Breakoutwatch Weekly Summary 08/06/2023

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Special July 4 Offer: 6 months for the price of 3

Enroll for a free trial and then Subscribe for 3 months ($105) and receive a 6 month Subscription ($187 value)

Email me after you have subscribed to receive the subscription extension

(Offer not available to current subscribers)

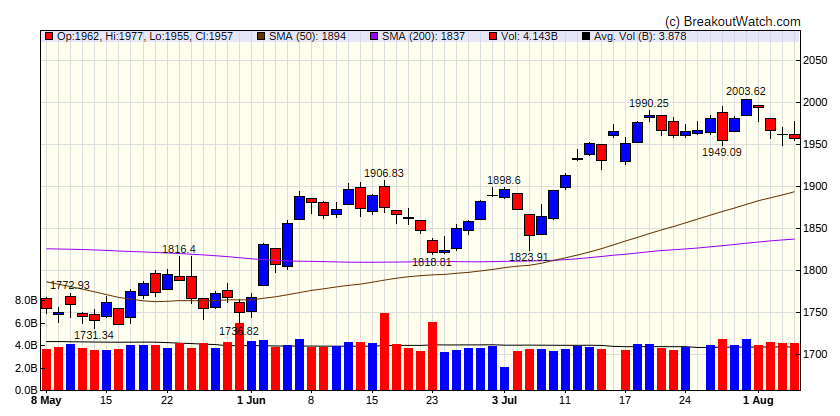

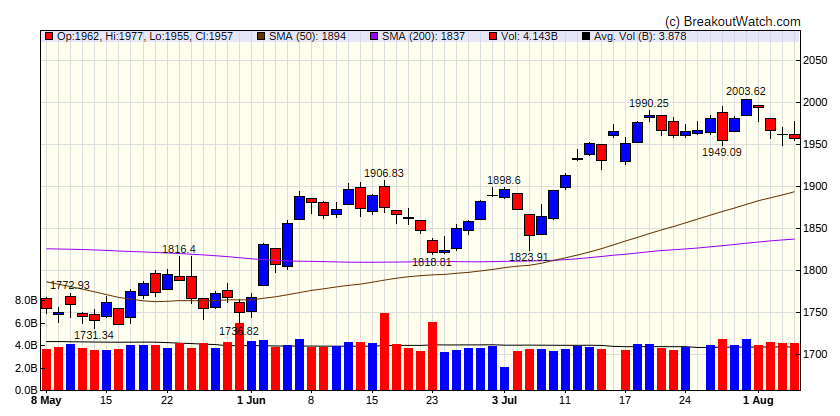

Market Summary

U.S. government’s credit rating downgraded

The major U.S. equity benchmarks started August with a down week after closing out a strong July. Stocks declined amid rising Treasury yields and an unexpected downgrade to the U.S. government’s credit rating. The technology-heavy Nasdaq Composite suffered the largest losses for the week. [more...]

Major Index Performance

| Dow Jones

|

| Last Close

| 35065.6 |

| Wk. Gain

| -1.13 % |

| Yr. Gain

| 5.78 % |

| Trend

| Up |

|

| S&P 500

|

| Last Close

| 4478.03 |

| Wk. Gain

| -2.33 % |

| Yr. Gain

| 16.21 % |

| Trend

| Up |

|

| NASDAQ Comp.

|

| Last Close

| 13909.2 |

| Wk. Gain

| -2.99 % |

| Yr. Gain

| 31.69 % |

| Trend

| Down |

|

| Russell 2000

|

| Last Close

| 1957.46 |

| Wk. Gain

| -1.38 % |

| Yr. Gain

| 10.61 % |

| Trend

| Up |

|

Performance by Sector

| Sector |

Wk. Change % |

Yr. Change % |

Trend |

| Consumer Discretionary |

-0.81 |

33.18 |

Up |

| Consumer Staples |

-1.7 |

2.2 |

Up |

| Energy |

0.5 |

1.52 |

Up |

| Finance |

-1.04 |

3.24 |

Up |

| Health Care |

-2.04 |

-1.64 |

Down |

| Industrials |

-1.83 |

14.02 |

Up |

| Technology |

-3.93 |

37.69 |

Up |

| Materials |

-2.44 |

7.94 |

Up |

| REIT |

-2.25 |

0.67 |

Down |

| Telecom |

-2.57 |

34.8 |

Up |

| Utilities |

-4.67 |

-10.24 |

Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Gain |

| SQZ |

VVX |

V2X, Inc. |

Asset Management |

69.8 % |

2.9 % |

| CWH |

TFII |

TFI International Inc. |

Trucking |

67.8 % |

1.6 % |

| SQZ |

VRA |

Vera Bradley, Inc. |

Asset Management |

60.7 % |

1.5 % |

| SQZ |

PHAT |

Phathom Pharmaceuticals, Inc. |

Biotechnology |

56.2 % |

0.7 % |

| SQZ |

KC |

Kingsoft Cloud Holdings Limited |

Software - Application |

55.6 % |

0.2 % |

| SQZ |

PROK |

ProKidney Corp. |

Biotechnology |

54.1 % |

0.9 % |

| SQZ |

PCVX |

Vaxcyte, Inc. |

Biotechnology |

52.5 % |

3.3 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Breakdowns within 5% of Breakdown Price

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Loss |

| SS |

MDLZ |

Mondelez International, Inc. |

Confectioners |

68.5 % |

-0.1 % |

| SS |

ORC |

Orchid Island Capital, Inc. |

Banks - Global |

65.8 % |

-2.2 % |

| SS |

TKR |

Timken Company (The) |

Telecom Services |

60.4 % |

-4.6 % |

| SS |

MFA |

MFA Financial, Inc. |

Banks - Global |

60.3 % |

-2.7 % |

| SS |

SNOW |

Snowflake Inc. |

Software - Application |

60.1 % |

-3.7 % |

| SS |

TMDX |

TransMedics Group, Inc. |

Medical Devices |

56.9 % |

-2.6 % |

| SS |

OPY |

Oppenheimer Holdings, Inc. |

Capital Markets |

54.3 % |

-3 % |

| SS |

OUST |

Ouster, Inc. |

Electronic Components |

54.2 % |

-4.2 % |

| SS |

BASE |

Couchbase, Inc. |

Software - Infrastructure |

52.3 % |

-4.9 % |

| SS |

WCC |

WESCO International, Inc. |

Industrial Distribution |

52.2 % |

-4 % |

| SS |

NOAH |

Noah Holdings Limited |

Asset Management |

50.4 % |

-3.1 % |

| SS |

TYRA |

Tyra Biosciences, Inc. |

Biotechnology |

49.5 % |

-2.7 % |

| SS |

VTYX |

Ventyx Biosciences, Inc. |

Biotechnology |

49 % |

-0.7 % |

| SS |

MEIP |

MEI Pharma, Inc. |

Biotechnology |

48.4 % |

-4.2 % |

| SS |

TPHS |

Trinity Place Holdings Inc. |

Real Estate - Development |

38.4 % |

-0.2 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

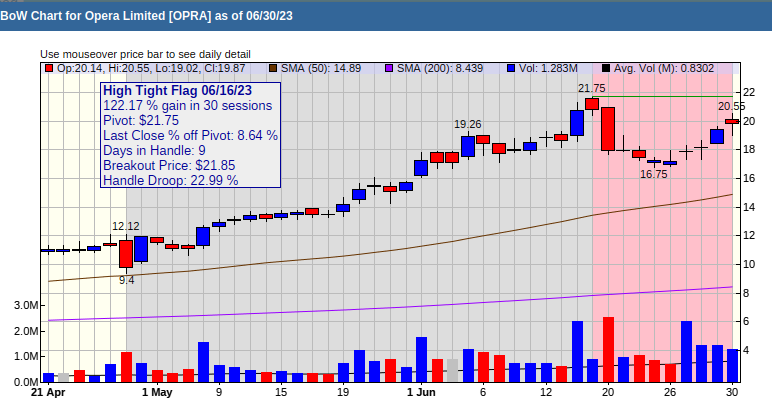

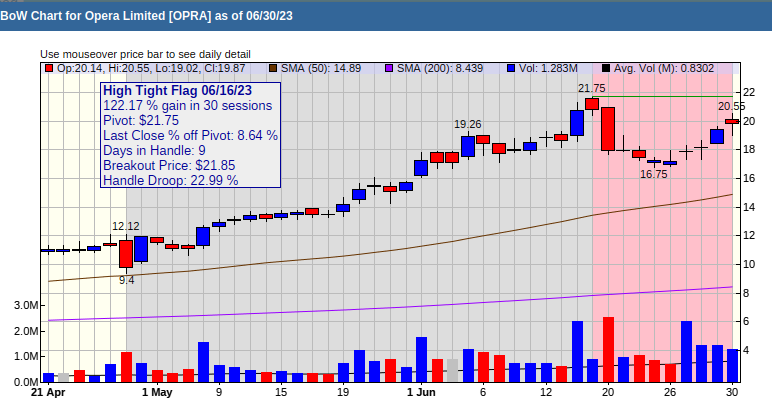

High Tight Flag Chart of the Week

Opera Limited (OPRA) Opera gained 117% in 30 sessions and has a relative strength Rank of 99. High flying stocks can fly higher and Opera is climbing again after some recent profit taking.