Breakoutwatch Weekly Summary 10/14/2023

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

The newsletter has been absent for a few weeks as I have concentrated on correcting some data problems introduced by a hack of the database. I believe all stock data is now correct and watchlist filters are working again. Next week I depart for 4 weeks on a European vacation but will try to produce this newsletter remotely.

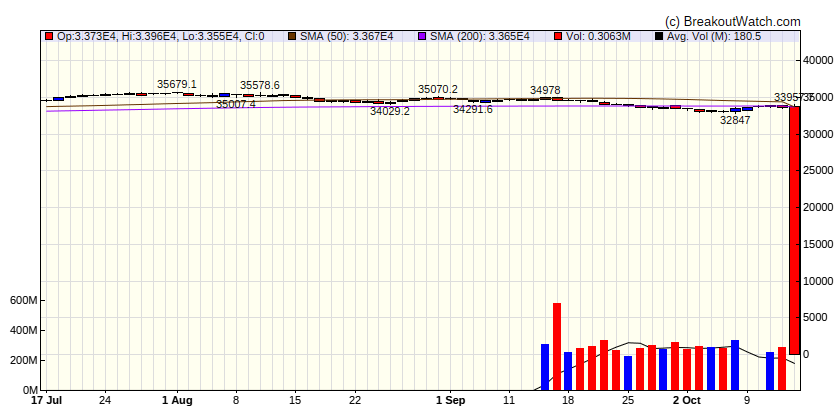

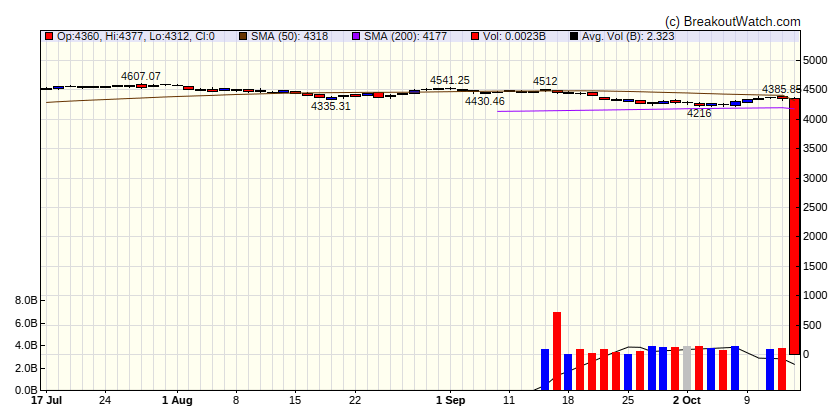

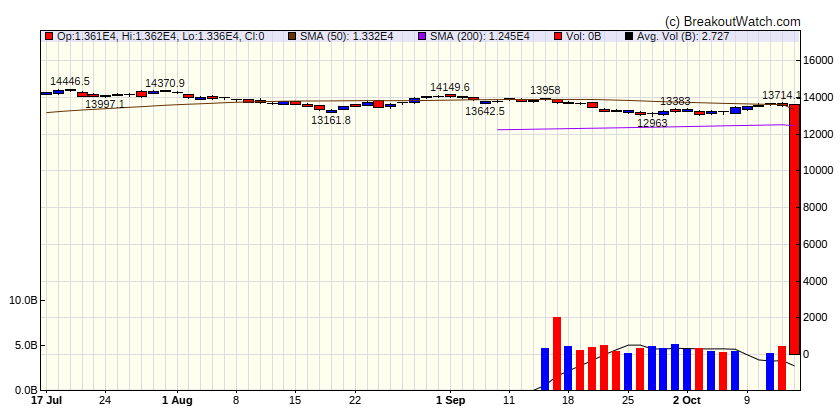

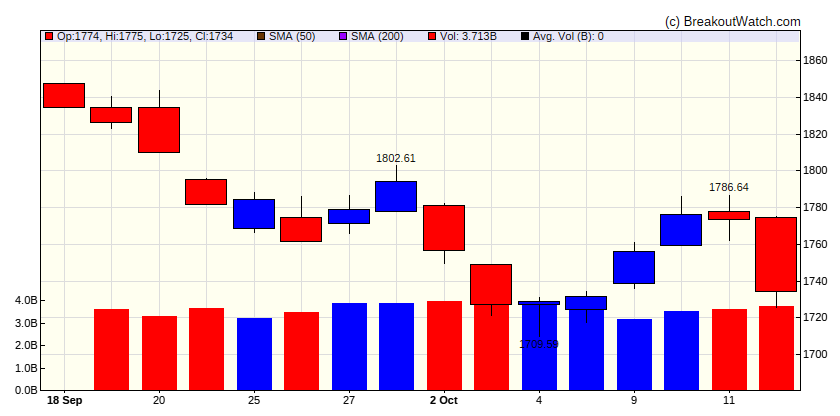

Market Summary

Stocks mixed as earnings season kicks off

The major indexes ended mixed as investors weighed inflation data against dovish signals from Federal Reserve officials. Large-cap value stocks outperformed, helped by earnings beats from Citigroup, Wells Fargo, and JPMorgan Chase. The banking giants kicked off the unofficial start to third-quarter earnings reporting season on a positive note, as their profits got a boost from higher interest rates. [more...]

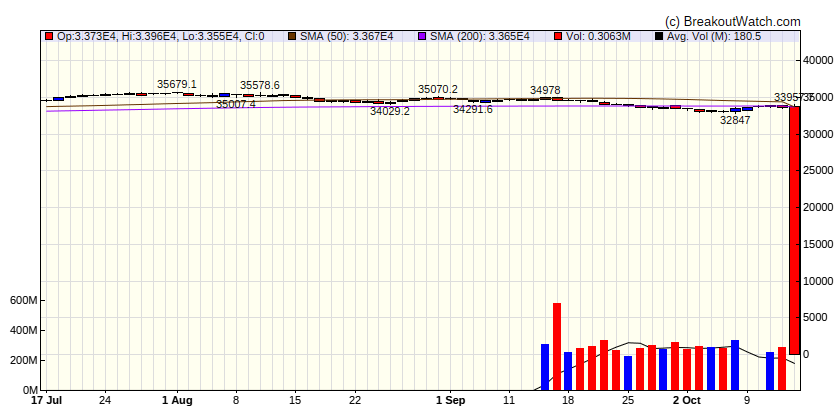

Major Index Performance

| Dow Jones

|

| Last Close

| 0 |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

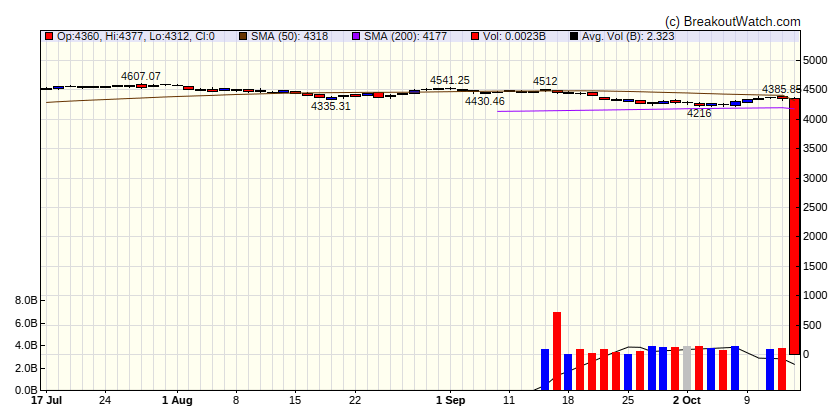

| S&P 500

|

| Last Close

| 0 |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

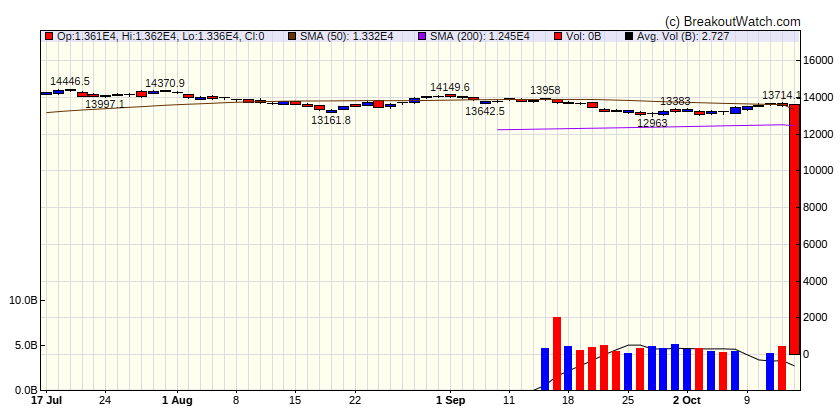

| NASDAQ Comp.

|

| Last Close

| 0 |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

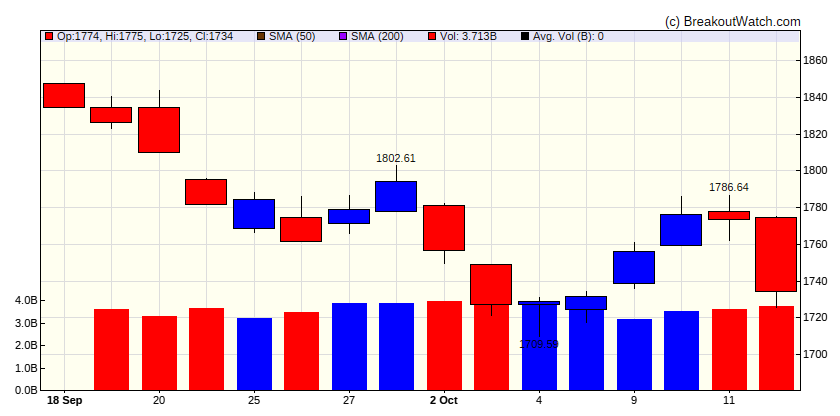

| Russell 2000

|

| Last Close

| 0 |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Down |

|

Performance by Sector

| Sector |

Wk. Change % |

Yr. Change % |

Trend |

| Consumer Discretionary |

0.33 |

21.67 |

Down |

| Consumer Staples |

0.33 |

-8.05 |

Down |

| Energy |

1.8 |

5.02 |

Down |

| Finance |

1.03 |

-2.81 |

Down |

| Health Care |

0.19 |

-4.67 |

Down |

| Industrials |

0.37 |

6.77 |

Down |

| Technology |

0.48 |

33.77 |

Up |

| Materials |

-0.2 |

-0.56 |

Down |

| REIT |

2.23 |

-8.47 |

Down |

| Telecom |

0.22 |

31.74 |

Up |

| Utilities |

3.46 |

-17.4 |

Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Gain |

| CWH |

LPG |

Dorian LPG Ltd. |

Biotechnology |

82.2 % |

0.8 % |

| DB |

INSW |

International Seaways, Inc. |

Software - Application |

80.3 % |

0.6 % |

| SQZ |

AVGO |

Broadcom Inc. |

Semiconductors |

77.6 % |

3.2 % |

| SQZ |

PLUS |

ePlus inc. |

Software - Application |

76.9 % |

1.7 % |

| SQZ |

VRTX |

Vertex Pharmaceuticals Inco |

Biotechnology |

75.8 % |

2.9 % |

| SQZ |

JPM |

JP Morgan Chase & Co. |

Banks - Diversified |

75.4 % |

1.5 % |

| DB |

UNH |

UnitedHealth Group Inco |

Healthcare Plans |

74.9 % |

1.7 % |

| CWH |

RNR |

RenaissanceRe Holdings Ltd. |

Insurance - Reinsurance |

74.1 % |

2.6 % |

| CWH |

DRS |

Leonardo DRS, Inc. |

Biotechnology |

72.1 % |

1.2 % |

| SQZ |

AMWD |

American Woodmark Corporation |

Asset Management |

71.9 % |

1.4 % |

| SQZ |

AVPT |

AvePoint, Inc. |

Software - Infrastructure |

70.8 % |

3 % |

| SQZ |

VMW |

Vmware, Inc. |

Software - Infrastructure |

70.8 % |

3.7 % |

| SQZ |

COST |

Costco Wholesale Corporation |

Discount Stores |

70.2 % |

0.5 % |

| SQZ |

CRVL |

CorVel Corp. |

Insurance Brokers |

69.9 % |

0.2 % |

| SQZ |

CTRE |

CareTrust REIT, Inc. |

REIT - Healthcare Facilities |

68.7 % |

1.7 % |

| SQZ |

RELY |

Remitly Global, Inc. |

Software - Infrastructure |

66.5 % |

2.9 % |

| SQZ |

LBRDA |

Liberty Broadband Corporation |

Telecom Services |

64.2 % |

0.3 % |

| SQZ |

BLTE |

Belite Bio, Inc |

Biotechnology |

60.5 % |

0.3 % |

| SQZ |

DBD |

Diebold Nixdorf Inco |

Software - Application |

41.8 % |

1 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Breakdowns within 5% of Breakdown Price

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Loss |

| SS |

ITI |

Iteris, Inc. |

Communication Equipment |

75.2 % |

-0.7 % |

| SS |

STN |

Stantec Inc |

Semiconductors |

74.9 % |

-2 % |

| SS |

SXI |

Standex International Corporation |

Specialty Industrial Machinery |

71.9 % |

-3.5 % |

| SS |

KOP |

Koppers Holdings Inc. |

Specialty Chemicals |

71.2 % |

-2.3 % |

| SS |

PINS |

Pinterest, Inc. |

REIT - Retail |

64.7 % |

-2.4 % |

| SS |

AMD |

Advanced Micro Devices, Inc. |

Semiconductors |

63.3 % |

-1 % |

| SS |

ZEUS |

Olympic Steel, Inc. |

Steel |

60.9 % |

-4.6 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Cup and Handle Chart of the Week

Aug. 16, 2023 /PRNewswire/ -- IDEAYA Biosciences, Inc. (Nasdaq: IDYA), a precision medicine oncology company committed to the discovery and development of targeted therapeutics, announced the achievement of First-Patient-In for the company-sponsored Phase 2 clinical trial evaluating darovasertib as neoadjuvant and adjuvant therapy in primary uveal melanoma (UM) patients.