Breakoutwatch Weekly Summary 10/01/2023

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

The newsletter has been absent for a few weeks as I have concentrated on correcting some data problems introduced by a hack of the database. I believe all stock data is now correct and watchlist filters are working again. Next week I depart for 4 weeks on a European vacation but will try to produce this newsletter remotely.

Market Summary

Key measure of U.S. inflation decelerates

Higher oil prices contributed to concerns that inflation could prove more difficult for central banks to tame, spurring a sell-off in bonds. As the week wore on, the increasing likelihood of a U.S. government shutdown may also have weighed on investor sentiment. The yield on the benchmark 10-year U.S. Treasury note peaked above 4.6% on Wednesday. (Bond prices and yields move in opposite directions.) However, 10-year Treasury yields ticked modestly lower after the release of encouraging eurozone and U.S. inflation data. Tax-exempt municipal bonds and high yield bonds also came under selling pressure. [more...]

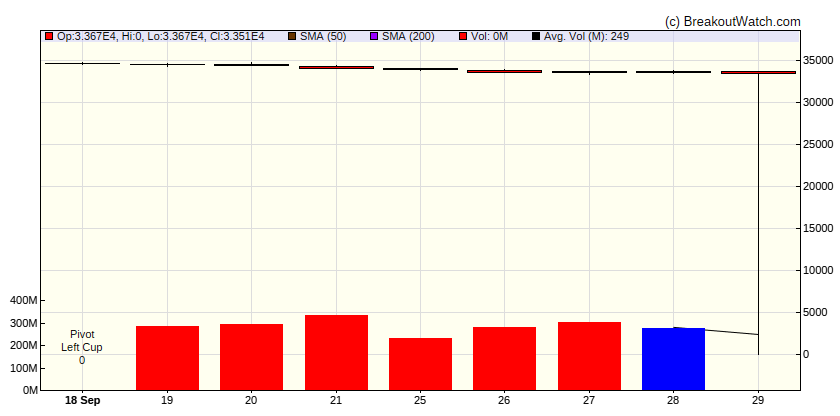

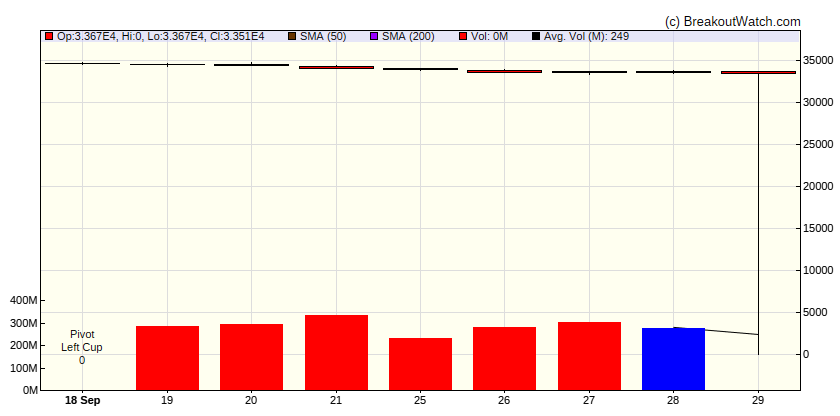

Major Index Performance

| Dow Jones

|

| Last Close

| 33507.5 |

| Wk. Gain

| -1.18 % |

| Yr. Gain

| -3.19 % |

| Trend

| Down |

|

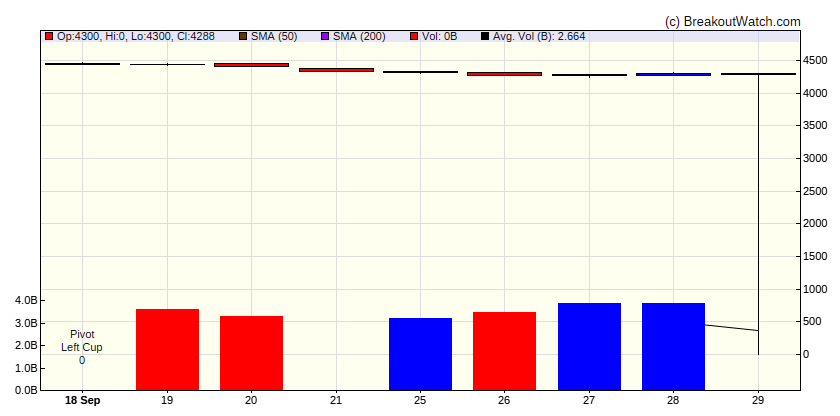

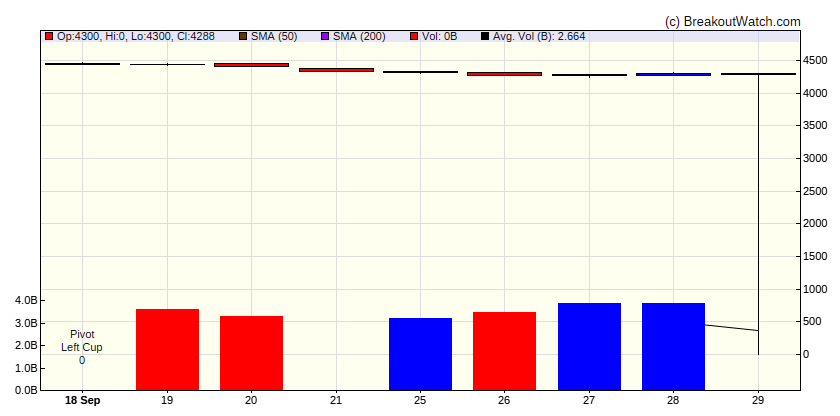

| S&P 500

|

| Last Close

| 4288.05 |

| Wk. Gain

| -0.52 % |

| Yr. Gain

| -3.53 % |

| Trend

| Down |

|

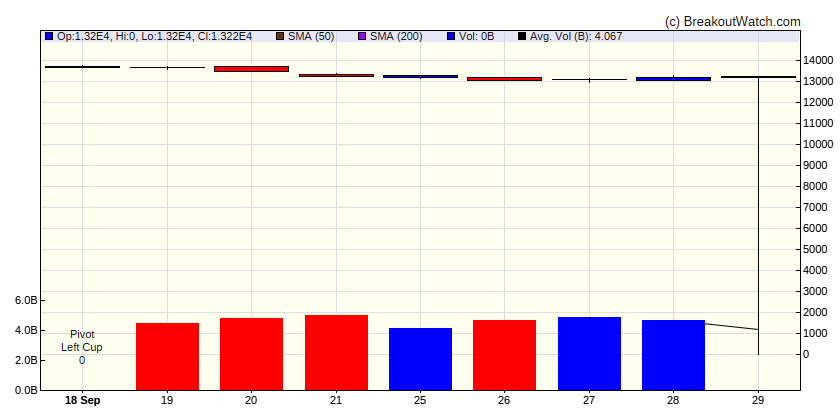

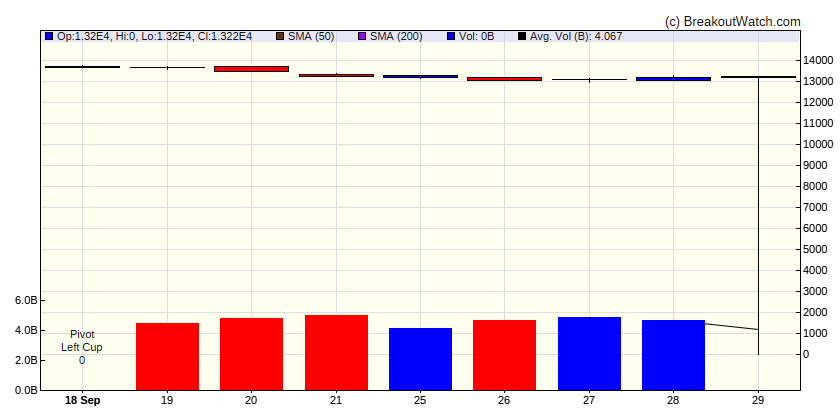

| NASDAQ Comp.

|

| Last Close

| 13219.3 |

| Wk. Gain

| 0.36 % |

| Yr. Gain

| -3.3 % |

| Trend

| Down |

|

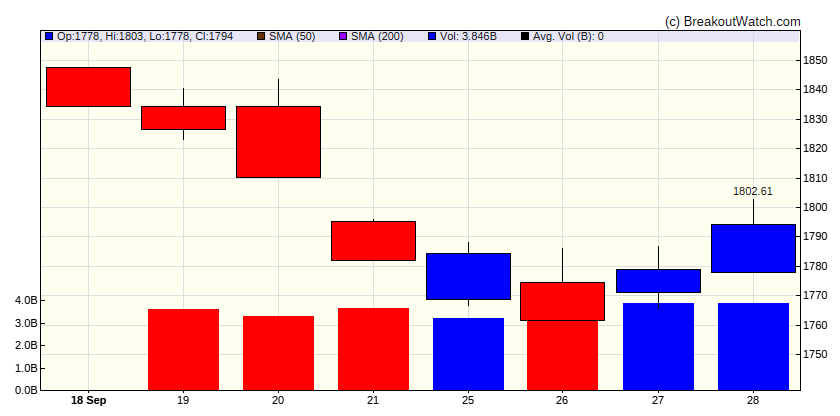

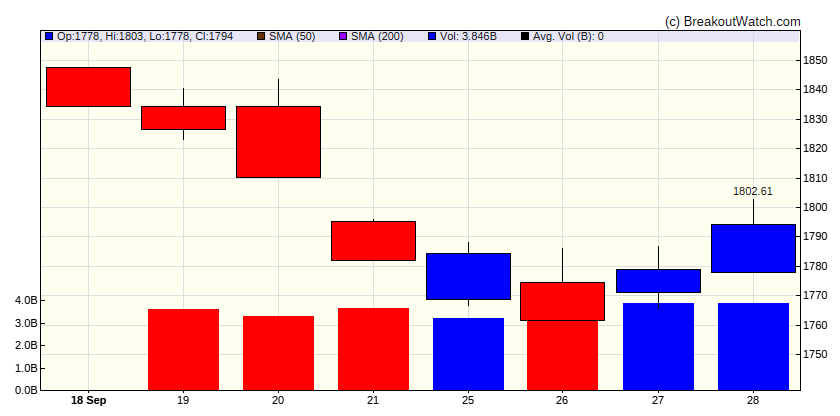

| Russell 2000

|

| Last Close

| 13219.3 |

| Wk. Gain

| 644.9 % |

| Yr. Gain

| 615.44 % |

| Trend

| Down |

|

Performance by Sector

| Sector |

Wk. Change % |

Yr. Change % |

Trend |

| Consumer Discretionary |

0.19 |

23.89 |

Down |

| Consumer Staples |

-2.17 |

-4.89 |

Down |

| Energy |

0.8 |

5.82 |

Up |

| Finance |

-1.59 |

-2.55 |

Down |

| Health Care |

-1.16 |

-5.05 |

Down |

| Industrials |

0.06 |

7.01 |

Down |

| Technology |

0.21 |

31.2 |

Down |

| Materials |

0.37 |

1.35 |

Down |

| REIT |

-1.91 |

-8.27 |

Down |

| Telecom |

0.3 |

29.54 |

Down |

| Utilities |

-6.96 |

-17.67 |

Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Gain |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Breakdowns within 5% of Breakdown Price

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Loss |

| SS |

ARLO |

Arlo Technologies, Inc. |

Real Estate - Development |

59.8 % |

-3.2 % |

| SS |

APLS |

Apellis Pharmaceuticals, Inc. |

Biotechnology |

36.8 % |

-0.4 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Cup and Handle Chart of the Week

Aug. 16, 2023 /PRNewswire/ -- IDEAYA Biosciences, Inc. (Nasdaq: IDYA), a precision medicine oncology company committed to the discovery and development of targeted therapeutics, announced the achievement of First-Patient-In for the company-sponsored Phase 2 clinical trial evaluating darovasertib as neoadjuvant and adjuvant therapy in primary uveal melanoma (UM) patients.