Breakoutwatch Weekly Summary 06/12/2023

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

S&P 500 enters bull market

Stocks closed modestly higher in a week of relatively subdued trading ahead of the Federal Reserve’s policy meeting and rate announcement on the following Wednesday. The week was notable for the S&P 500 Index moving into bull market territory, or up more than 20% off its mid-October lows. It was also notable for broadening market gains, with small-caps outperforming large-caps, and value shares outperforming growth stocks. An equally weighted S&P 500 Index also rose more than its capitalization-weighted counterpart for the first time in eight weeks and by the largest margin since late March. [more...]

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | 33876.8 |

| Wk. Gain | 2.08 % |

| Yr. Gain | 2.28 % |

| Trend | Up |

|

|

| S&P 500 | |

|---|---|

| Last Close | 4298.86 |

| Wk. Gain | 1.36 % |

| Yr. Gain | 12.27 % |

| Trend | Up |

|

|

| NASDAQ Comp. | |

|---|---|

| Last Close | 13259.1 |

| Wk. Gain | 0.52 % |

| Yr. Gain | 27.88 % |

| Trend | Up |

|

|

| Russell 2000 | |

|---|---|

| Last Close | 1865.71 |

| Wk. Gain | 4.68 % |

| Yr. Gain | 5.42 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | -59.05 | -49.44 | Up |

| Consumer Staples | -43.46 | -44.74 | Down |

| Energy | 40.18 | 109.19 | Down |

| Finance | 52.94 | 43.57 | Up |

| Health Care | -42.91 | -34.86 | Down |

| Industrials | -23.88 | -23.88 | Up |

| Technology | -49.83 | -49.83 | Up |

| Materials | -11.57 | -11.57 | Up |

| REIT | 18.01 | 18.01 | Down |

| Telecom | 26.07 | 26.07 | Up |

| Utilities | -22.08 | -22.08 | Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| SQZ | BBVA | Banco Bilbao Vizcaya Argentaria S.A. | Banks - Diversified | 80.9 % | 1.7 % |

| CWH | APG | APi Group Corporation | Engineering & Construction | 79 % | 3.4 % |

| CWH | ALSN | Allison Transmission Holdings, Inc. | Auto Parts | 78.6 % | 4.1 % |

| SQZ | OII | Oceaneering International, Inc. | Oil & Gas Equipment & Services | 78.6 % | 2.8 % |

| SQZ | FND | Floor & Decor Holdings, Inc. | Home Improvement Retail | 78.3 % | 3.2 % |

| SQZ | FLYW | Flywire Corporation | Software - Infrastructure | 75.9 % | 2 % |

| SQZ | HSBC | HSBC Holdings, plc. | Banks - Diversified | 75.4 % | 0.6 % |

| SQZ | GGG | Graco Inc. | Specialty Industrial Machinery | 73.9 % | 3 % |

| CWH | CMCO | Columbus McKinnon Corporation | Farm & Heavy Construction Machinery | 73.3 % | 4.3 % |

| SQZ | PGTI | PGT Innovations, Inc. | Building Products & Equipment | 73.3 % | 2.7 % |

| CWH | DOLE | Dole plc Ordinary Shares | Farm Products | 72.9 % | 0.1 % |

| SQZ | CROX | Crocs, Inc. | Footwear & Accessories | 72.9 % | 0.2 % |

| SQZ | MLR | Miller Industries, Inc. | Auto Parts | 72.7 % | 0.9 % |

| SQZ | GWW | W.W. Grainger, Inc. | Industrial Distribution | 72.3 % | 3 % |

| CWH | NVT | nVent Electric plc Ordina | Electrical Equipment & Parts | 71.8 % | 2.2 % |

| SQZ | CETX | Cemtrex Inc. | Software - Infrastructure | 71.6 % | 0.4 % |

| SQZ | GSHD | Goosehead Insurance, Inc. | Insurance - Diversified | 71.6 % | 2.1 % |

| CWH | LECO | Linco | Tools & Accessories | 71.3 % | 4.5 % |

| SQZ | HTH | Hilltop Holdings Inc. | Banks - Regional | 71.3 % | 0.8 % |

| SQZ | DEN | Denbury Inc. | Oil & Gas E&P | 70.9 % | 0.3 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | OI | O-I Glass, Inc. | Packaging & Containers | 72.2 % | -4 % |

| SS | BBCP | Concrete Pumping Holdings, Inc. | Engineering & Construction | 69.5 % | -0.3 % |

| SS | ATEC | Alphatec Holdings, Inc. | Medical Devices | 69 % | -1.7 % |

| SS | CASS | Cass Information Systems, Inc | Specialty Business Services | 65.9 % | -0.4 % |

| SS | LVOX | LiveVox Holdings, Inc. | Software - Infrastructure | 63.6 % | -2.5 % |

| SS | HRMY | Harmony Biosciences Holdings, Inc. | Biotechnology | 63 % | -0.4 % |

| SS | APD | Air Products and Chemicals, Inc. | Specialty Chemicals | 61.1 % | -1.2 % |

| SS | IOSP | Innospec Inc. | Specialty Chemicals | 59.2 % | -0.5 % |

| SS | FLXS | Flexsteel Industries, Inc. | Furnishings, Fixtures & Appliances | 56.9 % | -0.4 % |

| SS | MSTR | MicroStrategy Inco | Software - Application | 56.9 % | -2.8 % |

| SS | ENR | Energizer Holdings, Inc. | Electrical Equipment & Parts | 56.8 % | -1.2 % |

| SS | CTMX | CytomX Therapeutics, Inc. | Biotechnology | 53.7 % | -1.2 % |

| SS | PET | Wag! Group Co. | Software - Application | 48.6 % | -3.1 % |

| SS | ATEN | A10 Networks, Inc. | Software - Infrastructure | 45.6 % | -2.3 % |

| SS | CLF | Cleveland-Cliffs Inc. | Steel | 40 % | -0.4 % |

| SS | PRAX | Praxis Precision Medicines, Inc. | Biotechnology | 36.8 % | -0.2 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

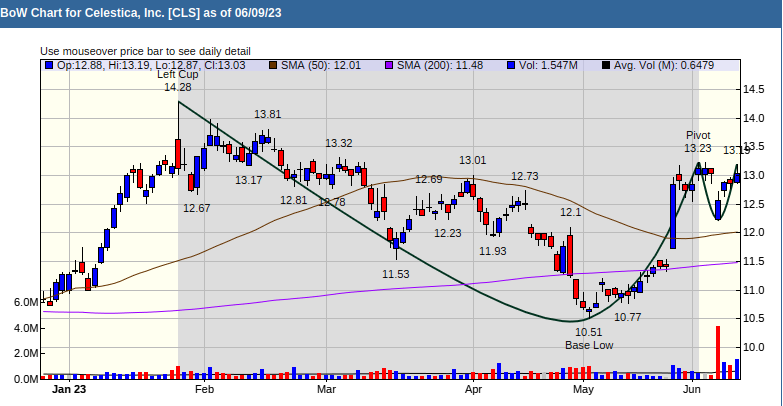

Cup and Handle Chart of the Week

Celestica - Inc. (CLS) Following strong profit taking upon setting its pivot, CLS has climbed the right side of the handle on strong volume. CLS has great technical strength and above average fundamentals. The stock surged on Friday on 2 times average volume and could be close to breakout.