Breakoutwatch Weekly Summary 09/12/2023

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

The newsletter has been absent for a few weeks as I have concentrated on correcting some data problems introduced by a hack of the database. I believe all stock data is now correct and watchlist filters are working again. Next week I depart for 4 weeks on a European vacation but will try to produce this newsletter remotely.

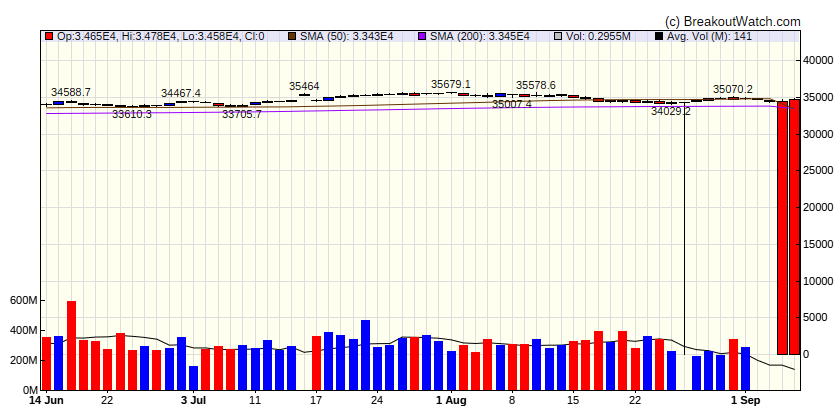

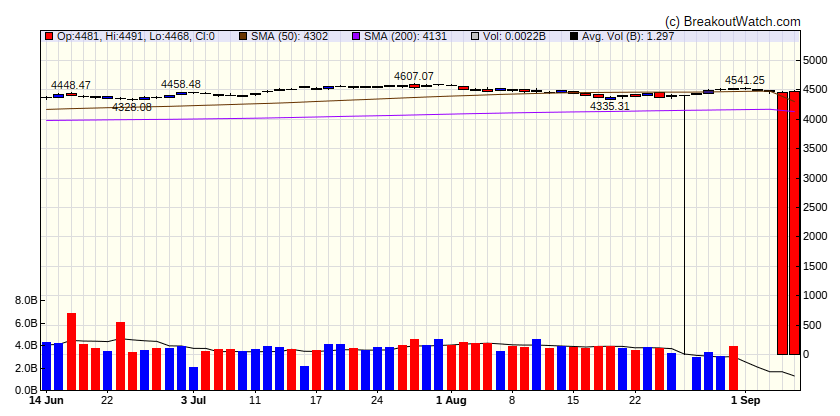

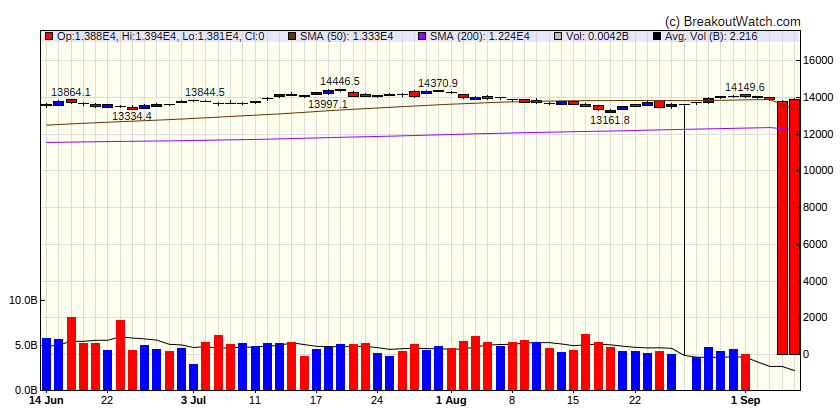

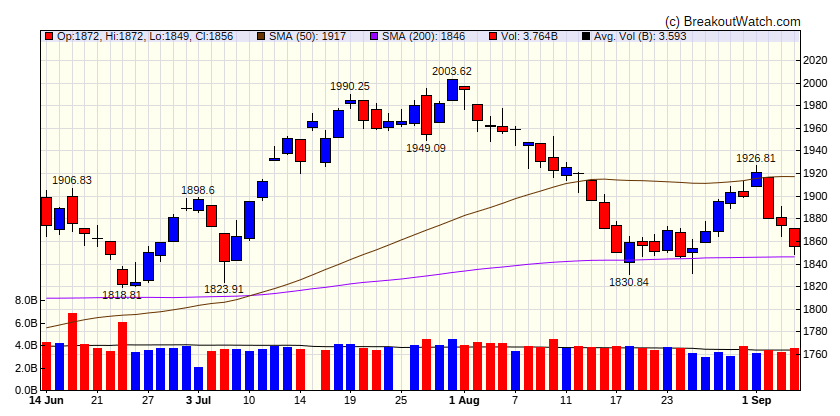

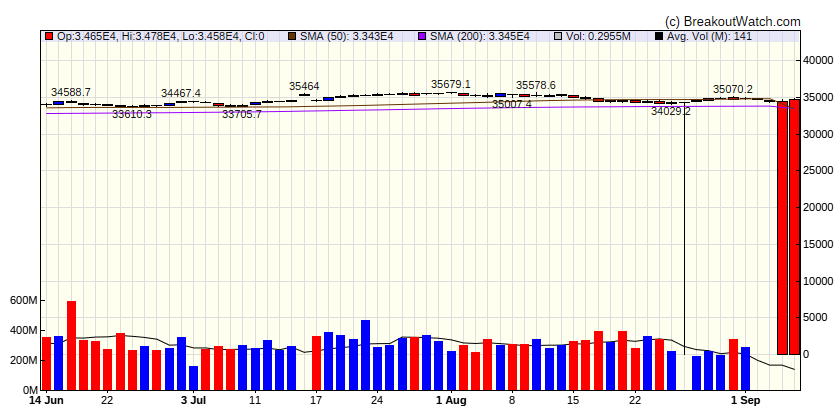

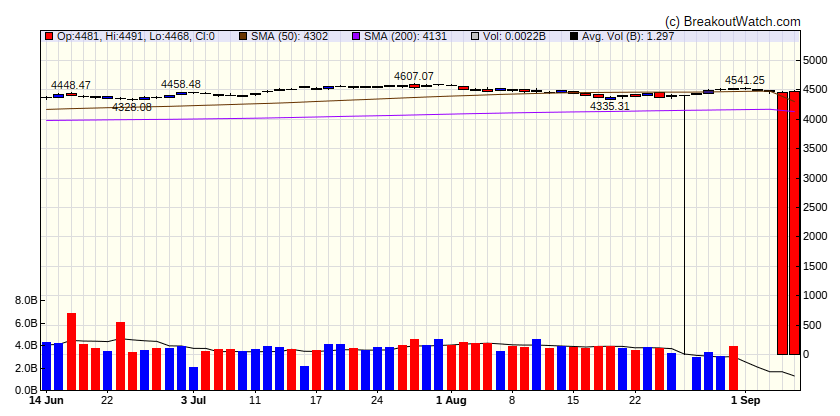

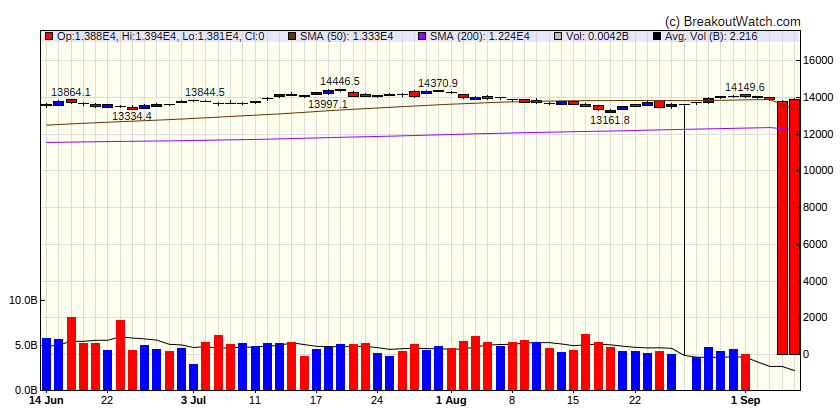

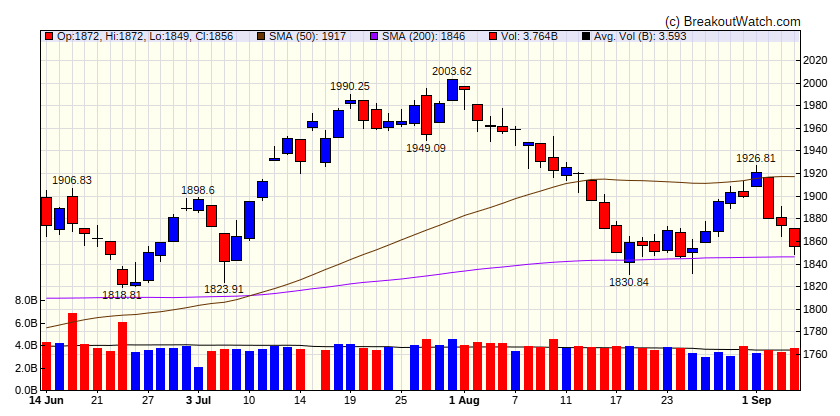

Market Summary

Good news for the economy remains bad news for stocks

Stocks closed lower over the holiday-shortened week as some positive economic signals drove an increase in interest rates. Growth stocks fared better than value shares, and large-caps outperformed small-caps by a wider margin. A decline in Apple, the most heavily weighted stock in the S&P 500 Index, drove part of the declines after news that Chinese government employees would no longer be able to use iPhones. Investors also may have been discouraged by reports that the upcoming iPhone 15 will be significantly more expensive than current models. Declines in NVIDIA and other chipmakers also weighed on the indexes. Markets were closed Monday in observance of the Labor Day holiday. [more...]

Major Index Performance

| Dow Jones

|

| Last Close

| 0 |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

| S&P 500

|

| Last Close

| 0 |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

| NASDAQ Comp.

|

| Last Close

| 0 |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

| Russell 2000

|

| Last Close

| 0 |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

Performance by Sector

| Sector |

Wk. Change % |

Yr. Change % |

Trend |

| Consumer Discretionary |

3.52 |

33.35 |

Up |

| Consumer Staples |

1.07 |

-0.52 |

Down |

| Energy |

-0.54 |

6.13 |

Up |

| Finance |

0.87 |

1.32 |

Up |

| Health Care |

0.71 |

-1.54 |

Down |

| Industrials |

-0.3 |

11.24 |

Up |

| Technology |

0.99 |

38.6 |

Up |

| Materials |

0.17 |

5.41 |

Up |

| REIT |

0.57 |

-1.08 |

Up |

| Telecom |

1.55 |

34.51 |

Up |

| Utilities |

1.95 |

-11.41 |

Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Gain |

| SQZ |

ACGL |

Arch Capital Group Ltd. |

Insurance - Diversified |

79.2 % |

3.9 % |

| SQZ |

AEL |

American Equity Investment Life Holding Company |

Insurance - Life |

75.2 % |

0.6 % |

| SQZ |

HCC |

Warrior Met Coal, Inc. |

Coking Coal |

73.1 % |

2.4 % |

| SQZ |

LIN |

Linde plc Ordinary Shares |

Specialty Chemicals |

71 % |

0.7 % |

| SQZ |

PDS |

Precision Drilling Corporation |

REIT - Office |

69.7 % |

0.6 % |

| SQZ |

SG |

Sweetgreen, Inc. |

Restaurants |

69.5 % |

0.3 % |

| SQZ |

ARGX |

argenx SE |

Biotechnology |

68 % |

2 % |

| SQZ |

DINO |

HF Sincl |

Restaurants |

67.8 % |

4.8 % |

| SQZ |

NGMS |

NeoGames S.A. |

Gambling |

66.3 % |

0.8 % |

| SQZ |

SQSP |

Squarespace, Inc. |

Software - Infrastructure |

66.1 % |

2.3 % |

| SQZ |

VTS |

Vitesse Energy, Inc. |

REIT - Healthcare Facilities |

64.9 % |

0.3 % |

| SQZ |

TTWO |

Take-Two Interactive Software, Inc. |

Home Improvement Retail |

62.9 % |

2.2 % |

| SQZ |

GKOS |

Glaukos Corporation |

Medical Devices |

62.7 % |

3.2 % |

| SQZ |

EVI |

EVI Industries, Inc. |

Industrial Distribution |

61.7 % |

2.7 % |

| SQZ |

ARLO |

Arlo Technologies, Inc. |

Real Estate - Development |

60.7 % |

3.1 % |

| SQZ |

APPN |

Appian Corporation |

Software - Infrastructure |

59.9 % |

1.9 % |

| SQZ |

ATLX |

Atlas Lithium Corporation |

Banks - Regional |

49.1 % |

1.9 % |

| SQZ |

TYRA |

Tyra Biosciences, Inc. |

Biotechnology |

47.9 % |

1.7 % |

| SQZ |

MRUS |

Merus N.V. |

Biotechnology |

47.8 % |

4.1 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Breakdowns within 5% of Breakdown Price

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Loss |

| SS |

MYRG |

MYR Group, Inc. |

Medical Devices |

79.8 % |

-3.2 % |

| SS |

STN |

Stantec Inc |

Semiconductors |

75.6 % |

-0.6 % |

| SS |

VMC |

Vulcan Materials Company (Holding Company) |

Building Materials |

75.5 % |

-1.7 % |

| SS |

TNC |

Tennant Company |

Specialty Industrial Machinery |

72.1 % |

-3 % |

| SS |

VNT |

Vontier Corporation |

REIT - Office |

71.7 % |

-2.2 % |

| SS |

PCOR |

Procore Technologies, Inc. |

Software - Application |

65.5 % |

-1.3 % |

| SS |

MRK |

Merck & Company, Inc. |

Drug Manufacturers - General |

63.9 % |

-0.3 % |

| SS |

ETNB |

89bio, Inc. |

Biotechnology |

58.8 % |

-2.5 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Cup and Handle Chart of the Week

Aug. 16, 2023 /PRNewswire/ -- IDEAYA Biosciences, Inc. (Nasdaq: IDYA), a precision medicine oncology company committed to the discovery and development of targeted therapeutics, announced the achievement of First-Patient-In for the company-sponsored Phase 2 clinical trial evaluating darovasertib as neoadjuvant and adjuvant therapy in primary uveal melanoma (UM) patients.