Breakoutwatch Weekly Summary 05/20/2023

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

Stocks briefly break out of trading band in narrow advance

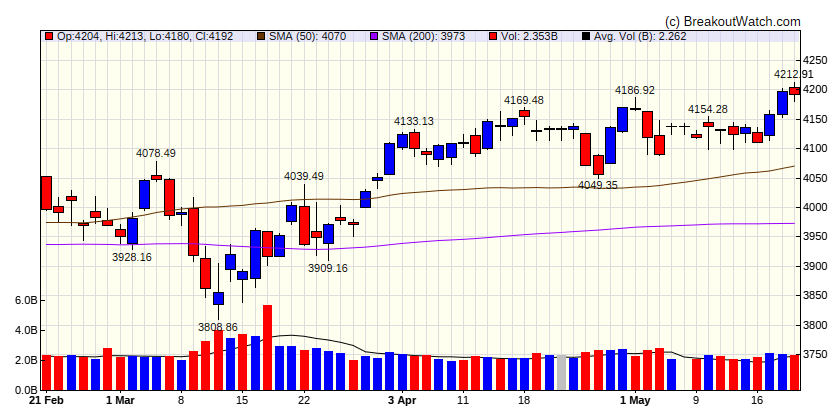

Stocks recorded solid gains for the week, with the S&P 500 Index breaching the 4,200 level in intraday trading for the first time since late August. The index has remained notably range-bound over the past few months, and T. Rowe Price traders observed that the previous week marked the sixth consecutive one in which it failed to move by more than 1%—the longest such stretch since November 2019. The market’s advance remained notably narrow as well, however. The equal-weighted S&P 500 Index (SPEXW) lagged by 77 basis points (0.77%) and ended the week up only 0.93% for the year to date, 825 basis points behind the weighted index. [more...]

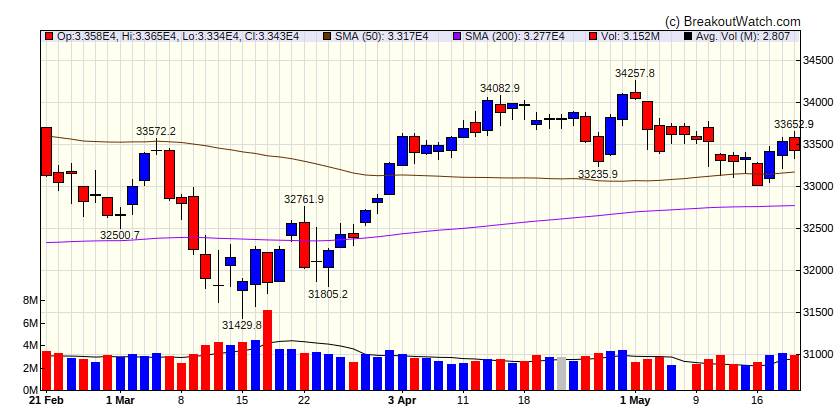

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | 33426.6 |

| Wk. Gain | 0.32 % |

| Yr. Gain | 0.92 % |

| Trend | Down |

|

|

| S&P 500 | |

|---|---|

| Last Close | 4191.98 |

| Wk. Gain | 1.58 % |

| Yr. Gain | 9.48 % |

| Trend | Up |

|

|

| NASDAQ Comp. | |

|---|---|

| Last Close | 12657.9 |

| Wk. Gain | 2.9 % |

| Yr. Gain | 22.08 % |

| Trend | Up |

|

|

| Russell 2000 | |

|---|---|

| Last Close | 1773.72 |

| Wk. Gain | 1.67 % |

| Yr. Gain | 0.22 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | 1.94 | 17.35 | Up |

| Consumer Staples | -1.62 | 2.44 | Down |

| Energy | 1.16 | -8.17 | Down |

| Finance | 2.33 | -5.65 | Down |

| Health Care | -0.71 | -2.11 | Down |

| Industrials | 1.16 | 3.9 | Up |

| Technology | 3.99 | 26.88 | Up |

| Materials | 0.45 | 1.49 | Down |

| REIT | -2.15 | -2.52 | Down |

| Telecom | 2.71 | 24.06 | Up |

| Utilities | -4.36 | -7.24 | Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| CWH | ARCO | Arcos Dorados Holdings Inc. | Restaurants | 81.4 % | 4.8 % |

| SQZ | BWMX | Betterware de Mexico, S.A.P.I. de C.V. | Specialty Retail | 77.6 % | 1 % |

| SQZ | FSS | Federal Signal Corporation | Pollution & Treatment Controls | 76.5 % | 4.3 % |

| CWH | LPG | Dorian LPG Ltd. | Oil & Gas Midstream | 76.4 % | 3.8 % |

| CWH | RCL | D/B/A Royal Caribbean Cruises Ltd. | Travel Services | 76.1 % | 1.6 % |

| SQZ | AQUA | Evoqua Water Technologies Corp. | Pollution & Treatment Controls | 76.1 % | 1.7 % |

| SQZ | EAT | Brinker International, Inc. | Restaurants | 76.1 % | 0.8 % |

| CWH | FLYW | Flywire Corporation | Software - Infrastructure | 75.9 % | 0.1 % |

| SQZ | DY | Dycom Industries, Inc. | Engineering & Construction | 74.3 % | 3.1 % |

| SQZ | OEC | Orion Engineered Carbons S.A | Specialty Chemicals | 73.4 % | 2.9 % |

| SQZ | FTAI | FTAI Aviation Ltd. | Rental & Leasing Services | 73.3 % | 4.1 % |

| SQZ | JPM | JP Morgan Chase & Co. | Banks - Diversified | 73.3 % | 0.5 % |

| CWH | VSH | Vishay Intertechnology, Inc. | Semiconductors | 73.2 % | 2.1 % |

| CWH | LOGI | Logitech International S.A. | Computer Hardware | 72.5 % | 1.2 % |

| SQZ | CSWI | CSW Industrials, Inc. | Specialty Industrial Machinery | 72.4 % | 1.6 % |

| SQZ | CHUY | Chuy's Holdings, Inc. | Restaurants | 72.2 % | 4.3 % |

| SQZ | KRUS | Kura Sushi USA, Inc. | Restaurants | 71.9 % | 2.2 % |

| SQZ | NS | Nustar Energy L.P. | Oil & Gas Midstream | 71.7 % | 3.2 % |

| SQZ | TJX | TJX Companies, Inc. | Apparel Retail | 71.7 % | 0.4 % |

| SQZ | ABC | AmerisourceBergen Corporation | Medical Distribution | 71.1 % | 0 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | CARE | Carter Bankshares, Inc. | Banks - Regional | 69.3 % | -1.1 % |

| SS | ERIE | Erie Indemnity Company | Insurance Brokers | 68.8 % | -0.7 % |

| SS | SJM | J.M. Smucker Company (The) New | Packaged Foods | 66.8 % | -1.1 % |

| SS | FLWS | 1-800-FLOWERS.COM, Inc. | Specialty Retail | 58.8 % | -3.1 % |

| SS | SMAP | SportsMap Tech Acquisition Corp. | Shell Companies | 50.4 % | -0.3 % |

| SS | BMY | Bristo | Drug Manufacturers - General | 50.2 % | -3.9 % |

| SS | UTZ | Utz Brands Inc | Packaged Foods | 50.2 % | -4.1 % |

| SS | KDNY | Chinook Therapeutics, Inc. | Biotechnology | 44.9 % | -3 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout at Next Session

| Symbol | BoP | Company | Industry | Within x% of BoP | C Score* | |

|---|---|---|---|---|---|---|

| There were no CWH stocks meeting our breakout model criteria | ||||||

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | ||||||

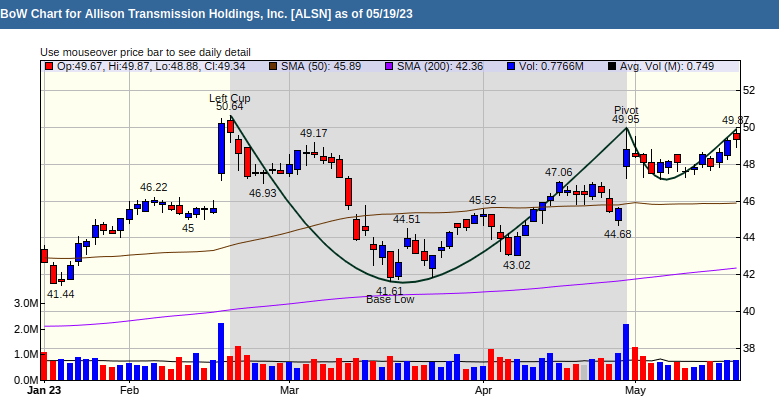

Cup and Handle Chart of the Week

Allison Transmission Holdings, Inc. (ALSN) is showing healthy accumulation as it builds the right side of the handle. The stock closed on Friday within just 0.2% of its Breakout Price (BoP) and appears ready to breakout