Breakoutwatch Weekly Summary 06/25/2023

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

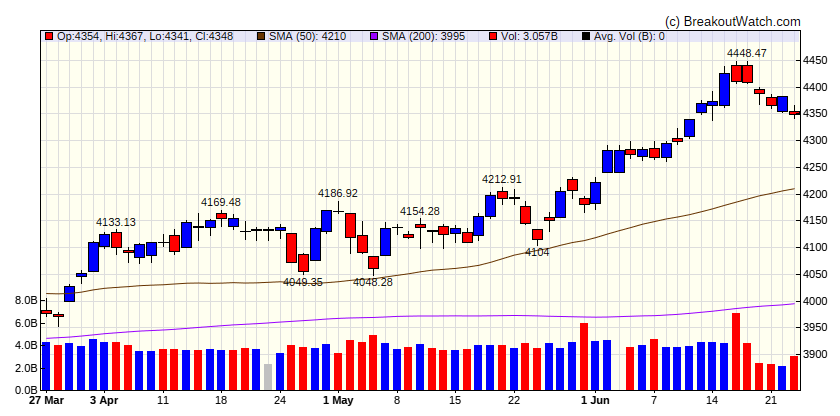

Market Summary

Stocks break winning streak

The major benchmarks closed lower in a holiday-shortened trading week. The Nasdaq Composite suffered its first weekly decline in two months, while the S&P 500 Index recorded its first drop in six weeks. Growth stocks outperformed value shares, while large-caps fared better than small-caps. T. Rowe Price traders noted that the annual rebalance of the Russell indexes on Friday appeared to keep volumes muted earlier in the week, as some investors prepared to shift the allocations of their portfolios in response. Markets were shuttered on Monday in observance of the Juneteenth holiday. [more...]

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | 33727.4 |

| Wk. Gain | -1.4 % |

| Yr. Gain | 1.83 % |

| Trend | Up |

|

|

| S&P 500 | |

|---|---|

| Last Close | 4348.33 |

| Wk. Gain | -1.09 % |

| Yr. Gain | 13.56 % |

| Trend | Up |

|

|

| NASDAQ Comp. | |

|---|---|

| Last Close | 13492.5 |

| Wk. Gain | -1.1 % |

| Yr. Gain | 30.13 % |

| Trend | Up |

|

|

| Russell 2000 | |

|---|---|

| Last Close | 1821.63 |

| Wk. Gain | -2.66 % |

| Yr. Gain | 2.93 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | -0.19 | 26.93 | Up |

| Consumer Staples | -0.4 | 1.31 | Down |

| Energy | -2.73 | -9.48 | Up |

| Finance | -1.98 | -3.92 | Up |

| Health Care | 0.8 | -1.24 | Up |

| Industrials | -0.98 | 8.73 | Up |

| Technology | -1.88 | 35.59 | Up |

| Materials | -1.36 | 3.11 | Up |

| REIT | -4.17 | -2.85 | Up |

| Telecom | -0.99 | 28.69 | Up |

| Utilities | -2.62 | -8.22 | Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| SQZ | ACGL | Arch Capital Group Ltd. | Insurance - Diversified | 78.3 % | 0.9 % |

| SQZ | MDXG | MiMedx Group, Inc | Biotechnology | 75.1 % | 1.1 % |

| CWH | AMZN | Amazon.com, Inc. | Internet Retail | 73.7 % | 0.7 % |

| SQZ | SHOP | Shopify Inc. | Software - Application | 72.4 % | 0.5 % |

| CWH | PAG | Penske Automotive Group, Inc. | Auto & Truck Dealerships | 69.4 % | 0 % |

| CWH | SUM | Summit Materials, Inc. | Building Materials | 68.3 % | 0.2 % |

| CWH | AN | AutoNation, Inc. | Auto & Truck Dealerships | 67.6 % | 0.9 % |

| SQZ | IHS | IHS Holding Limited Ordin | Telecom Services | 67.1 % | 0.9 % |

| SQZ | VCEL | Vericel Corporation | Biotechnology | 66.4 % | 1.8 % |

| SQZ | PESI | Perma-Fix Environmental Services, Inc. | Waste Management | 64.6 % | 1.3 % |

| CWH | DCGO | DocGo Inc. | Medical Care Facilities | 63.2 % | 0.4 % |

| SQZ | TYL | Tyler Technologies, Inc. | Software - Application | 61.7 % | 1.2 % |

| CWH | ELP | Companhia Paranaense de Energia (COPEL) American D | Utilities - Diversified | 59.7 % | 0.9 % |

| CWH | CVAC | CureVac N.V. | Biotechnology | 54.5 % | 1.3 % |

| SQZ | RIOT | Riot Platforms, Inc. | Capital Markets | 54.5 % | 3 % |

| HTF | APYX | Apyx Medical Corporation | Medical Devices | 53.6 % | 0.3 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | OII | Oceaneering International, Inc. | Oil & Gas Equipment & Services | 77.2 % | -0.1 % |

| SS | HAL | Halliburton Company | Oil & Gas Equipment & Services | 74.4 % | -2.1 % |

| SS | KFS | Kingsway Financial Services, Inc. | Auto & Truck Dealerships | 69.9 % | -2.1 % |

| SS | MCRI | Monarch Casino & Resort, Inc. | Resorts & Casinos | 62.1 % | -1.3 % |

| SS | ALNY | Alnylam Pharmaceuticals, Inc. | Biotechnology | 61.9 % | -3.2 % |

| SS | ADNT | Adient plc Ordinary Share | Auto Parts | 61.6 % | -2.1 % |

| SS | CALX | Calix, Inc | Software - Application | 60.2 % | -0.2 % |

| SS | COP | ConocoPhillips | Oil & Gas E&P | 59.3 % | -2.1 % |

| SS | EBF | Ennis, Inc. | Business Equipment & Supplies | 59.3 % | -1.6 % |

| SS | ET | Energy Transfer LP | Oil & Gas Midstream | 59.1 % | -1.2 % |

| SS | IOSP | Innospec Inc. | Specialty Chemicals | 58.7 % | -3.3 % |

| SS | NBIX | Neurocrine Biosciences, Inc. | Drug Manufacturers - Specialty & Generic | 58 % | -1.8 % |

| SS | GL | Globe Life Inc. | Insurance - Life | 57.1 % | -1.2 % |

| SS | ENR | Energizer Holdings, Inc. | Electrical Equipment & Parts | 55.6 % | -4.4 % |

| SS | PWSC | PowerSchool Holdings, Inc. | Software - Application | 55 % | -1 % |

| SS | LNN | Lindsay Corporation | Farm & Heavy Construction Machinery | 54.3 % | -0.8 % |

| SS | CPHC | Canterbury Park Holding Corporation | Gambling | 52.5 % | -1.1 % |

| SS | FET | Forum Energy Technologies, Inc. | Oil & Gas Equipment & Services | 52.4 % | -4.2 % |

| SS | ACCD | Accolade, Inc. | Health Information Services | 52.1 % | -3.5 % |

| SS | RPM | RPM International Inc. | Specialty Chemicals | 52 % | -0.3 % |

| SS | ANIK | Anika Therapeutics Inc. | Medical Devices | 50 % | -0.8 % |

| SS | VRDN | Viridian Therapeutics, Inc. | Biotechnology | 48.8 % | -1.2 % |

| SS | GPS | Gap, Inc. | Apparel Retail | 47.1 % | -3.8 % |

| SS | BE | Bloom Energy Corporation Class A | Electrical Equipment & Parts | 45.7 % | -5 % |

| SS | CLF | Cleveland-Cliffs Inc. | Steel | 42.3 % | -0.8 % |

| SS | PACK | Ranpak Holdings Corp Class A | Packaging & Containers | 41.2 % | -1 % |

| SS | SNDX | Syndax Pharmaceuticals, Inc. | Biotechnology | 39.7 % | -0.5 % |

| SS | GRTS | Gritstone bio, Inc. | Biotechnology | 29 % | -3.8 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

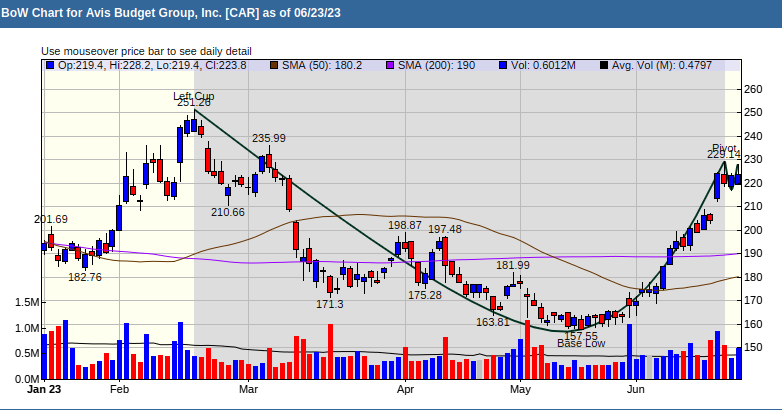

Cup and Handle Chart of the Week

Avis Budget Group - Inc. (CAR)