 64.3 % | -0.2 % |

| SS | NTIC | Northern Technologies International Corporation | Specialty Chemicals | 63.5 % | -0.8 % |

| SS | DTM | DT Midstream, Inc. | Oil & Gas Midstream | 62 % | -1.9 % |

| SS | ZLAB | Zai Lab Limited | Biotechnology | 60.6 % | -0.1 % |

| SS | UTL | UNITIL Corporation | Utilities - Diversified | 58.8 % | -0.5 % |

| SS | IONS | Ionis Pharmaceuticals, Inc. | Biotechnology | 57.8 % | -0 % |

| SS | GEG | Great Elm Group, Inc. | Medical Distribution | 54.5 % | -3.8 % |

| SS | SLCA | U.S. Silica Holdings, Inc. | Oil & Gas Equipment & Services | 54 % | -1.3 % |

| SS | FENC | Fennec Pharmaceuticals Inc. | Biotechnology | 52.2 % | -0.6 % |

| SS | GO | Grocery Outlet Holding Corp. | Grocery Stores | 51.5 % | -1.3 % |

| SS | FNKO | Funko, Inc. | Leisure | 46.3 % | -2.7 % |

| SS | DNLI | Denali Therapeutics Inc. | Biotechnology | 40.8 % | -1.4 % |

| SS | BEAM | Beam Therapeutics Inc. | Biotechnology | 40 % | -3.3 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout at Next Session

| Symbol | BoP | Company | Industry | Within x% of BoP | C Score* | |

|---|---|---|---|---|---|---|

| There were no CWH stocks meeting our breakout model criteria | ||||||

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | ||||||

Cup and Handle Chart of the Week

Although there were no stocks selected by our breakout model, GasLog Partners was selected by a filter on stocks with highest RS Rank, being under accumulation and having closed on above average volume.