Breakoutwatch Weekly Summary 04/09/2023

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

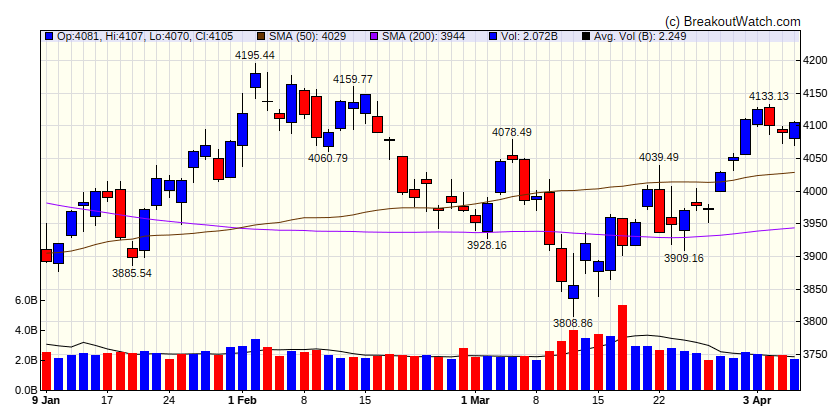

Benchmarks end mostly lower in light trading

The major benchmarks were mostly lower over a holiday-shortened week that T. Rowe Price traders noted was characterized by light and choppy trading. U.S. markets were shuttered on Friday, along with most of the other markets in the Americas, in observance of the Good Friday holiday, while Passover started on Wednesday evening. Our traders noted that investors also seemed to take a pause following the previous week’s quarter-end “window dressing,” in which some institutional investors adjusted their holdings in advance of their quarterly public disclosure. [more...]

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | 33485.3 |

| Wk. Gain | 0.72 % |

| Yr. Gain | 1.1 % |

| Trend | Up |

|

|

| S&P 500 | |

|---|---|

| Last Close | 4105.02 |

| Wk. Gain | 0.07 % |

| Yr. Gain | 7.21 % |

| Trend | Up |

|

|

| NASDAQ Comp. | |

|---|---|

| Last Close | 12088 |

| Wk. Gain | -0.48 % |

| Yr. Gain | 16.59 % |

| Trend | Up |

|

|

| Russell 2000 | |

|---|---|

| Last Close | 1754.46 |

| Wk. Gain | -2.75 % |

| Yr. Gain | -0.86 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | -2.28 | 12.72 | Up |

| Consumer Staples | 0.71 | 1.51 | Up |

| Energy | -1.8 | -2.16 | Up |

| Finance | -1.03 | -6.52 | Up |

| Health Care | 2.66 | -1.01 | Up |

| Industrials | -3.66 | 0.63 | Down |

| Technology | -0.88 | 20.12 | Up |

| Materials | -1.87 | 2.74 | Up |

| REIT | -0.66 | -0.11 | Up |

| Telecom | 2.05 | 20.76 | Up |

| Utilities | 3.33 | -1.95 | Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| SQZ | KNSL | Kinsale Capital Group, Inc. | Insurance - Property & Casualty | 79.9 % | 3.2 % |

| SQZ | NSP | Insperity, Inc. | Staffing & Employment Services | 77.5 % | 1.3 % |

| SQZ | MRK | Merck & Company, Inc. | Drug Manufacturers - General | 76.3 % | 3.2 % |

| SQZ | FOCS | Focus Financial Partners Inc. | Asset Management | 73.7 % | 0.1 % |

| CWH | CDMO | Avid Bioservices, Inc. | Biotechnology | 72.2 % | 4.8 % |

| SQZ | EAT | Brinker International, Inc. | Restaurants | 71.1 % | 0.3 % |

| SQZ | EZPW | EZCORP, Inc. | Credit Services | 70.6 % | 0.5 % |

| SQZ | TWNK | Hostess Brands, Inc. | Packaged Foods | 68.8 % | 0.2 % |

| SQZ | USPH | U.S. Physical Therapy, Inc. | Medical Care Facilities | 68.7 % | 2.9 % |

| SQZ | SJW | SJW Group | Utilities - Regulated Water | 68.3 % | 0.5 % |

| CWH | ITCI | Intra-Cellular Therapies Inc. | Drug Manufacturers - Specialty & Generic | 67.8 % | 2.5 % |

| SQZ | CBRL | Cracker Barrel Old Country Store, Inc. | Restaurants | 67.2 % | 0.2 % |

| SQZ | ESTA | Establishment Labs Holdings Inc. | Medical Devices | 65.8 % | 1.3 % |

| SQZ | FDP | Fresh Del Monte Produce, Inc. | Farm Products | 65.5 % | 0.7 % |

| CWH | FANH | Fanhua Inc. | Insurance Brokers | 65.4 % | 0.3 % |

| CWH | SGRY | Surgery Partners, Inc. | Medical Care Facilities | 62.5 % | 0.7 % |

| SQZ | UTZ | Utz Brands Inc | Packaged Foods | 62.2 % | 0.2 % |

| CWH | SKYW | SkyWest, Inc. | Airlines | 61.9 % | 0.5 % |

| SQZ | DBRG | DigitalBridge Group, Inc. | Real Estate Services | 61.8 % | 0.2 % |

| SQZ | STRA | Strategic Education, Inc. | Education & Training Services | 60.8 % | 1.3 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | MCHP | Microchip Technology Inco | Semiconductors | 78.9 % | -3.7 % |

| SS | ESE | ESCO Technologies Inc. | Scientific & Technical Instruments | 74.4 % | -1.6 % |

| SS | ARLP | Alliance Resource Partners, L.P. | Thermal Coal | 70.2 % | -1.7 % |

| SS | EVH | Evolent Health, Inc | Health Information Services | 70.1 % | -2.5 % |

| SS | CVE | Cenovus Energy Inc | Oil & Gas Integrated | 70 % | -2.6 % |

| SS | COP | ConocoPhillips | Oil & Gas E&P | 68.9 % | -0.5 % |

| SS | AN | AutoNation, Inc. | Auto & Truck Dealerships | 67.2 % | -5 % |

| SS | ATEN | A10 Networks, Inc. | Software - Infrastructure | 67 % | -2.5 % |

| SS | AME | AMETEK, Inc. | Specialty Industrial Machinery | 65.3 % | -4.8 % |

| SS | DY | Dycom Industries, Inc. | Engineering & Construction | 63.3 % | -3.7 % |

| SS | GLRE | Greenlight Reinsurance, Ltd. | Insurance - Reinsurance | 61.2 % | -2.3 % |

| SS | AVDL | Avadel Pharmaceuticals plc | Drug Manufacturers - Specialty & Generic | 60 % | -0.6 % |

| SS | HCI | HCI Group, Inc. | Insurance - Property & Casualty | 59.7 % | -2.2 % |

| SS | IBM | International Business Machines Corporation | Information Technology Services | 55.2 % | -0.6 % |

| SS | CGTX | Cognition Therapeutics, Inc. | Biotechnology | 31 % | -2.7 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout at Next Session

| Symbol | BoP | Company | Industry | Within x% of BoP | C Score* |

|---|---|---|---|---|---|

| GETY | Cognition Therapeutics, Inc. | Internet Content & Information | 86.37 | 58.7 | |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Chart of the Week

There were no CWH charts meeting our breakout criteria this week