Breakoutwatch Weekly Summary 08/21/2023

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

The newsletter has been absent for a few weeks as I have concentrated on correcting some data problems introduced by a hack of the database. I believe all stock data is now correct and watchlist filters are working again. Next week I depart for 4 weeks on a European vacation but will try to produce this newsletter remotely.

Market Summary

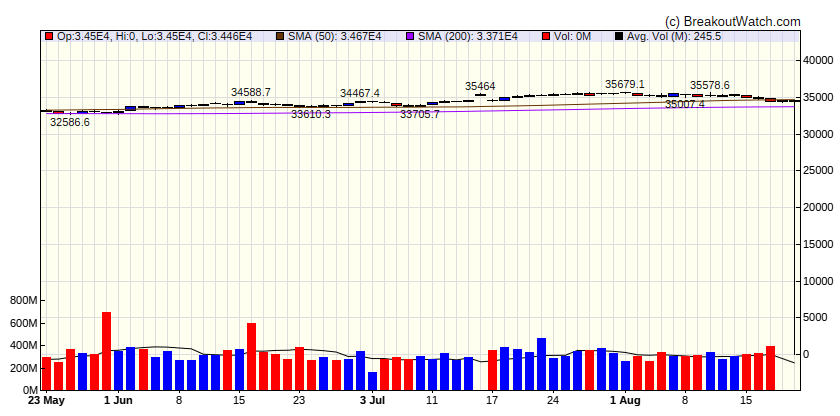

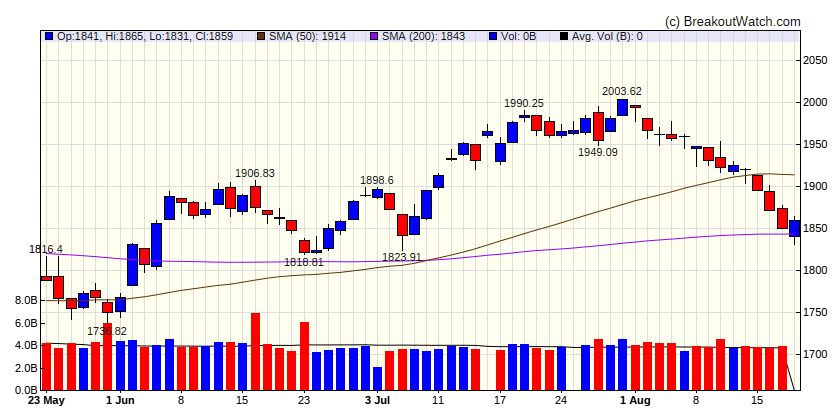

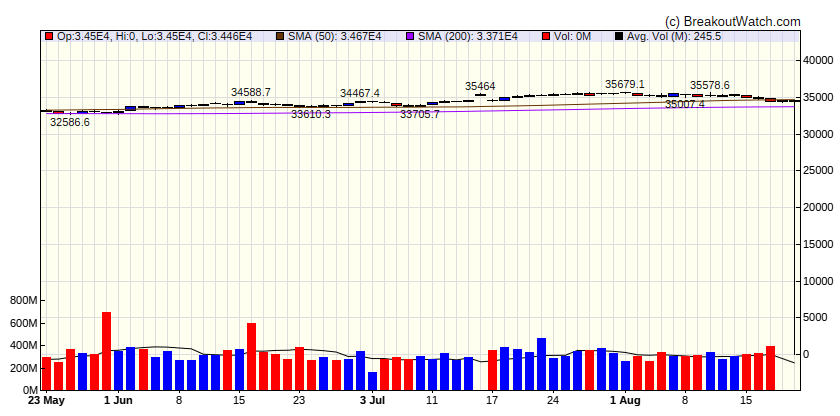

Stocks retreat for third consecutive week

Stocks were broadly lower as sentiment appeared to take a blow from a sharp increase in longer-term bond yields and fears of a sharp slowdown in China (see below). The S&P 500 Index ended the week down 5.15% from its July 26 intraday peak. Growth shares should theoretically suffer the most as rising rates place a greater discount on future earnings, but the Russell 1000 Growth Index held up modestly better than its value counterpart. Small-cap stocks performed the worst. T. Rowe Price traders noted that program trading, technical factors, and thin summer trading volumes may have accentuated the market’s swings. [more...]

Major Index Performance

| Dow Jones

|

| Last Close

| 34463.7 |

| Wk. Gain

| -1.29 % |

| Yr. Gain

| 3.97 % |

| Trend

| Down |

|

| S&P 500

|

| Last Close

| 4399.77 |

| Wk. Gain

| -0.77 % |

| Yr. Gain

| 14.18 % |

| Trend

| Down |

|

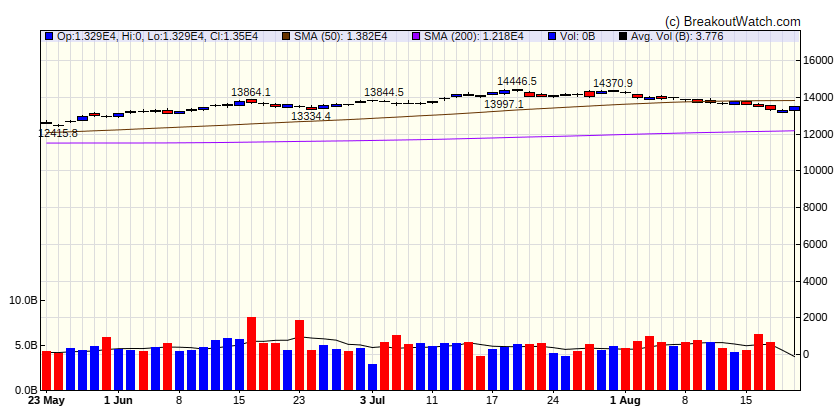

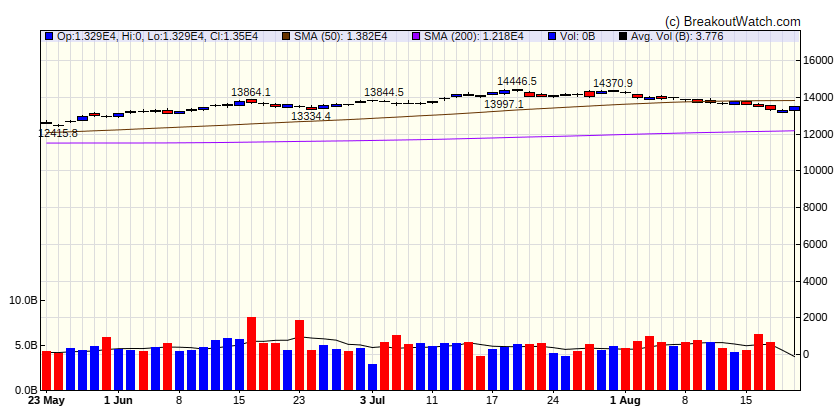

| NASDAQ Comp.

|

| Last Close

| 13497.6 |

| Wk. Gain

| -0.7 % |

| Yr. Gain

| 27.79 % |

| Trend

| Down |

|

| Russell 2000

|

| Last Close

| 13497.6 |

| Wk. Gain

| 612.66 % |

| Yr. Gain

| 662.68 % |

| Trend

| Down |

|

Performance by Sector

| Sector |

Wk. Change % |

Yr. Change % |

Trend |

| Consumer Discretionary |

-1.79 |

27.44 |

Down |

| Consumer Staples |

-1.8 |

-0.54 |

Down |

| Energy |

0.77 |

3.15 |

Up |

| Finance |

-0.62 |

-0.28 |

Down |

| Health Care |

-1.28 |

-1.28 |

Down |

| Industrials |

-1.31 |

11.32 |

Down |

| Technology |

0.05 |

34.39 |

Down |

| Materials |

-0.75 |

4.38 |

Down |

| REIT |

-2.7 |

-3.37 |

Down |

| Telecom |

-2.08 |

30.65 |

Down |

| Utilities |

-0.47 |

-11.85 |

Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Gain |

| SQZ |

TS |

Tenaris S.A. American Dep |

Gold |

83.2 % |

0.2 % |

| CWH |

BRBR |

BellRing Brands, Inc. |

Packaged Foods |

79 % |

0 % |

| CWH |

EQT |

EQT Corporation |

Asset Management |

77.2 % |

0.5 % |

| SQZ |

NTNX |

Nutanix, Inc. |

Software - Infrastructure |

72.4 % |

2.3 % |

| SQZ |

BLBD |

Blue Bird Corporation |

Auto Manufacturers |

72 % |

0.1 % |

| SQZ |

ROST |

Ross Stores, Inc. |

Apparel Retail |

67.6 % |

0.4 % |

| SQZ |

ORCL |

Oracle Corporation |

Software - Infrastructure |

67 % |

0.1 % |

| SQZ |

CFLT |

Confluent, Inc. |

Software - Infrastructure |

65.4 % |

1 % |

| SQZ |

SPB |

Spectrum Brands Holdings, Inc. |

Specialty Business Services |

63 % |

0.2 % |

| SQZ |

ETNB |

89bio, Inc. |

Biotechnology |

57.5 % |

2 % |

| CWH |

IDYA |

IDEAYA Biosciences, Inc. |

Biotechnology |

53.2 % |

1.6 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Breakdowns within 5% of Breakdown Price

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Loss |

| SS |

RDNT |

RadNet, Inc. |

|

69.5 % |

-4.2 % |

| SS |

ARHS |

Arhaus, Inc. |

Home Improvement Retail |

68.9 % |

-2.6 % |

| SS |

MDLZ |

Mondelez International, Inc. |

Confectioners |

68 % |

-3.6 % |

| SS |

SQSP |

Squarespace, Inc. |

|

67.7 % |

-1.4 % |

| SS |

TWO |

Two Harbors Investment Co |

Banks - Global |

63.8 % |

-2.9 % |

| SS |

ALOT |

AstroNova, Inc. |

Computer Hardware |

62 % |

-0.9 % |

| SS |

TOST |

Toast, Inc. |

|

62 % |

-1.8 % |

| SS |

SPRB |

Spruce Biosciences, Inc. |

Biotechnology |

58.7 % |

-1.8 % |

| SS |

VPG |

Vishay Precision Group, Inc. |

Financial Conglomerates |

57 % |

-4.2 % |

| SS |

CASS |

Cass Information Systems, Inc |

|

54.7 % |

-1.3 % |

| SS |

MGNX |

MacroGenics, Inc. |

|

52.2 % |

-1.2 % |

| SS |

FET |

Forum Energy Technologies, Inc. |

Industrial Distribution |

49.7 % |

-4.8 % |

| SS |

SUP |

Superior Industries International, Inc. |

|

44.4 % |

-4.9 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

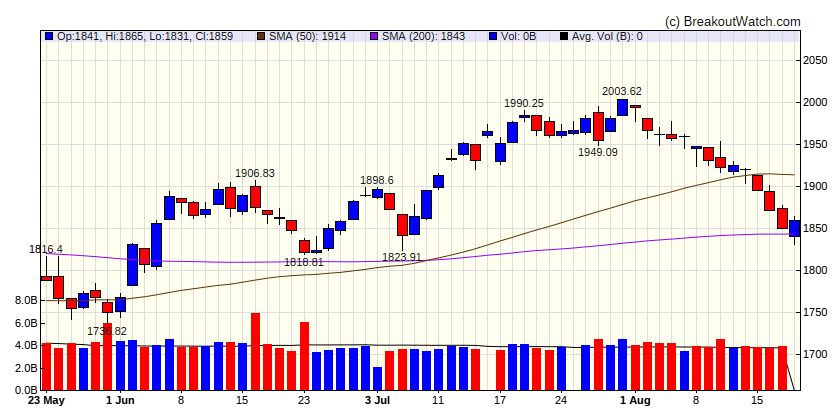

Cup and Handle Chart of the Week

Aug. 16, 2023 /PRNewswire/ -- IDEAYA Biosciences, Inc. (Nasdaq: IDYA), a precision medicine oncology company committed to the discovery and development of targeted therapeutics, announced the achievement of First-Patient-In for the company-sponsored Phase 2 clinical trial evaluating darovasertib as neoadjuvant and adjuvant therapy in primary uveal melanoma (UM) patients.